发布时间:2018-11-14

2018年10月资产管理月度简报

美国市场振幅最大的一个月

10月,美国股市跌幅既猛又快。主要股指(标普500指数、纳斯达克和罗素2000指数)均在较高点回落10%,但由于企业收益表现强劲,在本月最后两天略有回升。标准普尔指数1月份回升至初始水平之上,年初迄今已累计上涨1.4%。我们投资的仍是仅有正回报的三个板块:信息技术上涨9.9%,医疗保健上涨7.4%,非必须消费品上涨5.9%。但上升趋势已被打破。

美国的经济依然强劲

美国GDP第三季度增速为3.5%,是所有西方经济体中最强劲的。消费者信心正处于2000年网络泡沫破裂前的最高点。失业率下降、工资上涨、通胀预期减弱。商品房销量增长和房价上涨速度正在放缓但仍然良好。但市场情绪已变得谨慎起来。全球最大的基金管理公司Blackrock在过去两个季度出现资金外流,其中包括173亿美元的股票基金类。据媒体文章报道,市场对股票估值感到不安,分析师下调了2019年收益增长的预期,这预示着特朗普减税计划正逐渐失效。

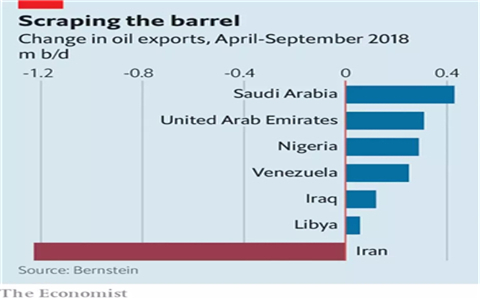

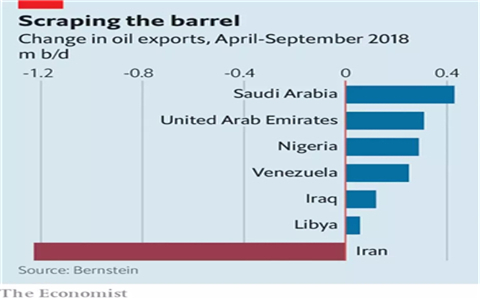

石油产量受限、价格却下跌

伊朗石油进口商预计美国将于11月4日开始对伊朗实施制裁,因此削减了石油进口量。其他生产商,尤其是沙特阿拉伯,目前已经开始弥补需求缺口。美国页岩油生产商正遭遇水力压裂技术极限,现有管道正在满负荷运转。然而,原油价格却下跌了约10%。给出的理由是全球经济增速放缓。

我们的政策

在资产管理方面,我们遵循以下四个原则:

确定并遵循利好趋势(追逐风险);

下跌时迅速杀跌(规避风险);

确认触底时再次建仓(再次追逐风险);

利用行业、国家和区域指数跟踪基金和一篮子组合进行分散投资,尽量降低投资一种股票或债券的风险。

James Cunningham

Chief Investment Officer

首席投资官

La Soleille Family Office (Suisse) SA

瑞士雷梭勒家族办公室

October 31st, 2018

2018年10月31日

English Version

A Rocky Month for US Markets

The fall came sharp and fast for American markets in October. The main indices (S&P 500, NASDAQ and Russell 2000) all reached correction status of -10% from their highs before recovering somewhat in the last two days of the month thanks to strong corporate earnings. The S&P crawled back above its starting level in January and is up 1.4% year-to-date. The same three sectors in which we were invested remain the only ones with positive returns: IT + 9.9%, Health Care +7.4% and Consumer Discretionary +5.9%. But the uptrend is broken.

US Economy Remains Strong

US GDP growth for the third quarter, at +3.5%, is the strongest of any Western economy. Consumer confidence is at its highest since 2000, before the dot.com crash. Unemployment is low, wages are rising, and inflation remains subdued. Growth in home sales, as well as the increase in house prices, is moderating but still good. But sentiment has turned cautious. Blackrock, the world’s largest fund manager, saw outflows in the last two quarters, including $17.3 billion from stock funds. Press articles show unease with stock valuations, and analysts paring earnings growth estimates for 2019, expecting the Trump tax-cut boost to pass.

Oil Prices Fall Despite Production Constraints

Importers of Iranian oil have cut back in anticipation of US sanctions starting November 4th. Other producers, particularly Saudi Arabia, have for now compensated. American shale producers are reaching technological limits for fracking, and existing pipelines are operating at full capacity. And yet crude prices have declined some 10%. The given reason is slowing global growth.

Our policy

In asset management we follow four principles:

Identify and follow positive trends (risk on)

Sell fast when they turn negative (risk off)

Buy again when a bottom is confirmed (risk back on)

Diversify by using index-tracking funds ,thus minimizing exposure to any particular stock or bond

We use mathematical modeling of prices and probabilities to determine if a trend is positive or negative, strengthening or weakening, and likely or not to continue for the next period (which for us is one month, to control trading cost “friction”). La Soleille is contrarian at the trend change, particularly when a downtrend turns positive. The Brazilian market welcomed the election of Jair Bolsonaro with a new high for the BOVESPA Index. The MSCI World (of which the US accounts for about half) is down -5.5% for the year, with Emerging Markets down -17.7% in dollar terms. Europe is off -10.7% and China’s Shenzen Index -31.7% despite Government efforts to stop the rout. South Korea has joined China in bear territory, also off more than -20% from its peak. As noted in our recent flash, we have sold all of our investments. With rising interest rates a threat to bonds, we keep our assets in cash.

James Cunningham

Chief Investment Officer

La Soleille Family Office (Suisse) SA

October 31st,2018

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com