发布时间:2019-09-06

《传承宝典》22

管理您与银行关系的价值(下)

作为一位英国家族办公室的负责人,Roelof 在管理高净值家庭和个人的全球利益方面拥有丰富的经验。他参与了许多不同的司法管辖区的商业活动、财富管理、财产梳理、艺术收藏和慈善事业。他一贯融入两代人或更多代之间,特别强调长期风险管理和协作决策。 Roelof 于2012年从德意志银行的伦敦分行加入Stonehage Fleming集团。他拥有会计荣誉学士学位,曾供职于毕马威会计师事务所,并于2007年获得英国特许会计师资格。他也是南非特许会计师协会(SAICA)和国际信托房地产从业者协会(STEP)的成员。

理解和预测银行的前景

银行的风险不仅存在于客户家庭本身的总体诚信度,且存在于家庭的风险管理过程中的所有方面事务,包括当前和历史上他们收购企业的实际经历,当然可能与其家族中央企业相比较:规模更小、关联较远。即使使用最复杂的流程,银行也不容易事先指定它需要的每一项信息,直到它对整体情况有了很好的理解。正是出于这个原因,当这家人觉得自己已经满足了所有的初始要求时,银行有时不得不要求提供更多的信息。 对于现有的关系,家属需要了解,银行的要求可能会因为各种可能的原因发生变化,包括新规定、银行风险偏好的变化以及相关部门员工的变化。银行人员的高流动率是一个切实存在的问题,因为初来乍到的人往往不像他或她的前任那样理解环境,可能会开始提出更多问题。还应该理解的是,法规遵循(合规)过程中的许多筛选(甄别)过程现在都是自动化的,数据中的任何微小错误都可能抛出一个红旗,从而导致更深切的审查,以至于需要更多的信息。了解银行的需求将有助于这家人在同一个地方收集并维护好所有的、或大部分的必要信息,以满足他们的需求,并尽可能地预测他们的需求。

关键是要讲一个连贯的故事,能够支持家族及其所有企业的声誉和诚信,而不是银行必须一点一点地提取信息。即便是慈善基金会,理应得到充分的保护,不幸的是,它们过去也曾被不道德的经营者用来掩盖洗钱活动。

与银行沟通

首先,应与客户关系经理或开户人员进行一次讨论,以确定家庭银行交易可能触及的所有不同银行办事部门,他们需要在何种程度上直接了解情况,以及他们是否有任何特殊要求,视他们的管辖权或他们的职能来定。 例如,不同的司法管辖区、证券交易和银行交易的流程,其相互之间的要求,可能都会有所不同。许多银行现在提供或试图提供一项“全球护照”服务,该服务将使这家人能够在任何管辖区的任何银行分支机构开立账户,同时只需要提供最少量的额外信息,以满足当地的合规性需求。现在的建议是,争取与银行总部和其他有关部门的合规工作人员直接接触,接触的级别尽可能地高。这可能并不容易,因为合规人员被要求保持客观,但在大型和复杂的情况下,他们可能也会认识到:与客户或他们的顾问会面,可能是弥合他们理解上任何分歧的最有效方式。除此之外,最资深员工的流动率往往远低于实际水平,因此连续性的可能性更大。 建议每年更新所有相关数据,并要求银行对银行文件中的所有数据进行全面审查,以确保数据准确,因为即使是最小的错误,如果触发了系统中的一个小警告旗,也可能造成问题。这一审查将包括检查银行内部代码,以确定“共同报告标准(即CRS)”,这将有助于避免信息被发送到错误的司法管辖区的当局,有时还会带来较不幸的后果。

English Version

UNDERSTANDING AND ANTICIPATING THE BANK’S PERSPECTIVE

Most families simply respond to specific requests for information rather than trying to understand the bank’s requirements and preparing themselves to meet those needs. It is frustrating for the bank, as well as the client, to have information extracted bit by bit, when the answer to one question provokes the need for a further request. Banks handle these matters in different ways and it is now wise to have a detailed discussion with the relationship manager to establish which departments of the bank need to be satisfied and what it is they are looking for. Where it is possible to speak to any of the key individuals in the bank it is entirely sensible and legitimate to seek direct access to these people and to try to build a relationship.

For most families with complex circumstances, a change of mind-set is required. No longer should the bank accounts be something they take for granted as of right, but something they make a pitch for, just as when negotiating a loan or raising external investment. Like it or not, they need to remember that the bank is lending its name and integrity to the family and that the family benefits from that in all parts of the world, where the family name may not be known. 3rd parties will be more willing to transact with them because it is assumed the bank has undertaken the necessary checks. The bank is hence undertaking some degree of risk and it needs to appraise this risk, just as it would a loan application.

The risk to the bank lies not just in the general integrity of the client family itself, but in the family’s own risk management processes across all aspects of its affairs, including the current and historical practices in businesses they have acquired, however small and remote they may be from the central family enterprise.

Even with the most sophisticated processes, it is not easy for a bank to specify in advance every piece of information it requires, until it has a good understanding of the overall picture. It is for this reason that banks sometimes have to ask for yet more information when the family feels it has met all their initial requirements.

It should also be understood that many of the screening procedures in the compliance process are now automated and any slight error in the data may throw up a red flag, which leads to closer scrutiny and thus the need for more information.

Understanding what the bank is looking for helps the family to assemble and maintain in one place all or most of the information necessary to meet their needs and anticipate their requirements as far as possible.

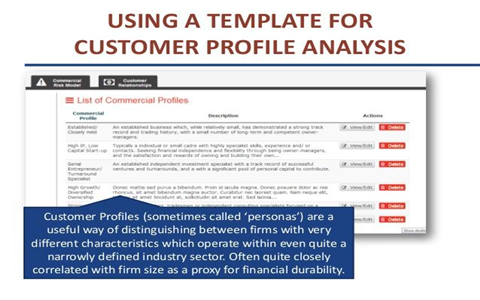

ASSEMBLING THE PACKAGE

As suggested above, the family needs to ‘make a pitch’ to a prospective new banker and to continually update the bank with further developments, just as it would when the bank reviews a borrowing facility

The pitch should include the following:

The point is to tell a coherent story which supports the reputation and integrity of the family and all its businesses, rather than the bank having to extract information bit by bit. Even charitable foundations need to be fully covered as unfortunately they have in the past been used by unscrupulous operators as a cover for money laundering activities.

COMMUNICATING WITH THE BANK

Firstly, a discussion should take place with the relationship manager or account opening officer to identify all the different bank offices which may be touched by the family’s banking transactions, to what extent they need to understand the situation directly and whether they may have any particular requirements, resulting from their jurisdiction or their function.

Many banks now offer or attempt to offer a ‘global passport’ service, which will enable the family to open accounts with any branch of the bank in any jurisdiction, with a minimum of additional information to meet local compliance needs.

It advisable to update all those involved annually and to ask the bank to conduct a full review of all data held on the bank’s file, to ensure it is accurate, as even the smallest error may create a problem, if it triggers a flag in the system. This review will include checking the internal bank codes for ‘Common Reporting Standards’, which will help avoid the possibility of information being sent to authorities in the wrong jurisdictions, sometimes with unfortunate consequences.

该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com