发布时间:2018-10-18

尽管贸易战在不断升级,但是美国经济表现却越来越强劲。消费者信心正处于十年来的最高水平,而失业率则处于创纪录的低点。强势美元正在抑制通货膨胀。有些分析师认为,任何投入和进口成本的上升都会被强劲的国内需求所吸收,并最终导致工资水平大幅上涨。虽然10年期美国国债收益率已升至3%以上,但美联储已表示将在增加信贷成本方面仍然持谨慎态度。至于美国股市,所有主要股指9月均升至新高,各行业板块之间的轮换已弥补了信息技术板块的疲软表现。标普500指数今年迄今为止上涨了9%。但只有三个行业表现出色:信息技术、非必需消费品和医疗保健。

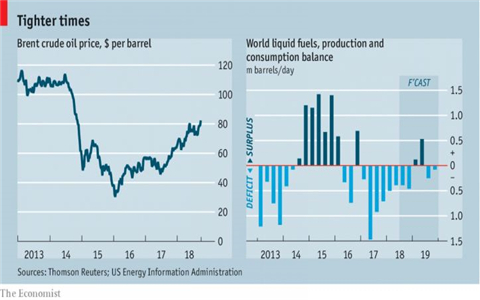

新兴市场的增长已受到美元升值和油价上涨的冲击。在欧洲,消费者和企业的情绪正在减弱,如下图(采购经理出口订单)所示。欧洲股指也相应走弱,今年下跌了3.4%,远低于1月份的高点。

我们的政策

在资产管理方面,我们遵循的原则是:

• 鉴别并紧跟上涨行情(追逐风险);

• 出现下跌行情时立刻清仓(规避风险);

• 确认触底时逐步建仓(重新追逐风险);

• 利用指数基金进行分散投资,尽量降低投资一种股票或债券的风险。

除了在美国,今年很少有股票市场的回报率为正数的。挪威股市最强,上涨了19.2%。然后纳斯达克上涨了15.7%,其次是沙特阿拉伯上涨了9.2%,标普上涨了9.0%,哥伦比亚上涨了6.8%。摩根士丹利资本国际(美国占约一半)全球股价表现较弱,仅上涨了2.4%,而按美元计算,新兴市场下跌了9.7%。欧洲股市下跌了3.4%,中国下挫27.8%。我们仍然对美国牛市持怀疑态度,但根据我们的制度,我们将继续投资美国股市,在医疗保健和能源两个板块各增加10%的投资。我们将继续持有10%的非必需消费品和信息技术股票,并已出售持有的欧洲ETF基金。我们的股权投资风险为40%,全部在美国。加息是债券市场面临的一大威胁,所以,我们尽量保持现金资产平衡。

James Cunningham

Chief Investment Officer

首席投资官

La Soleille Family Office (Suisse) SA

瑞士雷梭勒家族办公室

September 30th, 2018

2018年9月30日

English Version

The Lonely Bull

he escalating trade war notwithstanding, the US economy is going from strength to strength. Consumer sentiment is at its highest in a decade while unemployment is at record lows. A strong dollar is keeping inflation subdued. Some analysts suggest that any rise in input and import costs can be absorbed by strong domestic demand and, at last, rising wages. Although 10-year US Treasury yields have risen above 3%, the Federal Reserve has indicated that it will remain cautious in increasing the cost of credit. As for US stocks, indices rose in September to new highs for all the major indices as rotations between sectors compensated for some weakness in Information Technology. The broad S&P 500 index is up 9% year-to-date. But only three sectors have outperformed: IT, Consumer Discretionary and Health Care.

The Rest Of the World is Weak

Growth in emerging markets has been hit by a higher US dollar and higher oil prices. In Europe, consumer and corporate sentiment is weakening, as shown in the graph of purchasing managers’ export orders below. European stock indices are correspondingly weak, off -3.4% for the year and well below their January highs.

Our Policy

In asset management we follow four principles:

Identify and follow positive trends (risk on)

Sell fast when they turn negative (risk off)

Buy again when a bottom is confirmed (risk back on)

Diversify by using index-tracking funds ,thus minimizing exposure to any particular stock or bond

We use mathematical modeling of prices and probabilities to determine if a trend is positive or negative, strengthening or weakening, and likely or not to continue for the next period which for us is one month, to control trading cost “friction”. Other than in the US, there are few stock markets with positive returns this year. Norway is up +19.2%. Then comes NASDAQ +15.7%, followed by Saudi Arabia +9.2%, the S&P up + 9.0% and Colombia at +6.8%. The MSCI World (of which the US accounts for about half) is weak at +2.4%, while Emerging Markets are down -9.7% in dollar terms. Europe is off -3.4% and China -27.8%. We remain skeptical of the US Bull, but our system requires us to invest further in the US trend with 10% each in American Health Care and Energy baskets. We continue to hold 10% positions each in American Consumer Discretionary and IT baskets, and have sold our European ETF. Our equity exposure stands at 40%, all in America. With rising interest rates a threat to bonds, we keep the balance of our assets in cash.

James Cunningham

Chief Investment Officer

La Soleille Family Office (Suisse) SA

September 30th, 2018

该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。