发布时间:2023-05-09

本文内容由雷梭勒家族办公室根据Banque Bonhôte英语文章翻译整理,版权归原作者所有。更多信息可以访问银行官网:https://www.bonhote.ch/en/

概览

上周市场保持稳定。宏观经济数据显示,通胀正在经济复苏局势下逐渐放缓。美国各家银行的一季度财报也令人欣慰,息差增长对账面净利带来的积极影响得以凸显。

债券收益率在上周也很稳定,10年期国债的收益率在3.50%左右,德国的同类别债券收益率为2.50%。

在美国,代表纽约地区的纽约联储商业活动指数为-9.8,而上月为-10.1。相比之下,私营领域的增长步伐加快,综合PMI(采购经理人指数)为53.5,高于上月的52.3。服务业PMI好于预期,为53.7,而预测值为52.6。

通胀正在经济复苏局势下逐渐放缓

就业方面,初次申请失业救济金人数在4月10日这一周增加5,000人,达到24.5万人,而前一周为24万人。

我们可以看到,就业市场依然稳定,通胀尽管仍高于美联储的长期目标,但目前正在放缓。市场已将下周的基准政策利率提高了0.25个百分点,随后利率可能会有一段时间持平。

在欧元区,消费者价格通胀在3月有所放缓,但核心通胀依然高启。总体通胀指数同比下降至6.9%,但环比上升0.9%,符合预期。核心通胀(剔除了食品和能源部分)上月同比放缓至7.5%。

欧元区制造业和服务业的综合PMI从3月份的53.7回升到本月的54.4,表明4月份私营领域业务活跃。

在德国,3月份生产价格环比下降2.6%,因此年度涨幅仅为7.5%,低于2月份(+15.8%)。

在中国,在家庭消费的推动下,经济活动的增长速度高于预期,而建筑投资继续减少。国内生产总值同比增长4.5%,零售额增长10.6%。消费支出势头重现,也帮助促成了路易·威登、爱马仕和欧莱雅等奢侈品牌一季报的稳健业绩。

中国经济增速高于预期

在此背景下,标普500指数上周收盘时基本没有变化(-0.10%)。科技股密集的纳斯达克指数小幅下跌0.42%。STOXX欧洲600指数上周小幅上涨(+0.45%)。

本周的亮点将是下一批企业盈利,以及美国的耐用品订单和PCE通胀(译者注:PCE为个人消费支出物价指数,2002年被美联储采纳为衡量通胀的主要指标)。

SMI(瑞士市场指数)已回到今年的高点,但它必须向上突破11500点,以便为其在适当的时候冲上11750点留出空间。

关键数据

(数据来自上一期周五刊出的文章)

天然气仍然是问题

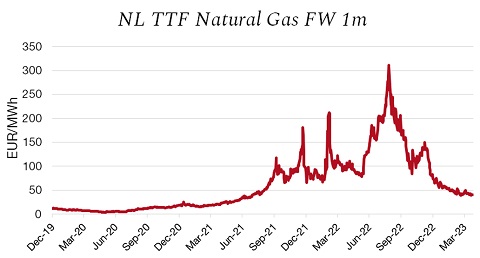

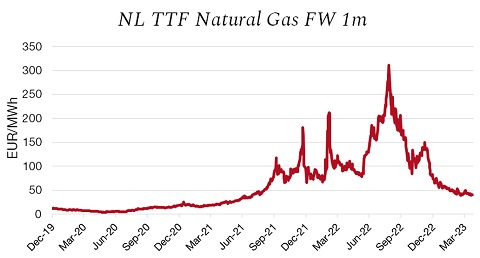

自乌克兰战争爆发以来,欧洲天然气市场急剧波动,最低曾于2020年8月不到5欧元/兆瓦时,最高则于2022年8月超过300欧元/兆瓦时。目前的价格约为40欧元/兆瓦时。

近年来,全球天然气产量急剧上升,2021年已超过4万亿立方米。天然气的主要生产国是美国、俄罗斯和伊朗。

荷兰TTF天然气期货价格

虽然市场价格已从高点大幅下落,但能源危机仍然伴随着我们——原因有几个。首先,天然气价格的波动使家庭难以计划其能源成本。其次,市场价格虽然降低,但并未降到对家庭和企业收取的价格水平,因为能源价格取决于多个其他因素,如关税、输送和分配成本以及能源供应商赚取的利润。

最后,天然气价格的走向也受到环境问题的影响。天然气的使用促使温室气体排放增加。因此,各国和各公司正在越来越多地关注投资更加清洁的能源,从而实现能源结构的多样化。

尽管天然气产量增加,但亚洲和北美等地的需求持续超过供应,而天然气生产国和购买国之间的紧张关系也对价格造成压力。因此,在继续寻求可持续和可负担的能源解决方案时,目前的能源危机是政府、公司和消费者担心的主要问题。

Original English Text

More reassuring news

Overview

Markets held steady last week. Macroeconomic data showed that inflation is slowly easing amid a resilient economy. The first set of quarterly earnings from US banks was also reassuring, highlighting the positive impact of higher interest margins on bottom lines.

Bond yields were also stable over the week with the yield in 10-year Treasuries around 3.50% and the German equivalent at 2.50%.

In the US, the New York Fed's business activity index, representing the New York area, clocked in at -9.8 versus -10.1 the previous month. In contrast, private sector growth picked up pace, with the composite PMI coming in at 53.5 up from 52.3 the previous month. The services component was better than expected at 53.7 compared with the 52.6 forecast.

Inflation is slowly easing amid a resilient economy

On the employment front, initial jobless claims rose by 5,000 to 245,000 in the week beginning 10 April versus 240,000 in the previous week.

As we can see, the labour market is still solid and inflation is slowing, though remaining above the Fed's long-term target. The market has priced in a quarter-point increase in the benchmark policy rate next week, possibly followed by a hiatus in rate hikes.

In the Eurozone, consumer price inflation slowed up in March but core inflation was still high. The headline index was down at 6.9% year-on-year but up 0.9% month-on-month, in line with expectations. Core inflation – which excludes food and energy – slowed to 7.5% year-on-year last month.

The Eurozone's composite PMI, for manufacturing and services, recovered from 53.7 in March to 54.4 this month, pointing to buoyant private sector activity in April.

In Germany, producer prices fell 2.6% month-on-month in March, resulting in an annual increase of 7.5%, slower than in February (+15.8%).

Over in China, growth in economic activity accelerated to a sharper degree than expected, driven by household consumption, while construction investment continued decreasing. GDP was up 4.5% year-on-year and retail sales rose by 10.6%. The renewed momentum in consumer spending has been part of the reason behind the solid quarterly revenue reports by LVMH, Hermès and L'Oréal, all luxury goods groups.

China's economic growth accelerated more expected

Against this backdrop, the S&P 500 ended the week more or less unchanged (-0.10%). The tech-heavy Nasdaq edged down by a modest 0.42%. The Stoxx 600 Europe ended the week up slightly (+0.45%).

Highlights this week will be the next batch of corporate earnings, plus durable goods orders and PCE inflation out of the US.

Key data

(values from the Friday preceding publication)

Gas still an issue

Since the outbreak of the war in Ukraine, the European natural gas market has fluctuated sharply, from a low of less than EUR 5/MWh in August 2020 to a high of more than EUR 300/MWh in August 2022. The current price is around EUR 40/MWh.

Global natural gas production has risen sharply in recent years to exceed 4,000 billions of cubic metres in 2021. The main producers of natural gas are the US, Russia and Iran.

Although the market price has fallen sharply from its peak, the energy crisis is still with us – for several reasons. First, volatility in gas prices makes it hard for households to plan their energy costs. In addition, the lower market price has not filtered down to the prices charged to households and businesses because the price of energy depends on several other factors such as duties, transmission and distribution costs and the margins earned by energy suppliers.

Lastly, the direction of gas prices is also influenced by environmental concerns. The use of natural gas drives up greenhouse gas emissions. Countries and companies are therefore looking increasingly to diversify their energy mix by investing in cleaner energy sources.

Despite increased production of natural gas, demand continues to outstrip supply in Asia and North America, for example, while tensions between the countries producing the gas and those buying it are also putting pressure on prices. The ongoing energy crisis is therefore a major worry for governments, companies and consumers as the search for sustainable and affordable energy solutions continues.

本文转载自瑞士雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)投资咨询

4)企业服务 5)居留计划 6)国际教育

更多资讯请登录网站 www.sooswiss.com