发布时间:2019-09-12

《传承宝典》23

固定收益信贷, 本年度展望

尼古拉是Stonehage Fleming家族办公室投资管理部门的领导人,他全面负责所有独立固定收益的管理、现金管控下的投资组合、以及对第三方固定收益基金投资的选择和监控。他还领导着基金与证券选择委员会,并拥有超过10年管理固定收益投资组合的经验。尼古拉于2013年9月加入Stonehage Fleming 集团并担任投资经理。2000年,他在苏黎世的瑞银(UBS)私人银行开始了自己的职业生涯。2002年,他跳槽到伦敦的瑞银财富管理公司,加入了投资组合管理团队,管理着多资产类别的投资组合。尼古拉拥有英国华威商学院的经济学和金融学硕士学位,以及IMC和PCIAM专业资格证书,同时还是英国特许证券与投资协会(CISI)的特许会员。

截至19年中期,固定收益市场——信贷和利率表现良好。今年上半年,高收益债券市场出现了20多年来的最佳表现。投资及债券也表现强劲,受益于政府债券的上涨。上述两者的整体回报率都在7%-9%。新兴市场的强势货币债券(即保值货币债券,多为欧美国债)的回报率为8%,而新兴市场本币债券也表现强劲——截至6月底上涨了约6%。如果我们把时钟拨回到2018年第四季度,信贷市场似乎正分崩离析。高收益债券和杠杆贷款市场都出现了大幅下跌,甚至投资级市场也出现了一些疲软。由于投资者们越来越担心全球经济状况、贸易战和货币政策收紧的影响,信贷息差扩大。在2019年的头几个月里,一切都变了。发达市场央行的措辞变得越来越温和(鸽派),允许了风险资产的止跌回升,以及政府债券收益率的下降。美联储(FED)主席杰罗姆•鲍威尔(Jerome·Powell)公开讨论了降息的可能性,市场则完全消化了7月底首次降息的预期。与此同时,欧洲央行(ECB)似乎也在着手转向降息,其结果是欧洲核心国家的国债收益率再次大幅下跌。

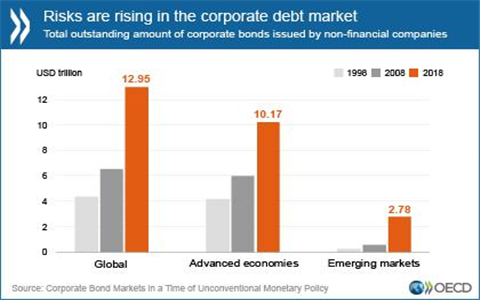

我们目前所处的环境是,约有12万亿美元资产(约占Bloomberg Barclays全球综合总基准的1/4)购买交易了收益率为负的债券。这不仅会将投资者赶出其自然栖息地,还会在投资者寻求正收益之际,为信贷市场提供支持。信用指标很好地反映了公司债券市场的健康状况。美国和欧洲企业的债务收益和利息覆盖率等指标表现良好,在总体上,企业都似乎相当健康(苹果公司、迪士尼、可口可乐等都正在忙于发债)。我们还注意到,“到期墙”(意指:某一年到期的债务数量) 间隔良好,短期内将仅存在有限数量的公司债务到期。我们再次处在利率不断走低的环境中,这对企业债务来说是件好事。企业将能够以较低的成本对债务进行再融资,并维持其利率覆盖率;我们预计违约率更不会大幅上升。尽管2019年剩余的时间不太可能出现这种回报,但我们迄今已看到,我们相信固定收益市场在未来一段时间内仍将受到支撑。

English Version

Nicholas is a Director of Stonehage Fleming Investment Management, he has overall responsibility for both the management of all segregated fixed income and cash management portfolios, as well as the selection and monitoring of investments in third party fixed income funds. He also heads up the Fund and Security Selection Committee and has over 10 years’ experience managing fixed income portfolios.

Nicholas joined the Stonehage Fleming Group as an Investment Manager in September 2013. He started his career at UBS Private Bank in Zurich in 2000 and moved to UBS Wealth Management in London in 2002 joining the Portfolio Management team to manage multi-asset class portfolios. Nicholas holds an MSc in Economics and Finance from Warwick Business School, as well as the IMC and PCIAM professional qualifications and is a Chartered Fellow of the Chartered Institute for Securities and Investments.

Fixed income markets - credit and rates - have performed well to the mid-point of the year. The first half of the year saw the high yield bond market enjoying its best performance for over two decades. Investment grade bonds also performed strongly, benefitting from the rally in government bonds. Both have seen returns between 7%-9% across the board. Emerging market hard currency bonds have returned 8%, while emerging market local currency bonds also performed strongly up around 6% to the end of June.

If we roll the clocks back to Q4 2018, credit markets seemed to be falling apart. The high yield and leveraged loan markets both saw significant falls and even, the investment grade market experienced some weakness. Credit spreads widened, as investors grew increasingly concerned about the state of the global economy, the impact of trade wars and monetary policy tightening.

During the first months of 2019, everything changed. Developed market central bank rhetoric turned increasingly dovish, allowing risk assets to rally and government bond yields to drop. In the US, Federal Reserve Chairman Jerome Powell, openly discussed the potential for rate cuts with the market fully pricing in the first cut for the end of July. Meanwhile the European Central Bank too appears to be maneuvering towards lower rates and, as a result, yields across core Europe have once again gone deeply negative.

We are now in an environment where there are circa $12tn of assets – around a quarter of the Bloomberg Barclays Global Aggregate benchmark – trading with negative yields. This has the effect of pushing investors out of their natural habitats but also lending support to credit markets as investors seek out positive yields.

Credit metrics give a good indication of the health of the corporate bond market. Metrics such as earnings over debt and interest coverage for companies across the US and Europe are holding up well, and companies overall appear to be reasonably healthy (Apple, Disney, Coca-Cola and others are busy issuing bonds now).

We also observe that the ‘maturity wall’- an indication of the amount of debt maturing in a given year - is well spaced out, with a limited amount of corporate debt coming due in the short term. It is positive for corporate debt that we are again in an environment where interest rates are moving lower. Companies will be able to refinance their debt at cheap levels and maintain interest coverage; we do not expect to see a significant increase in the default rate.

Although the rest of 2019 is unlikely to see the sort of returns, we have seen so far, we believe fixed income markets will remain supported for some time to come.

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com