发布时间:2019-04-08

《传承宝典》7

影响力投资 跨越代沟

影响力投资:

Campden Wealth 机构的研究主管丽贝卡•古奇(Rebecca Gooch)女士表示,家族办公室对于影响力投资的关注趋势,在过去一年有所加速。她表示,该研究集团今年与瑞银(UBS)合作对全球家族办公室进行的年度调查反映了这一点。她指出:“影响力投资正成为家族办公室行业的一个热门趋势,目前约有三分之一的家族办公室参与其中。

全球领先的多家族办公室 Stonehage Fleming 的私人资本投资团队负责人理查德•克拉克-杰沃斯(Richard Clarke-Jervoise)也表示,客户对影响力投资正越来越感兴趣。他表示:“在过去12至18个月里,我们经历了一个台阶式的变化,感觉我们已经经历了一个转折点,人们的兴趣变得更具实质性。”高盛资产管理公司的环境、社会、治理和影响力投资部门的董事总经理——约翰•戈尔茨坦说:家族办公室正在增加影响力投资的份额,从他们投资组合中的5~10%,已上升至25~50%。他补充到:甚至 Impact Network 签署到了100%的案例,一些家庭办公室和其他财富投资者都已经同意将他们所有的投资资源,都集中在影响力投资之上。

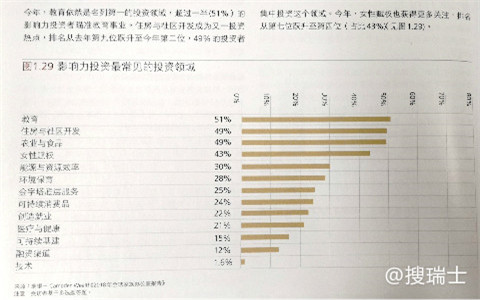

影响力投资的一个显著优势是,它可以是一个有效的方式,使一个家族的几代人走到一起。理财顾问们表示,通常情况下,最初的财富创造者们,很难让子女或孙辈对家族财富的投资感兴趣。但随着年轻一代倾向于更具有社会意识,影响力投资可以成为吸引他们加入的一种方式。“两代人之间存在着巨大的分歧,很难弥合这种分歧,”克拉克-杰沃斯指出。“影响力投资,通常是两代人之间,第一次就投资而进行的有意义的对话,因此,它提供了更多的巩固作用。它在让两代人都站在同一立场上,讨论对两代人都重要的问题方面,发挥了非常微妙但非常重要的作用。” 通常是年轻的一代,首次提出影响力投资的话题。古奇表示,对于从事影响力投资的家族办公室来说,目前约有一半的资金用于教育、环保或提高能源和资源的效率。

家族办公室的另一个趋势是,随着婴儿潮一代寿命的延长,年轻一代将在晚年继承财产。父母还健在的年轻一代现在已经三四十岁了。然而,这并不意味着他们无法做出投资决策;相反,顾问们表示,他们对投资的看法之所以受到尊重,是因为他们成熟,尽管他们自己无法控制资金。

English Version

Impact investing crosses generation gap

Impact investing refers to investments "with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return" . Socially responsible investment can be away of bringing the generations together. Rebecca Gooch, who says while some family offices have embraced impact investing, others are ‘in the dark’. Impact investing is new, dynamic and at the frontier of investment. Family offices are often old, traditional and conservative in their outlook. The two are not obvious partners, then, but family offices are showing more interest in impact investing, and say the strategy can bring benefits for a family as a whole.

The move towards impact investing by family offices has accelerated in the past year, according to Rebecca Gooch, director of research at Campden Wealth. She says the research group’s annual survey ofglobal family offices, carried out with UBS this year, and published inSeptember, reflects this. “Impact investing is becoming a heated trend in the family office community, with about a third of family offices now engaged in it,” she notes.

Richard Clarke-Jervoise, head of the private capital investment team at multi-family office Stonehage Fleming, also says impact investing has become of increasing interest to clients. “There has been a step change in the past 12-18 months where it feels like we have gone through a tipping point and the interest has become more material,”he says. John Goldstein, managing director of environmental, social and governance and impact investing at Goldman Sachs Asset Management, says family offices are increasing the amount of impact investing they do, from 5-10 per cent of their portfolio to 25-50 per cent. Some, he says, have even signed up to the 100% Impact Network, a group of family offices and other wealthy investors who have agreed to put all of their resources into impact investment.

A significant advantage of impact investingis that it can be an effective way to bring generations of a family together. Often, advisers say, the original wealth creator finds it difficult to interest children or grandchildren in the investment side of the family wealth. But with the younger generation tending to be more socially minded, impact investing can be a way of drawing them in. “There is a huge divide between the generations and it is very difficult to bridge that divide,” notes Clarke-Jervoise.“Impact investment is often the first time that both generations have a meaningful conversation about investment so it is providing more of a cementing role. It plays a very subtle but very important role in getting both generations on the same page and talking about matters that are important to both of them.”

It is usually the younger generation that raises the topic of impact investment for the first time. Gooch says that for family offices undertaking impact investment, about half the money is currently put towards education, environmentalism or energy and resource efficiency. Another trend at family offices is that the younger generation is inheriting money later in life as baby boomers live longer. The younger generation whose parents are still alive are now in their 30s or 40s. Yet this does not mean they are not able to make investment decisions; rather, advisers say, their views on investment are respected because of their maturity, even though they do not have control of the money themselves.

该文章为搜瑞士网站原创,部分图片摘引自网络媒体的公开资源,如需转载,敬请注明出处。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com