-

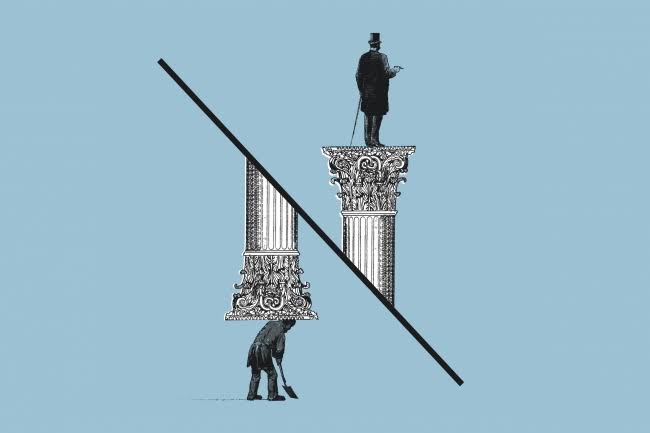

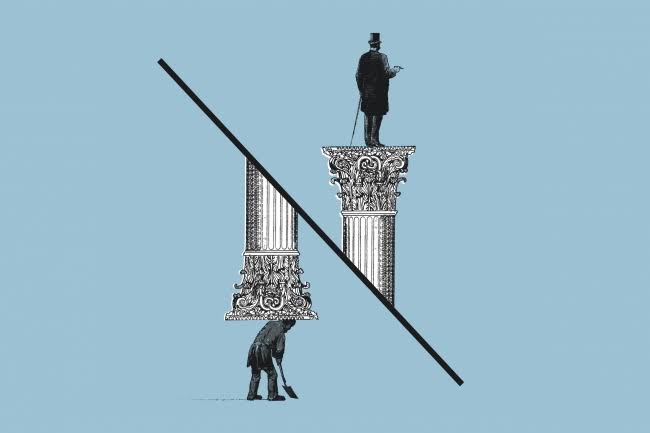

《传承宝典》8——长子继承制正在衰落

《传承宝典》8——长子继承制正在衰落

《传承宝典》8 长子继承制正在衰落 领导力:

确保当前正确的模式,进而惠及未来数代人 建立正确的领导模式是至关重要的,可以帮助一个家族克服不断变化中的环境所带来的不确定性,并确保财富安全地从一代转移到下一代,如果这是经过他们一致同意的目标的话。一个有效的领导模式,可以使一个家族能够管理所有的风险,包括内部和外部的风险,使得其个人或其他家庭成员,都拥有处理家族资本各个方面的技能。任命一位家族内部的新领导人,其方式并没有对错之分。在民主体制下,领导人会根据其特定角色的技能而被任命,这将使一个家族具备覆盖所有风险的能力。家族不应害怕在没有合适的内部候选人的情况下,从外部寻求帮助,也不应害怕为这一进程而寻求咨询和辅助。 有组织的准备,是领导力必不可少的。有效的培训应该培养人们的天赋,给予他们足够的自主权,让他们在家族结构中找到自己的声音和角色。一旦建立了正确的领导模式,就必须进行强有力的沟通宣传,以确保所有领导人和更广泛的家族成员们,都了解家族的目标, 以及为实现这些目标而提出的战略。 根据 Stonehage Fleming 家族办公室的最新研究,依据长子继承权(由最先出生的孩子继承遗产的权利)来选出下一代领导人的家族数量,将降至目前的三分之一。在这份题为《变革时代的实用智慧与领导力》的调查报告中,28%的受访家族表示,未来的领导人目前是根据长子继承制(即:primogeniture)选出的,而只有10%的家族表示,他们认为这种情况将在未来继续下去。家族治理和继承事务主管马修•弗莱明(Matthew Fleming)在本周举行的Stonehage Fleming家族投资大会上表示:“有切实的迹象表明,这种趋势正在发生转变——一种明确的趋势,针对英才教育制度和挑选家族领导人的新方法。”他补充称:“还有一种明显的趋势是,家族领导人不止一个。” 理想的情况是,一个家庭在每一代人中都有几位不同的高素质领导者,每个人都扮演适合自己技能的角色。这样的领导角色不仅包括家族企业的首席执行官或财富管理主管,还可能包括家族文化与发展主管、下一代接班人的主管和慈善事业主管。在选择领导者方面,13%的受访者表示,他们家族或家族企业的领导者目前是由委员会选出的。33%的人认为这应该是未来领导人的选择方式。马修警告说:“将领导人的选择正式化确实具有挑战性。”“一些家庭使用平衡计分卡,一些家庭请外部顾问帮忙,一些家庭使用受托人,还有一些家庭同时使用这三种方法。” 报告中列出的家族五大风险,均指向利用和部署家庭的社会、文化和智力资本的需要,来化解应对家庭纠纷、未能吸引下一代或未能选择出合适领导人等风险。随着更好地管理这些非财务风险的需求已得到更广泛的承认,更广泛的领导角色的需求也将会得到接受。马修说:“多年来,在文化和社会资本方面,人们有很多方式来引导家庭。”“只有当你回首往事时,你才会意识到,领导者的选举对一个家庭的代际成功做出了多么关键的贡献。” 封面图为《三代人的冒险》——瑞士Piccard科学家家族 English Version Trend emerges towards more democratic leader selection Leadership: Ensuring the right model now and for future generations Having the right leadership model in place is essential to see a family through the uncertainties of a changing environment and ensure the safe transition of wealth from one generation to the next, if that is their agreed purpose. An effective leadership model enables a family to manage all risks, both internal and external, with an individual or individuals with the skills to address every aspect of a familys capital. There is no right or wrong way to appoint new leaders within a family. A democratic system, where leaders are appointed for their role-specific skills, will equip a family to cover off the full spectrum of risks. Families should not be afraid to look externally in the absence of a suitable internal candidate, also for counsel and facilitation of the process. Structured preparation for leadership is essential. Effective training should nurture peoples natural aptitudes and give them enough autonomy to find their own voice and role within the family structure. Once the right leadership model is in place, strong communication is essential to ensure that all leaders and the wider family are kept abreast of the family objectives and the proposed strategy to achieve them. The number of families selecting the next generation of leaders based on primogeniture - the right of the first born to inherit an estate - will drop to a third of todays figure, according to the latest research by Stonehage Fleming. 28% of families surveyed for the report, subtitled Practical Wisdom and Leadership for Changing Times’, said that future leaders are currently selected on the basis of primogeniture, whereas only 10% said that they see it continuing in the future. “There is real evidence of a shift – a definite trend towards a meritocracy and towards new methods of choosing family leaders”, said Matthew Fleming, Head of Family Governance and Succession, speaking at the Stonehage Fleming Family Investment Conference this week. “There is also a definite trend towards having more than one family leader”, he added. Ideally, a family will have several different high quality leaders in every generation, each filling a role that befits their skills. Such leadership roles will not only include the chief executive of a family business or a head of wealth management, but may also include a head of family culture and development, a head of next generation and a head of philanthropy. When it comes to choosing leaders, 13% of survey respondents said that leaders in their family or family business are currently selected by committee. 33% believed that it should be the way leaders are selected in the future. “Formalising the selection of leaders is really challenging,” cautioned Matthew. “Some families use balanced scorecards, some get outside consultants in to help, some use trustees and some use a combination of all three.”The top five risks identified by the families in the report, all point towards the need to harness and deploy a familys social, cultural and intellectual capital, addressing risks such as family disputes and a failure to engage the next generation or choose appropriate leaders. As the requirement to better manage these non-financial risks is more widely acknowledged, the need for a wider range of leadership roles is also likely to be accepted.“There are lots of ways in which people have led families in cultural and social capital over the years”, said Matthew. “It is only when you look back that you realise what an utterly critical contribution they have made to the intergenerational success of a family.” 该文章转账自雷梭勒家族办公室,如有侵权,敬请告知删除。 Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

-

莱蒙国际学校——在艺术世界将遥不可及成为现实

莱蒙国际学校——在艺术世界将遥不可及成为现实

莱蒙国际学校 在艺术世界将遥不可及成为现实 1. 不断启发学生的艺术才能,聆听感受学生的艺术之声 莱蒙国际学校的表演和视觉艺术课程,是学校所有课程中不可缺少的一部分,学校出色的师资力量再结合很多精彩的课程项目,意在丰富和充实学生的学术、社交和友谊氛围,鼓励正在成长中的学生建立起自尊心,利用自我灵感发挥创造力,全面提升学术表现。我们相信利用艺术性的经验和思维,如同让学生搭乘一辆飞驰的汽车,来探索学习中最重要的技能——批判性思维和自我表达能力。我们鼓励学生去发现和追寻最适合自己的艺术领域,无论是视觉艺术、音乐、戏剧表演、还是各种舞蹈形式。作为学校最具代表性的课程项目,比如:莱蒙国际学校小提琴课程,展示出了我们在艺术方面的责任和承诺,作为整个莱蒙教育板块的重要组成部分(必修课程)。同样地,莱蒙国际学校完善的硬件设施,可以提供便利又广阔的艺术类课程选择,更加印证了学校旨在培养学生的创造力和自我表达能力。 2. 为您的孩子提供一个世界级的学习音乐机会 从学生6岁起,每名莱蒙学生将会有机会学习(遵循)到一套最具创新的艺术课程,学校与美国茱莉亚音乐学院共同合作研发出优质的课程,而茱莉亚音乐学院是世界艺术表演教育中的佼佼者和当仁不让的领导者。课程富有高质量的教学和与时俱进的资源,学校所提供的学习环境,能让学生感受到茱莉亚音乐学院纯正的艺术观、传统、专业知识。当学习茱莉亚音乐学院的艺术表演课程时,会给您的孩子带来一种绝无仅有的学习体验。 3. 关于茱莉亚音乐学院的课程设置 课程在传统音乐课程的基础上,您的孩子会进入到一套茱莉亚音乐学院独创的“策划曲目”体系,这个体系是由12个核心类别组成的,这里面包含了广泛的音乐流派、调性、对应的文化题材。这其中每一种类别都以一个标志性的作品为例,辅之以精心策划的延展作品,可以让您的孩子探索音乐的不同元素和整个音乐环境下学生所扮演的角色。键盘表演作为学习音乐的入门理论知识。没有一种更好的方式,可以让学生理解音乐概念,并通过最先进的资源和最雄厚的师资力量来完成。每个学生都将通过灵活地使用音乐键盘,来探索音乐世界的基本原理,培养学生自我鉴赏能力。 4. 解锁你孩子的想象能力 学生理解和参与才艺展示课程,对孩子来说会得到很大益处。当学生融入到由茱莉亚音乐学院设计的课程活动时,将会帮助学生透彻地理解音乐语言、发展创造性思维:比如即兴表演和作词作曲能力。随着学习课程的深入,孩子的一些宝贵技能会得到发展,比如:辩证性思维,适应能力,敢于冒险能力和严明的组织纪律协同性,让孩子在学习中的各个方面都受益匪浅,为他们未来人生道路走向成功做好充分的准备。 5. 真正享有茱莉亚音乐学院的教学资源 您的孩子将会共享全球茱莉亚音乐学院的教学资源,比如:表演者的作品、艺术家教程、权威专业课程。除此之外,还会定期开展与莱蒙学生之间的互动课程,比如:艺术巡讲、专家课堂,在学校里进行表演艺术课等音乐活动。 该文章为搜瑞士网站原创,部分图片摘引自网络媒体的公开资源,如需转载,敬请注明出处。Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

-

瑞士校园动态新鲜事04.17

瑞士校园动态新鲜事04.17

瑞士国际学校 校园动态04.17 一. 莱蒙国际学校(College du Leman)校园新鲜事 世界水源日(World Water Day) 珍惜水资源,人人有责! 愿莱蒙的全体学生们,本周都有一个愉快的春季假期(Spring Break)! 二. 博索雷学院(Beau Soleil College)校园新鲜事 勇于表达自我,在节奏和韵律中,展示真我的一面! 以积极乐观的心态,来学习交流、规划升学, 并提升自我修养。 和你的同学们一起欢声歌唱,总是一直充满乐趣。 随着前不久一场新的降雪,校园里又回到了白雪皑皑的梦幻景象。 我校的后勤保障部门,正在紧锣密鼓地铲除观景台上的积雪,以便让学生们在返校之后不会受到任何影响。感谢工作人员的辛勤付出~! 三. 瑞士美国学校(TASIS)校园新鲜事 近期天气非常好,造型典雅、优美的校园建筑,在蓝天白云的映衬下,更加的备受瞩目并充满朝气。 春天的脚步悄悄地临近了,校园里随处可见春日生机盎然的印记,木兰花已经在不知不觉中绽放。在这一令人身心愉悦的季节,校园入口处也是花团锦簇,繁花点点,让人流连赞叹。 目前的校园,正处在这一年中最怡然惬意的时光里,快拿起你的相机来记录大自然的良辰美景吧! 瑞士美国学校的小学生们,正徒步结伴前往 Palmer Center,参观全天的Usborne 书展活动。每名同学都非常地好奇与激动,在书展现场拿到了很多他们爱不释手的可爱读物。 不同年级的学生,都可以随时从校园的观景台上,欣赏卢加诺湖(瑞士意大利语区)的壮观景色。 学校组织了一场排球慈善赛,这个活动取得了巨大的成功,每名同学都沉浸在运动的乐趣中,同时还达到了筹集善款、奉献爱心的公益目的。 瑞士美国学校(TASIS)的校长 Christopher Nikoloff 先生,感受着校园露台午后悠扬的时光,并和校领导们一起探讨学校未来的发展情况。 今天五年级和八年级的学生 共同参加了一年一度的校园介绍日活动 学生设计的服装展示日 展现出同学们自我的时尚品味和审美特点 在午后的校园里,时刻面带着微笑 用豁达的心态来面对学习与挑战 该文章为搜瑞士网站原创,部分图片摘引自网络媒体的公开资源,如需转载,敬请注明出处。 Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

-

《传承宝典》7——影响力投资 跨越代沟

《传承宝典》7——影响力投资 跨越代沟

《传承宝典》7影响力投资 跨越代沟 影响力投资: 在产生财务回报的同时,产生可衡量的、对于社会和环境有益影响的投资。这类对社会负责任的投资,可成为让几代人走到一起的方式。Rebecca Gooch说,虽然一些家族办公室已经接受了影响力投资,但其他家族办公室则仍旧“一无所知”。 影响力投资是一种新兴的、活跃的、处于投资前沿的投资方式。家族办公室的观念往往陈旧、传统、保守。因此,这两者之间并不是显而易见的合作伙伴,但家族办公室对影响力投资正表现出了更大的兴趣,并表示:这一策略可以为整个家族带来好处。 Campden Wealth 机构的研究主管丽贝卡•古奇(Rebecca Gooch)女士表示,家族办公室对于影响力投资的关注趋势,在过去一年有所加速。她表示,该研究集团今年与瑞银(UBS)合作对全球家族办公室进行的年度调查反映了这一点。她指出:“影响力投资正成为家族办公室行业的一个热门趋势,目前约有三分之一的家族办公室参与其中。 全球领先的多家族办公室 Stonehage Fleming 的私人资本投资团队负责人理查德•克拉克-杰沃斯(Richard Clarke-Jervoise)也表示,客户对影响力投资正越来越感兴趣。他表示:“在过去12至18个月里,我们经历了一个台阶式的变化,感觉我们已经经历了一个转折点,人们的兴趣变得更具实质性。”高盛资产管理公司的环境、社会、治理和影响力投资部门的董事总经理——约翰•戈尔茨坦说:家族办公室正在增加影响力投资的份额,从他们投资组合中的5~10%,已上升至25~50%。他补充到:甚至Impact Network 签署到了100%的案例,一些家庭办公室和其他财富投资者都已经同意将他们所有的投资资源,都集中在影响力投资之上。 影响力投资的一个显著优势是,它可以是一个有效的方式,使一个家族的几代人走到一起。理财顾问们表示,通常情况下,最初的财富创造者们,很难让子女或孙辈对家族财富的投资感兴趣。但随着年轻一代倾向于更具有社会意识,影响力投资可以成为吸引他们加入的一种方式。“两代人之间存在着巨大的分歧,很难弥合这种分歧,”克拉克-杰沃斯指出。“影响力投资,通常是两代人之间,第一次就投资而进行的有意义的对话,因此,它提供了更多的巩固作用。它在让两代人都站在同一立场上,讨论对两代人都重要的问题方面,发挥了非常微妙但非常重要的作用。”

通常是年轻的一代,首次提出影响力投资的话题。古奇表示,对于从事影响力投资的家族办公室来说,目前约有一半的资金用于教育、环保或提高能源和资源的效率。 家族办公室的另一个趋势是,随着婴儿潮一代寿命的延长,年轻一代将在晚年继承财产。父母还健在的年轻一代现在已经三四十岁了。然而,这并不意味着他们无法做出投资决策;相反,顾问们表示,他们对投资的看法之所以受到尊重,是因为他们成熟,尽管他们自己无法控制资金。 English Version Impact investing crosses generation gap Impact investing refers to investments "with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return" . Socially responsible investment can be away of bringing the generations together. Rebecca Gooch, who says while some family offices have embraced impact investing, others are ‘in the dark’. Impact investing is new, dynamic and at the frontier of investment. Family offices are often old, traditional and conservative in their outlook. The two are not obvious partners, then, but family offices are showing more interest in impact investing, and say the strategy can bring benefits for a family as a whole. The move towards impact investing by family offices has accelerated in the past year, according to Rebecca Gooch, director of research at Campden Wealth. She says the research group’s annual survey ofglobal family offices, carried out with UBS this year, and published inSeptember, reflects this. “Impact investing is becoming a heated trend in the family office community, with about a third of family offices now engaged in it,” she notes. Richard Clarke-Jervoise, head of the private capital investment team at multi-family office Stonehage Fleming, also says impact investing has become of increasing interest to clients. “There has been a step change in the past 12-18 months where it feels like we have gone through a tipping point and the interest has become more material,”he says. John Goldstein, managing director of environmental, social and governance and impact investing at Goldman Sachs Asset Management, says family offices are increasing the amount of impact investing they do, from 5-10 per cent of their portfolio to 25-50 per cent. Some, he says, have even signed up to the 100% Impact Network, a group of family offices and other wealthy investors who have agreed to put all of their resources into impact investment. A significant advantage of impact investingis that it can be an effective way to bring generations of a family together. Often, advisers say, the original wealth creator finds it difficult to interest children or grandchildren in the investment side of the family wealth. But with the younger generation tending to be more socially minded, impact investing can be a way of drawing them in. “There is a huge divide between the generations and it is very difficult to bridge that divide,” notes Clarke-Jervoise.“Impact investment is often the first time that both generations have a meaningful conversation about investment so it is providing more of a cementing role. It plays a very subtle but very important role in getting both generations on the same page and talking about matters that are important to both of them.” It is usually the younger generation that raises the topic of impact investment for the first time. Gooch says that for family offices undertaking impact investment, about half the money is currently put towards education, environmentalism or energy and resource efficiency. Another trend at family offices is that the younger generation is inheriting money later in life as baby boomers live longer. The younger generation whose parents are still alive are now in their 30s or 40s. Yet this does not mean they are not able to make investment decisions; rather, advisers say, their views on investment are respected because of their maturity, even though they do not have control of the money themselves. 该文章为搜瑞士网站原创,部分图片摘引自网络媒体的公开资源,如需转载,敬请注明出处。 Sooswiss为您提供 瑞士方向私人管家式的定制服务: 1)家族传承 2)财富管理 3)瑞士投资 4)居留计划 5)税务优化 6)家族治理 更多资讯请登录网站 www.sooswiss.com

《传承宝典》8——长子继承制正在衰落

《传承宝典》8——长子继承制正在衰落

莱蒙国际学校——在艺术世界将遥不可及成为现实

莱蒙国际学校——在艺术世界将遥不可及成为现实

瑞士校园动态新鲜事04.17

瑞士校园动态新鲜事04.17

《传承宝典》7——影响力投资 跨越代沟

《传承宝典》7——影响力投资 跨越代沟