发布时间:2019-10-11

2019年9月资产管理月度简报

美国、中国、日本、尤其是德国的出口订单下降、全球增长放缓、沙特阿拉伯石油基础设施遭受攻击、香港骚乱、猪流感、英国脱欧陷入僵局、特朗普总统即将遭到弹劾——这些都是9月份全球多数市场走弱的充足理由。随着美联储一如预期地再次降息,消费依然强劲,美国股市在九月中旬逆势上涨,然后掉头下跌。10月份的头几天,美国制造业采购经理人指数(PMI)意外疲弱,为47.8,表明需求正在萎缩。标准普尔500指数两天内下跌超过3%。美国和中国之间的贸易战已经严重损害了美国的农业,也开始影响到了美国的工业。

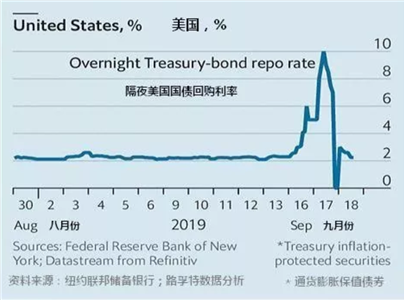

美国的银行业现金短缺

上述图表中的下半部分显示,美国各银行以政府债券为抵押相互拆借的“回购利率”出现飙升。上半部分显示,银行一直在购买债券,而不是发放贷款。尽管美联储通过向银行系统注入约1000亿美元并成功地稳定了美元货币市场,但这是一个令人担忧的事态发展。10年期的美国国债收益率跌至1.65%,为2009年6月熊市最深处以来的最低水平,表明投资者在避险。标准普尔500指数的高点是在7月份。从技术上讲,突破200日移动均线(下方的黄线)将会引发大幅回调。

正如读者所知,La Soleille不会根据经济、行业或公司分析做市场预测,只按照市场行情和其它技术指标作出判断。在资产管理方面,我们遵循的原则是:

• 鉴别并紧跟上涨行情(追逐风险);

• 出现下跌行情时立刻清仓(规避风险);

• 确认触底时逐步建仓(重新追逐风险);

• 利用指数基金进行分散投资,尽量降低投资一种股票或债券的风险。

我们利用价格-概率数学建模法判断市场是否显现利好或下跌趋势,是否走强或走弱,是否有可能在下一个周期(对我们而言是一个月)继续利好或下跌行情,(以此控制“摩擦性”交易成本)。La Soleille在趋势变化时采取相反立场,尤其是在止跌反弹时。

到目前为止,2019年表现最好的国家股票指数仍然是俄罗斯(+29.2%),其次是上海(+23.3%)和巴西(+17.7%),全部以美元计价,美国标准普尔500指数上涨+17.5%。请注意,与平均年回报率相比,所有这些表现都非常好。在5月31日出售了所有头寸,并锁定了10%的收益后,我们保持着100%的现金。我们将耐心等待,直到股价出现可信的底部,或一个新的高点得到检验和确认。

English Version

Tipping point?

Falling export orders in the US, China, Japan, and especially Germany, slowing global growth, attacks on Saudi Arabia’s oil infrastructure, Hong Kong in uproar, swine flu, Brexit stuck, an impeachment of President Trump in the offing: plenty of reasons for most world markets to be weaker in September.

With the Fed cutting rates again as expected and consumption still strong, American stocks rose against that trend through mid-month before rolling over. In the first days of October, the US manufacturing purchasing managers’ index (PMI) came in surprisingly weak at 47.8, indicating contracting demand. The S&P 500 index lost more than 3% in two days. The US/China trade war, already ravaging American agriculture, is starting to bite industry.

A cash shortage at American banks

The foregoing chart shows, below, a spike in the “repo rate” at which US banks lend to each other short-term against Government bonds. The upper section shows that banks have been buying bonds instead of making loans.Although the Fed succeeded in calming the dollar money markets by injecting some $100 billion into the banking system, this is an alarming development. 10-year Treasury yields fell to 1.65%, the lowest since June 2009 in the depths of the bear market, suggesting a flight to safety. The S&P 500’s high was in July. Technically, a break through the 200-day moving average (the yellow line below) would trigger a sharp correction.

Our Policy

As our readers know, La Soleille does not make predictions but acts on market trends and other technical signals alone. In asset management we follow four principles:

• Identify and follow positive trends (risk on)

• Sell fast when they turn negative (risk off)

• Buy again when a bottom is confirmed (risk back on)

• Diversify by using index-tracking funds, thus minimizing exposure to any particular stock or bond

We use mathematical modeling of prices and probabilities to determine if a trend is positive or negative, strengthening or weakening, and likely or not to continue for the next period which for us is one month, to control trading cost “friction”.

Summary And Outlook

The best-performing national stock index thus far in 2019 is still Russia (+29.2%), followed by Shanghai (+23.3%) and Brazil (+17.7%), all in US dollars, with the US S&P 500 index up +17.5%. Note that all of these performances are very good compared to average annual returns.After the sale of all of our positions on May 31st, locking in a 10% gain, we are 100% in cash. We will be patient until a credible bottom in share prices builds, or a new high is tested and confirmed.

该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com