发布时间:2019-02-26

《传承宝典》3

培养孩子的财商

无论是聊起鸟儿或小蜜蜂,还是解释某一爱宠的离世,父母们都会知道:这类艰难的谈话,对孩子情感和智力的成长至关重要。而对许多父母来说,事关乎钱的对话,却是他们最不想与孩子探讨的话题之一。根据普信集团(T. Rowe Price)2015年的一项研究,超过四分之一的受访家长表示:让孩子参与家庭财务的讨论并不重要;41%的人表示,他们有时会避免与孩子谈论钱的问题。但是,父母越早教会孩子金钱,他们就越能有效地培养财务成功的成年人。那么,如何以一种有意义、易于理解、引人入胜的方式开始对话呢?这里,有一些关于如何与你的孩子谈论多种理财概念的想法。

许多父母用零花钱来教育孩子有关金钱的知识。但您可以更进一步,帮助他们为自己的现金制定好预算 (可以遵照50:30:20的原则,来付费/消费/储蓄)。运用真实的例子,来阐明每个月的花销——比如:足球队服、给小朋友的生日礼物、新校服、或者最吃喜欢的零食——这样,您的孩子就能知道每一美元的价值。通过列举现实生活中的例子,您可以和孩子们分享:如何做才能够维持他们目前的生活方式。

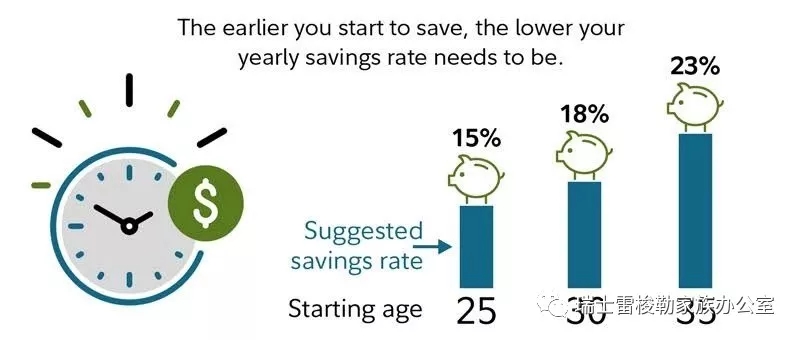

大多数的孩子想要新东西——鞋子、电子游戏或是新奇的小玩意。为什么不让他们存够钱来自己买呢?您一旦向孩子们展示了他们想要之物的成本,就可以适时地向他们介绍、引入、创建并实施一个长期储蓄的计划。想要追踪零花钱与存钱的去向,您可以试试 Bankaroo 这款手机应用程序,它是由一位11岁的女孩突发奇想、并由她的家人开发出来的。通过制定储蓄计划、运用真实起效的具体例子,来帮助您的孩子们,您正在为他们日后思考更复杂的目标铺平了道路——比如:为了上大学而提前储蓄。

孩子们可能甚至从未意识到:您的家庭有财务上的责任必须考虑,比如为您的房子所申请的抵押贷款。为了解释贷款的概念,给您的孩子提供一个他们可以产生联系的例子,好比:借钱吃午饭。让您的孩子想象一下,他们借给小朋友几美元买午餐,过了不多久,朋友还了钱。朋友扔了一袋薯片作为对于借款的额外“感谢”。抵押贷款就是这样, 银行贷款给你买房子,并要求你以利息的形式表示额外的“感谢”(利息是一个复杂的概念,但零食会有所帮助。)如果那个朋友不还借款,您的孩子以后就不会想借给他吃午饭的钱了。同样,银行也不愿贷款给那些过去没有还清借款的人。

这个活动将能实际演示出(而非告诉孩子):钱是如何运作、并帮上很多家庭的,尤其是那些不愿与孩子谈论钱的父母。孩子们想要玩得开心,所以要好好利用这一点,使用适合他们年龄的电脑游戏、应用程序和玩具,来教授他们理财技能。试试看 PayDay 或者 Cashflow for Kids 软件,这些游戏能以吸引人的方式,模拟出真实生活中的财务策略和情况。也有经典的选择,如玩收银机、大富翁、或Game of Life 等应用程序,其原理都基于米尔顿-布拉德利(Milton Bradley)的1860年棋盘游戏。

孩子的未来是您一生中最重要的投资,所以早点开始对话吧!诀窍是从小处做起:在家里,用日常生活中的例子来教您的孩子关于金钱的知识。随着时间的推移,您将能够解释更复杂的话题,比如:为上大学存钱和买房(著名金融网站NerdWallet上的各个专题性分论坛)。最终,您的投资会得到回报:您将更有可能看到您的孩子成长为一个快乐、财务上自信的成年人。

English Version

Whether it’s talking about the birds and the bees or explaining the death of a loved one, parents know that difficult conversations are essential for their kids' emotional and intellectual growth. For many parents, talking about money is one of the hard conversations they least want to have with their kids.

According to a 2015 T. Rowe Price study, over a quarter of surveyed parents sayit’s not important to include kids in discussions about family finances; 41% report that they sometimes avoid talking to their kids about money.But the sooner parents teach children about money, the more effective they’ll be in raising financially successful adults. So how do you start the conversation in a way that will be meaningful, comprehensible and engaging?Here are some ideas for how to talk to your children about a variety of financial concepts.

Many parents use an allowance as a way to teach children about money. You can take it one step further by helping them create a budget for their cash.Use real-world examples of monthly expenses — like a soccer uniform, a birthday present for a friend, new school clothes, or favorite snacks — so your kids can see what a dollar is worth. By including real-life examples, you’ll share with your children what it takes to maintain their lifestyle.

Most kids want something new — shoes, video games or gadgets. Why not have them save enough to make the purchase themselves?Once you show your children the cost of what they want, introduce the idea of creating and putting into place a long-term savings plan.To track allowance and save toward goals try the app Bankaroo, thought up by an 11-year-old girl and developed by her family.By helping your kids create a savings plan using concrete examples that actually matter to them, you pave the way for them to think about more complex goals, such as saving for college.

Children might not even realize that your family has financial obligations to consider, such as getting amortgage for your home. To explain the concept of a loan, provide your children with an example they can relate to, like borrowing money for lunch.Ask your children to imagine that they loan a friend a few dollars to buy lunch, and the friend pays it back after a little while. The friend throws in a bag of chips as an extra “thanks” for the loan. A mortgageis like that — the bank loans you money to buy the house and requires thatextra “thanks” in the form of interest. (Interest is a tricky concept, but snacks help.)And if that friend doesn’t pay back the loan, your childisn’t going to want to lend him lunch money in the future. Similarly, bankshes itate to lend money to people who haven’t paid off loans in the past.

An activity that shows, instead of tells, how money works would be helpful for many families, especially for parents who are hesitant totalk to their kids about money. Kids want to have fun, so capitalize on this byusing age-appropriate games, apps and toys that teach financial skills.Try PayDay or Cashflow for Kids, games that simulate real life financial strategies and situations in an engaging way. There are also classic options such as play cash registers, Monopoly, or the Game of Life app based on Milton Bradley’s 1860 board game.

Your child’s future is the most important investment you’ll ever make, so start the conversation early. The trick is to start small and at home, using everyday examples to teach your children about money. Over time,you’ll be able to explain more complex topics, such as saving for college and buying a home. And eventually the investment will pay off: You’ll be more likely to see your children grow into happy, financially confident adults.

该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com