-

《传承宝典》4: 初创型公司CEO的一天

《传承宝典》4: 初创型公司CEO的一天

《传承宝典》4初创型公司CEO的一天 作为 Future is Now 《传承宝典》的一部分,我们新近采访了私募股权和风险投资领域的不同参与者,包括:大企业、初创型公司和引人注目的并购交易撮合者,透视他们的日常生活(day-to-day life),来为家族未来的接班人,提供创业榜样与职场借鉴。首先,我们采访了位于伦敦的一家食品分享主题初创型公司:OLIO 的联合创始人兼首席执行官 Tessa Cook 女士(图左)。该公司提供了一个免费的应用程序(app),允许用户之间分享不需要的食物,以减少浪费。 创立Olio公司的想法: 我是一个农民的女儿,我从小就亲身体会到生产食物需要付出多少努力,所以我非常讨厌浪费食物。当我搬家的时候,我突然灵光一闪,搬运工说我们必须扔掉所有的食物。我不打算这么做,所以我走上街头,想找个人和我一起分享食物,结果失败了。 这非常令人沮丧,因为我知道会有人喜欢这些食物,但他们只是不知道而已,而这就是制作OLIO的想法的来源。 创建OLIO后,您的一天是怎么度过的? 首先,并没有什么是典型的一天,但有些事情是我每天都在做的。也许最重要的是 OLIO 的客户支持,以及花时间与我们的用户互动,了解他们使用我们产品的方式,并收集他们的建议,如何来提高服务。我认为由一个首席执行官这么做是很不寻常的,但我觉得这是一个宝贵的与用户保持联系的方式。我负责决定我们什么时候构建那些特性,我通常会先为技术团队绘制一个线框图(wireframe),然后反馈他们的工作,并测试该应用程序(app)的新版本。另一件我花了很多时间的重要事情是维护投资者关系。即使在我们不筹款的时候,我每周都会和投资者见面,尽早建立良好的关系(nice and early),这样,当我们准备筹款的时候,我们就知道谁最适合我们(a good fit)。最后,我召开内部会议,支持我们的团队成员发挥各自的作用,并就我们的流程和系统商讨改进方法、提出反馈意见。这在我们寻求迅速扩大规模的过程中非常重要。 你工作中最有挑战性的方面? 筹款无疑是其中之一。我们是一家以技术为本(tech-for-good)的公司,我们的使命对我们来说非常重要,因此我们正在寻找一种非常特殊的投资者类型,其能够立即缩小(narrow down)我们所关注的资金池范围。此外,我们是一家女性创办的企业(这个行业对女性创办的公司存在偏见),我们的盈利之路依然为时尚早,你已经开始看到挑战了!毫无疑问,这个角色中最有回报的部分,就是我们知道我们每天所产生的影响力。作为一名创始人是很困难的,在那些黑暗的时刻,我总是被我们收到的来自用户的邮件所激励,看到所有的食物都进入应用程序,并从垃圾箱中被保存下来。 如何平衡工作和生活? 我们在OLIO采取的方法,很大程度上是由这样一个事实形成的:我们是两个有孩子的女性创始人,因此,我们都可以远程地、灵活地工作。我们很少考虑工作与生活的平衡,这似乎表明有一种东西叫做“工作”,也有一种东西叫做“生活”。我们更全面地思考如何过一种平衡的生活。这意味着每个团队成员都会在“工作日”抽出时间来享受他们的幸福。 你对未来和现在的创始人有何建议? 尽可能快地出产一些小的东西,这样您就可以对真实数据的构建、测试、学习做出响应——并尽可能快地加以循环。初创公司的创始人也有一种倾向,即立刻开发出一款应用程序,而我总是鼓励人们尝试找到一种方法来验证你的假设,这种方法不需要你花费毕生积蓄来开发一款昂贵的应用程序,比如 Facebook 或 WhatsApp! English Version A day in the life of a startup CEO As part of a new series, were speaking to different players in the privateequity and venture capital space—including companies, startups and noteworthy dealmakers—to find out what day-to-day life looks like for them.

To kick it off, we talked to Tessa Cook (pictured on left), co-founder and CEO of London-based food sharing startup OLIO. The company provides a free app which allows users to share unwanted food to reduce waste. How did the idea for OLIO come about? Im a farmers daughter, so I grew up learning first hand just how much hard work goes into producing food, so as a result I absolutely hate wasting food. The lightbulb moment came when I was moving country, and the removal men said we had to throw away all our food. I wasnt going to do that, so I set out on the street to try and find someone to share my food with and failed.It was very frustrating because I knew that there would be people who wouldve loved that food, but they just didnt know about it, and that was where the idea for OLIO came from. Having set up OLIO, what does a typical day look likefor you? Firstly, there is no such thing as a typical day, but there are things that I do most days. Perhaps the most important of which is customer support for OLIO and spending time interacting with our users, understanding how they use our product and getting their suggestions as to how to improve the service—I think thats quite unusual for a CEO to be doing that, but I find it an invaluable way to stay in touch with our users. Im responsible for deciding what features we build and when, and I will often start by sketching up a wireframe for the technical team and then feeding back on their work and testing the new versions of the app. What is the most challenging aspect of your job? Fundraising is definitely one of them. Were a tech-for-good company and our mission is very important to us, so were looking for a very specific type of investor, which immediately narrows down the pool were looking at. Add to that the fact that were a female-founded business (and the industry is biased against female-founded companies) and were still very early in our monetisation journey, and you start to see the challenge! We talked about what the most challenging aspect of your role was, but what is the most rewarding? Without a doubt, the most rewarding part of the role is the impact that we know were having every day. Being a founder is hard, and in those dark moments, Im always motivated by the emails that we receive from our users and seeing all the food coming onto the app and being saved from the bin. Being a CEO, how do you balance work and personal life? The approach we take at OLIO is very much formed by the fact that were two female founders who have children, so as a result, we all work remotely and flexibly. We dont think so much about work-life balance,which seems to suggest that theres a thing called "work" and a thing called "life." We think much more holistically about how to lead a balanced life. And that means that every team member carves out time during the"working day" to spend on their wellbeing. What advice would you have for future and current founders? Get something small out, as quickly as possible, soyou can respond to real data—build, test, learn—and get that loop happening as quickly as possible. There is also a tendency for startup founders to build an app right away, and I always encourage people to try to find a way to test your hypothesis which doesnt require you to sink your life savings in building an expensive app—such as Facebook or WhatsApp! By: Leah Hodgson October 9, 2018 该文章为搜瑞士网站原创,部分图片摘引自网络媒体的公开资源,如需转载,敬请注明出处。 Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

-

中国登陆瑞士的企业名单(2019年最全版)

中国登陆瑞士的企业名单(2019年最全版)

中国登陆瑞士的企业名单 (2019年最全版) 瑞士已经与中国签署了一份《投资保护协定》,该协定于2010年4月13日起正式生效。该协定要求瑞士公平、平等地对待中国投资,并且信守针对特定投资项目的承诺(如果有的话)。此外,该协定还保护中国投资免于遭受非商业风险,例如政府的歧视、没有法律依据或无补偿的征收、或者为直接投资或资本转移设置障碍等。一旦发生违约情形,被侵权的中国投资人可向ICSID仲裁庭(国际投资争端解决中心)或者临时仲裁庭对瑞士提起诉讼。 此后,随着两国双边关系的持续推进,以及经贸往来的逐步扩大,特别是中瑞自贸协定(FTA)于2014年7月1日生效之后,登陆瑞士的中国企业已经过百,而吸引他们的不仅仅是众所周知的稳定政经环境、国际化门户、低税率和高效的金融服务,我们将在近期为您一一梳理、简明分析。2019年瑞士实行税务改革,目前瑞士26个州的企业所得税约为13.5%,为欧洲最低。 该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。 Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

-

2019年3月资产管理月度简报

2019年3月资产管理月度简报

2019年3月资产管理月度简报反弹在三月份暂停 尽管美国市场第一季度的表现,是1998年以来最为强劲的,但标准普尔500指数仅上涨了0.5%(见下图),而摩根士丹利资本国际全球指数在3月份也仅上涨0.1%。虽然全球经济增长正在放缓,但IT领域(+18.2%)和能源(+15.6%)板块的表现,均优于工业(+15.5%)。从技术层面看,市场仍在试图突破(在我们之前发布的资管报告中提到过的)那三次中途失败的反弹区间。未来几周,上市公司将开始公布第一季度利润。在全球贸易和增长放缓的情况下,它们还会上涨吗?低利率意味着经济增长将进一步放缓 尽管股市自12月24日的低点以来大幅上涨,但政府债券的收益率却有所下降。德国10年期国债收益率为负,而在美国,10年期国债收益率已跌破短期收益率。这表明投资者预计通胀将会下降,或许还会伴随着经济衰退。高油价加上较低的通胀预期意味着:其它商品的价格充其量也是停滞不前。如果没有通货膨胀,更高的能源成本只能意味着更低的消费需求。市场是否在庆祝美国联邦储备委员会(FED)和欧洲央行(ECB)采取了更为忍让的姿态,而没有考虑到企业利润增长放缓的潜在影响。包括来福车(LYFT)、优步(UBER)和图片分享网站Pinterest在内的互联网商务公司,正赶在市场表现良好之际进行IPO。与此同时,英国脱欧问题仍未解决,中美贸易谈判仍在拖延。中国股市的投资者们,所预期的结果显然好到足以抵消国内需求和投资放缓的影响:今年,上海股市上涨了21.2%,而科技股云集的深圳股市则欢欣鼓舞地上涨了30.5%。 中国账户盈余的消失 尽管中国的贸易平衡在过去5年中有所减弱,但正是出境旅游业的迅猛增长,使该国著名的贸易顺差降为近于零的水平。这反映出中国消费者正变得越来越富裕,他们的储蓄率正在下降,较低的储蓄可能意味着较低的投资和生产率。我们的政策 正如读者所知,La Soleille不会根据经济、行业或公司分析做市场预测,只按照市场行情和其它技术指标作出判断。我们利用价格-概率数学建模法判断市场是否显现利好或下跌趋势,是否走强或走弱,是否有可能在下一个周期(对我们而言是一个月)继续利好或下跌行情,(以此控制“摩擦性”交易成本)。La Soleille在趋势变化时采取相反立场,尤其是在止跌反弹时。小结与展望 排在上证指数之后,2019年到目前为止,表现最好的国家股票指数依次是:意大利(+15.7%)、俄罗斯(+13.2%)和沙特阿拉伯(+12.8%),均以美元计价。第一个国家正陷入衰退的漩涡,而另外两个国家则得益于油价的上涨。股市目前的水平与去年10月我们卖出最后一批头寸时大致相同。在市场突破目前的阻力位之前,我们仍持有100%的现金。James CunninghamChief Investment Officer首席投资官La Soleille Family Office (Suisse) SA瑞士雷梭勒家族办公室March 31st, 20192019年3月31日 English Version The Rally Stalls in March Although US markets had their strongest first quarter since 1998, The S&P 500 index rose just 0.5% (see graph below) and the MSCI World index a mere 0.1% in March. IT(+18.2%) and Energy (+15.6%) out performed as did Industrials (+ 15.5%) despites lowing growth across the world. On a technical basis, the market is still trying to break through the zone of the three failed rallies mentioned in our previous Bulletin. Listed companies will begin reporting first-quarter profits in coming weeks. Will they rise despite slowing global trade and growth?Low Interest Rates Suggest More Slowing in Economies While stock markets have rallied sharply since a low on December 24th, government bond yields have fallen. Germand 10-year Bund yields are negative and, in America, 10-year Treasury yields are below short-term yields. This indicates that investors expect inflation to fall, perhaps with a recession. Higher oil prices combined with lower inflation expectations mean that prices for other goods will stagnate at best. Absent inflation, higher energy costs can only mean lower consumer demand. Are markets celebrating more accomodating postures from both the US Federal Resserve and the European Central Bank without considering the implicatiosn of slower growth on corporate profits? Internet commerce companies including Lyft, Uber and Pinterest are rushing to make IPOs while the market is sweet. Meanwhile, Brexit remains unsolved and the China/US trade talks drag on. Chinese stock investors apparently anticipate an outcome good enough to compensate for slowing domestic demand and investment: Shanghai is up +21.2% and Tech-heavy Shenzhen a euphoric +30.5% this year.China’s Vanishing Current Account Surplus

While China’s balance of trade has weakened over the past five years, it is the dramatic rise in foreign tourism that has shrunk the country’s famed surplus to near zero. This reflects a declining savings rate among Chinese consumers as they grow more prosperous. Lower savings can mean lower investment and productivity.Our policy In asset management we follow four principles: Identify and follow positive trends (risk on) Sell fast when they turn negative (risk off) Buy again when a bottom is confirmed (risk back on) Diversify by using index-tracking funds, thus minimizing exposure to any particular stock or bondSummary and Outlook After Shanghai, the best national stock index performances thus far in 2019 are Italy (+15.7%), Russia (+13.2%) and Saudi Arabia (+12.8%), all in US dollars. The first country is in recession, while the other two ride higher oil prices. Stock market levels are roughly where they were when we sold our last positions in October. Until the market breaks through current resistance, we remain 100% in cash.James CunninghamChief Investment OfficerLa Soleille Family Office (Suisse) SAMarch 31st, 2019 该文章为搜瑞士原创,部分图片摘引自网络媒体的公开资源,如需转载,敬请注明出处。 Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

-

《传承宝典》3——培养孩子的财商

《传承宝典》3——培养孩子的财商

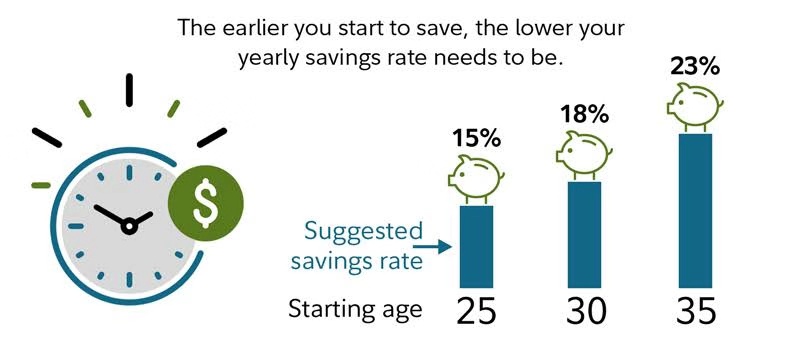

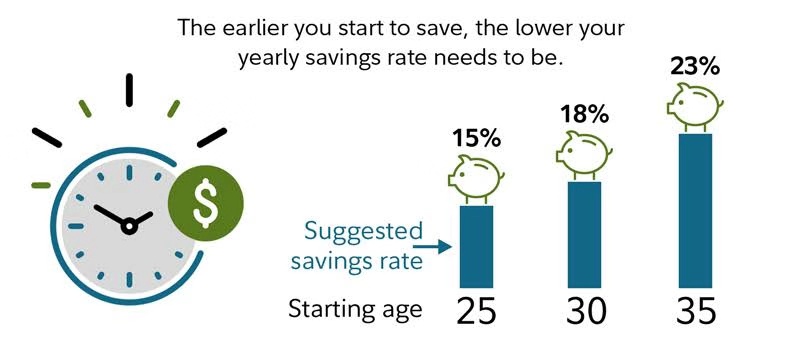

《传承宝典》3培养孩子的财商 如何和你的孩子谈论金钱? 无论是聊起鸟儿或小蜜蜂,还是解释某一爱宠的离世,父母们都会知道:这类艰难的谈话,对孩子情感和智力的成长至关重要。而对许多父母来说,事关乎钱的对话,却是他们最不想与孩子探讨的话题之一。根据普信集团(T. Rowe Price)2015年的一项研究,超过四分之一的受访家长表示:让孩子参与家庭财务的讨论并不重要;41%的人表示,他们有时会避免与孩子谈论钱的问题。但是,父母越早教会孩子金钱,他们就越能有效地培养财务成功的成年人。那么,如何以一种有意义、易于理解、引人入胜的方式开始对话呢?这里,有一些关于如何与你的孩子谈论多种理财概念的想法。 指导他们制定预算 许多父母用零花钱来教育孩子有关金钱的知识。但您可以更进一步,帮助他们为自己的现金制定好预算 (可以遵照50:30:20的原则,来付费/消费/储蓄)。运用真实的例子,来阐明每个月的花销——比如:足球队服、给小朋友的生日礼物、新校服、或者最吃喜欢的零食——这样,您的孩子就能知道每一美元的价值。通过列举现实生活中的例子,您可以和孩子们分享:如何做才能够维持他们目前的生活方式。 大多数的孩子想要新东西——鞋子、电子游戏或是新奇的小玩意。为什么不让他们存够钱来自己买呢?您一旦向孩子们展示了他们想要之物的成本,就可以适时地向他们介绍、引入、创建并实施一个长期储蓄的计划。想要追踪零花钱与存钱的去向,您可以试试 Bankaroo 这款手机应用程序,它是由一位11岁的女孩突发奇想、并由她的家人开发出来的。通过制定储蓄计划、运用真实起效的具体例子,来帮助您的孩子们,您正在为他们日后思考更复杂的目标铺平了道路——比如:为了上大学而提前储蓄。 解释借贷 孩子们可能甚至从未意识到:您的家庭有财务上的责任必须考虑,比如为您的房子所申请的抵押贷款。为了解释贷款的概念,给您的孩子提供一个他们可以产生联系的例子,好比:借钱吃午饭。让您的孩子想象一下,他们借给小朋友几美元买午餐,过了不多久,朋友还了钱。朋友扔了一袋薯片作为对于借款的额外“感谢”。抵押贷款就是这样, 银行贷款给你买房子,并要求你以利息的形式表示额外的“感谢”(利息是一个复杂的概念,但零食会有所帮助。)如果那个朋友不还借款,您的孩子以后就不会想借给他吃午饭的钱了。同样,银行也不愿贷款给那些过去没有还清借款的人。 参与以钱为主题的游戏 这个活动将能实际演示出(而非告诉孩子):钱是如何运作、并帮上很多家庭的,尤其是那些不愿与孩子谈论钱的父母。孩子们想要玩得开心,所以要好好利用这一点,使用适合他们年龄的电脑游戏、应用程序和玩具,来教授他们理财技能。试试看 PayDay 或者 Cashflow for Kids

软件,这些游戏能以吸引人的方式,模拟出真实生活中的财务策略和情况。也有经典的选择,如玩收银机、大富翁、或Game of Life

等应用程序,其原理都基于米尔顿-布拉德利(Milton Bradley)的1860年棋盘游戏。 启蒙越早越关键 孩子的未来是您一生中最重要的投资,所以早点开始对话吧!诀窍是从小处做起:在家里,用日常生活中的例子来教您的孩子关于金钱的知识。随着时间的推移,您将能够解释更复杂的话题,比如:为上大学存钱和买房(著名金融网站NerdWallet上的各个专题性分论坛)。最终,您的投资会得到回报:您将更有可能看到您的孩子成长为一个快乐、财务上自信的成年人。 English Version How to talk to your kids about money Whether it’s talking about the birds and the bees or explaining the death of a loved one, parents know that difficult conversations are essential for their kids emotional and intellectual growth. For many parents, talking about money is one of the hard conversations they least want to have with their kids. According to a 2015 T. Rowe Price study, over a quarter of surveyed parents sayit’s not important to include kids in discussions about family finances; 41% report that they sometimes avoid talking to their kids about money.But the sooner parents teach children about money, the more effective they’ll be in raising financially successful adults. So how do you start the conversation in a way that will be meaningful, comprehensible and engaging?Here are some ideas for how to talk to your children about a variety of financial concepts. Guide them through a budget Many parents use an allowance as a way to teach children about money. You can take it one step further by helping them create a budget for their cash.Use real-world examples of monthly expenses — like a soccer uniform, a birthday present for a friend, new school clothes, or favorite snacks — so your kids can see what a dollar is worth. By including real-life examples, you’ll share with your children what it takes to maintain their lifestyle. Help set long-term savings goals Most kids want something new — shoes, video games or gadgets. Why not have them save enough to make the purchase themselves?Once you show your children the cost of what they want, introduce the idea of creating and putting into place a long-term savings plan.To track allowance and save toward goals try the app Bankaroo, thought up by an 11-year-old girl and developed by her family.By helping your kids create a savings plan using concrete examples that actually matter to them, you pave the way for them to think about more complex goals, such as saving for college. Explain borrowing Children might not even realize that your family has financial obligations to consider, such as getting amortgage for your home. To explain the concept of a loan, provide your children with an example they can relate to, like borrowing money for lunch.Ask your children to imagine that they loan a friend a few dollars to buy lunch, and the friend pays it back after a little while. The friend throws in a bag of chips as an extra “thanks” for the loan. A mortgageis like that — the bank loans you money to buy the house and requires thatextra “thanks” in the form of interest. (Interest is a tricky concept, but snacks help.)And if that friend doesn’t pay back the loan, your childisn’t going to want to lend him lunch money in the future. Similarly, bankshes itate to lend money to people who haven’t paid off loans in the past. Play money themed games An activity that shows, instead of tells, how money works would be helpful for many families, especially for parents who are hesitant totalk to their kids about money. Kids want to have fun, so capitalize on this byusing age-appropriate games, apps and toys that teach financial skills.Try PayDay or Cashflow for Kids, games that simulate real life financial strategies and situations in an engaging way. There are also classic options such as play cash registers, Monopoly, or the Game of Life app based on Milton Bradley’s 1860 board game. Starting early is key Your child’s future is the most important investment you’ll ever make, so start the conversation early. The trick is to start small and at home, using everyday examples to teach your children about money. Over time,you’ll be able to explain more complex topics, such as saving for college and buying a home. And eventually the investment will pay off: You’ll be more likely to see your children grow into happy, financially confident adults. 该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。 Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

《传承宝典》4: 初创型公司CEO的一天

《传承宝典》4: 初创型公司CEO的一天

中国登陆瑞士的企业名单(2019年最全版)

中国登陆瑞士的企业名单(2019年最全版)

2019年3月资产管理月度简报

2019年3月资产管理月度简报

《传承宝典》3——培养孩子的财商

《传承宝典》3——培养孩子的财商