发布时间:2019-02-23

《传承宝典》2

更广泛的财富理念

超越遗嘱的“宪法(家族宪章)”,或一整套规则,有助于防止家庭分裂。说到理财计划,大多数人只关心存够钱,让自己过得舒服,或许还会留一点给子女或孙辈。然而,有些家族是幸运的,他们已经创造了足够多的财富,留下了可以代代相传的遗产。对这些家族来说,虽然重在保全并维持他们的财富直至未来,但更令人关切的是:以一种家庭单位完整维系的方式来管理家族。国际家族事务办公室 Stonehage Fleming 的合伙人马修•弗莱明(Matthew Fleming)表示:“每个家庭都有自己的动力(dynamics),但根据我们的经验,这些动力往往与财富有关。”他当然清楚。因为他是弗莱明的第五代子孙。弗莱明家族所有200位在世成员,都是其家族办公室的客户和股东。“我理解与财富相对应的特权,以及随之而来的责任。”他还明白,如果没有适当的结构和规则来管理这些遗产,家族内部的瓦解——乃至财富蒸发——是多么地容易。正是基于这一点,该机构大约每两年进行一次调查,以了解诸多家族正在面临的问题。其最新的报告《资本的四大支柱:变革时代的实践智慧和领导力》概述了财富跨代转移的挑战。

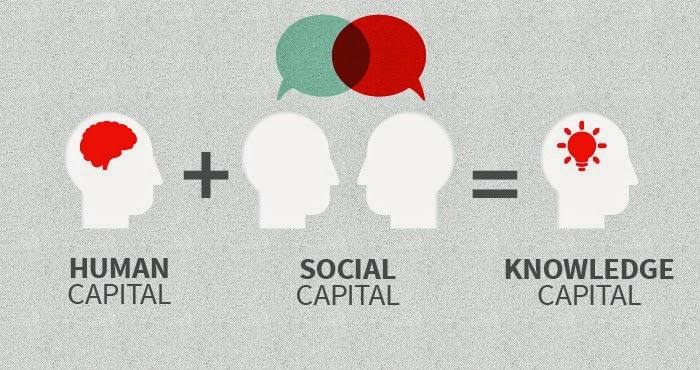

该报告的标题暗示了这样一个事实,即:一个家族的有形资产,只是其更广泛遗产的一部分,就像桌子的四根柱或四条腿一样,每一支柱(资本)都有其发挥的作用:金融资本——构成家族财富的有形资产、企业和财产; 智力资本——一个家族应用于管理其财富、对社会的贡献和集体福祉的技能、知识、经验和智慧; 文化资本——通过确定家族成员在生活中的共同观点和主题,将一个家庭(或无法)凝聚在一起; 社会资本——家族与社会、及其生活所在的社区之间的联系和参与方式. 弗莱明先生通过伦敦的一个视频连线,与媒体建立了联系,他说:年轻一代正在努力应对的正是这种社会资本。“他们非常清楚不平等的加剧,以及许多人与资本主义的脱节。”越来越多的人认为:财富只有被用来为社会做出积极贡献,同时满足家庭的财务需求,才能代代相传。

“软问题”更加复杂

越来越多的家族也开始意识到,保本只是管理财富的一个简单部分。而“软问题”则要复杂得多。其中就包括:继承规划、家族领导权和激励下一代。弗莱明先生表示:“家族成员意识到,家族领导权不应简单地传给长子,而应是精英管理,培训则是必不可少的。”虽然南非有许多跨越4代、5代、6代或更久的家族,但Stonehage Fleming在当地的家族办公室也为那些最近才赚到大钱的家庭提供支持。当地办事处CEO约翰•范•齐尔表示:“这些人可能包括当地商界人士、体育明星或其他人才。”

虽然财富的创造者们可能会说:他们不想从坟墓里来延续统治,但拥有一部“宪法(家族宪章)”,或一整套超越遗嘱的规则来管理您的财富,的确可以帮助防止家庭分裂。曼德拉家族或许可以证明这一点。

English Version

A ‘constitution’ or set of rules that goes beyond a will can help to prevent division in families.

When it comes to financial planning, most people are concerned simply with saving enough to see out their lives comfortably and perhaps leaving a little for their children or grand children. However, some families are in the fortunate position where sufficient wealth has been generated to leave a legacy that can be handed down from generation to generation. For these families, while the focus is on preserving and sustaining their wealth into the future, of greater concern is managing the family in a way that preserves the integrity of the family unit. “Every family has their own dynamics, but in our experience, these are very often compounded by wealth,”says Matthew Fleming, a partner at international family office Stonehage Fleming.

He should know. He is a fifth-generation Fleming. All 200 living members of the Fleming family are clients of and shareholders in the family office. “I understand the privilege of relative wealth and the responsibilities that come with that.” He also understands how easily families can implode – and wealthe vaporate – if there are no structures and rules in place to manage that legacy. It is with this in mind that the firm conducts a survey, roughly every two years, to understand the issues facing families.

Its latest report, Four Pillars of Capital:

Practical Wisdom and Leadership for Changing Times, outlines the challenges in the transfer of wealth across generations. The title of the report alludes to the fact that a family’s tangible assets are just one part of a broader legacy and – like four pillars or legs of a table – each has a role to play.

Financial Capital:

The tangible assets, businesses and properties that make up a family's wealth

Intellectual Capital:

The skill, knowledge, experience and wisdom that a family can apply to the management of its wealth, its contribution to society, and its collective well-being

Cultural Capital:

That which brings a family together (or not) by identifying shared perspectives and themes in the way its members conduct their lives, and Social capital – the way in which a family relates to and engages with society and the communities in which it lives and operates.

Social Capital:

It is this social capital that the younger generation is grappling with,says Fleming, who connected with media via a video link from London.

“They are very aware of growing inequality and the disconnect that many people are feeling from capitalism. There is a growing belief that wealth can only be created and preserved through generations if it is used to make a positive contribution to the community, as well as providing for a family’s financial needs,” he says.

The report notes that the gulf in perceptions and values between the generations is significantly greater than in the past, which has an impact onlong-term planning objectives. However, inter generational relationships are less hierarchical than before, which makes discussion on previously taboo topics – like money – easier than in the past.

‘Softer issues’ more complex

Increasingly families are also coming to realise that capital preservationis the easy part of managing wealth. Far more complex are the ‘softer issues’.These include succession planning, family leadership and engaging the next generation. “Families realise that instead of the leadership baton simply being passed on to the eldest son, family leadership should be about meritocracy and that training is essential,” says Fleming.

While South Africa is home to many families that span four, five, six generations or more, the local offices of Stonehage Fleming also provide support to families who may have come into money more recently. “These can include local business people, as well as sports stars and other talented individuals,” says Johan van Zyl, CEO of the local office.

“While the wealth creator may say that they do not want to rule from the grave, having a ‘constitution’ or set of rules – that goes beyond a will – forthe management of your wealth can help to prevent division in families.”The Mandela family could perhaps attest to this.

该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com