发布时间:2018-04-20

➣ 1387:Bishop Fabri of Geneva allows bankers to charge interest

➤ 1387年:日内瓦法布里主教允许银行收取利息

➣ The importance of (trade)-fairs is growing in the 15th century

➤ 15世纪,(贸易)集市的重要性逐渐加强

◆ Foreign Exchange activities 对外交易活动

◆ Transfer of funds from one place to the other

资金从一个地方转移到其他地方

◆ Letter of Credit 信用证

◆ Secured Credit (Lonbard) 抵押担保贷款(Lonbard)

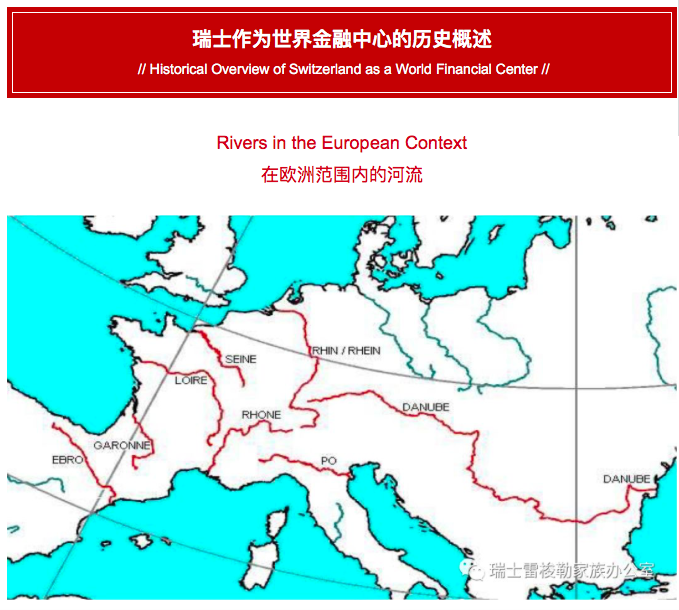

➣ Network and exchanges develop within the Swiss and European cities

➤ 瑞士和欧洲城市之间的网络和交易发展

➣ Growing importance of transfer, debit and credit activities

➤ 转让、借记和信贷活动日益重要

➣ Wealth accumulation in Switzerland mainly by:

➤瑞士的财富积累主要由以下活动形成:

◆ Trading/Merchant 交易或批发

◆ Mercenary services for other nations (France, Holland, principalities in Italy etc.)

为其他国家提供的雇佣兵服务(法国、荷兰和意大利公国等)

➣ Artisans develop and teach their know-how where they settled down

➤ 手工业者在他们定居下来的地方发展和传授技能

➣ The book printing industry becomes very important

➤ 书本印刷业变得非常重要

➣ Textiles printing flourishes

➤ 纺织品印花繁荣发展

➣ Development of the activities of clock- and watchmakers

➤ 时钟和钟表匠活动开始发展起来

➣ After the 18th Century:Several Banks are created by Hugenots,mainly in Geneva

➤ 18世纪后:Hugenots法国胡格诺派新教徒建立了几家银行,主要分布于日内瓦

➣ Before and specially after the French Revolution of 1789 and during and after the devastating Napoleonic Wars and instability all over in Europe (wars in Italy, Austro-Hungary,Franco-Prussia, USA) capital flees for Switzerland

➤ 1789年法国大革命前后,以及颇具毁灭性的拿破仑战争期间和之后,整个欧洲都处于不稳定状态(意大利战争、奥匈帝国战争、普法战争和美国战争)各国资本逃往瑞士

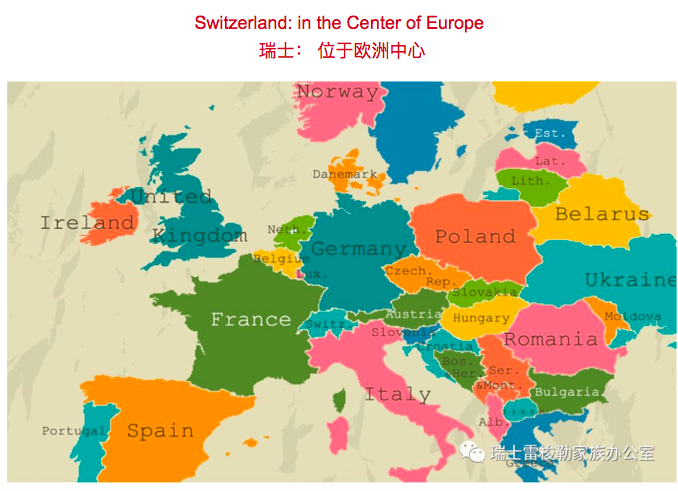

➣ In the Treaty of Vienna 1815, the frontiers of Europe are newly defined, also partially in Switzerland

➤ 在1815年维也纳条约中重新定义欧洲边界,部分处于瑞士境内

➣ Recognition of the Swiss neutrality in the same treaty

➤ 在同一条约中,承认瑞士的中立国地位

➣ Important financial needs for large industrial projects

➤ 大型工业项目的重大财务需求

➣ Wealth is accumulating and needs financial advice

➤ 财富持续积累,需要理财建议

➣ Opening of the first savings banks, the Cantonal banks, the large commercial Banks(Credit Suisse, UBS, SBC Banking) and of course, private Banks such as the Bank Bonhôte,created 1815)

➤ 第一批储蓄银行、州立银行、大型商业银行(瑞士信贷银行、瑞士联合银行和瑞士银行)和私人银行开业(如于1815年建立的Bonhôte银行)

➣ Creation of insurance companies in the second part of the 19th century

➤ 19世纪后半叶,保险公司开始建立

➣ 50 years later: inauguration of the Swiss National Bank

➤ 50年后:瑞士国家银行成立

➣ Switzerland continues to play a major role as «Save Heaven» during the First World War, specially afterwards in the 1930th, during and after the Second World War

➤ 瑞士作为一处“安全避风港”,在以下时间段发挥了重要作用,即第一次世界大战期间、特别是上世纪30年代之后、第二次世界大战期间以及战后

➣ Banking Secrecy is introduced 1934 to fight espionage

➤ 1934年开始实行银行保密制度,用于对抗间谍

➣ After the 1960, Switzerland rises to an international financial centre(3rd behind London and New York)

➤ 1960年后,瑞士上升为国际金融中心(继伦敦和纽约后的第3个国际金融中心)

➣ 2017,Switzerland starts data exchange with designated Countries

➤ 2017年,瑞士开始与指定国家进行数据交换

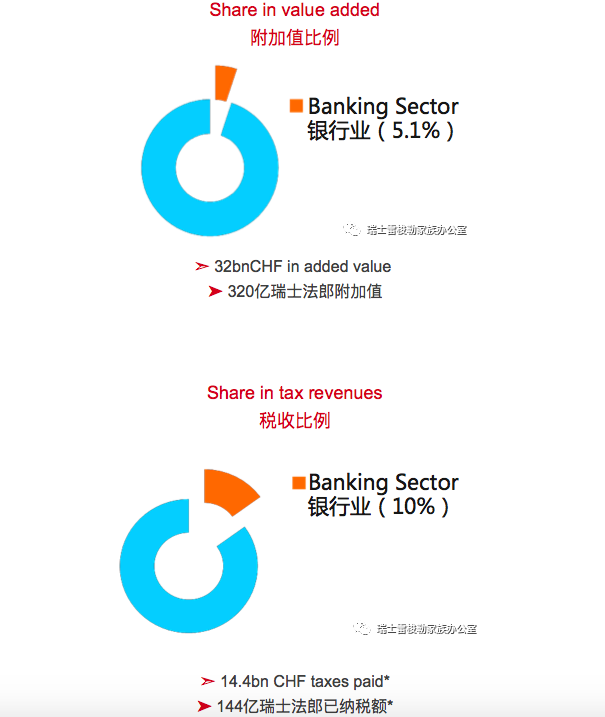

➣ Importance of the Financial place of Switzerland continues to grow

➤ 瑞士金融地位变得日益重要

➣ In the future, Switzerland wants to continue to have a strong, internationally competitive financial market which makes a substantial contribution to prosperity in the country

➤ 瑞士希望能继续拥有强大的、具有国际竞争力的金融市场,为国家的繁荣作出重大贡献

➣ This requires the creation of the best possible, internationally accepted framework which is shaped in such a way that the Swiss financial market:

➤ 这需要创造最好的、国际公认的框架,形成该框架后,瑞士金融市场可以:

◆ offers services of outstanding quality which are valued by clients from all over the world

提供优质服务,深受世界各地客户的好评

◆ can stand firm even in the face of the severest shocks in international financial and capital markets

即使面临国际金融和资本市场的剧烈冲击,也持续稳定

◆ acts as an international role model by consistently combating abuses

作为国际榜样展开行动,持续打击滥用

Sources:The Swiss Financial Center, August 2017

来源:瑞士金融中心,2017年8月

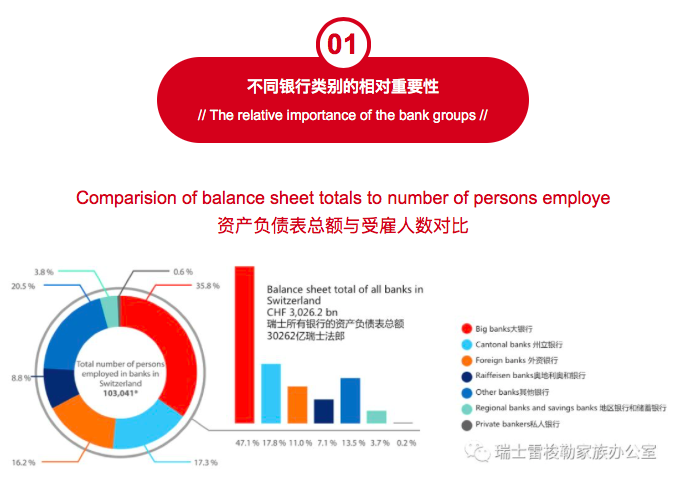

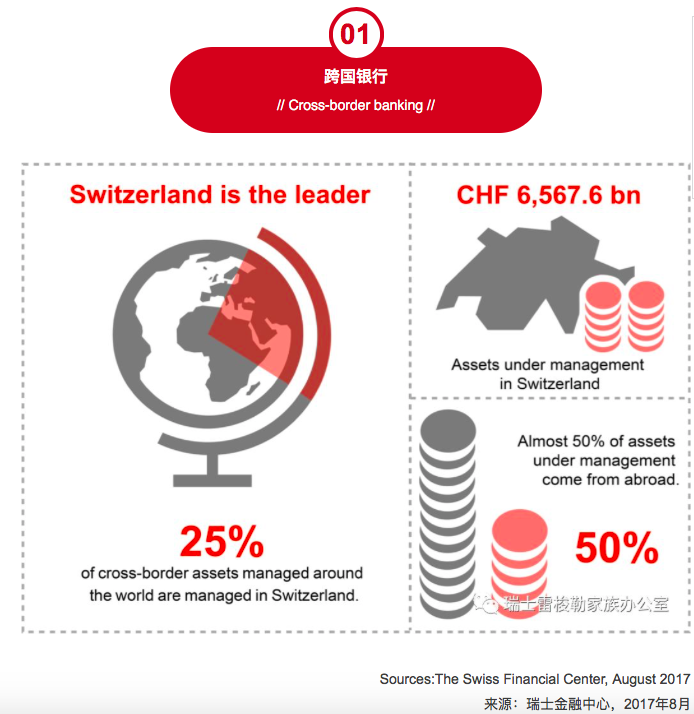

➣ 261banks

➤ 261所银行

➣ 8 different banking groups

➤ 8个不同的银行类别

➣ This diversity is one of the core strengths of the Swiss financial centre

➤ 这种多样性是瑞士金融中心的核心优势之一

➣ The banks fulfill their role in the Swiss economy

➤ 银行在瑞士经济方面发挥其作用

➣ They finance Swiss companies reliably – and did so even during the financial crisis

➤ 他们为瑞士公司提供了可靠的融资——即使在金融危机期间也是如此

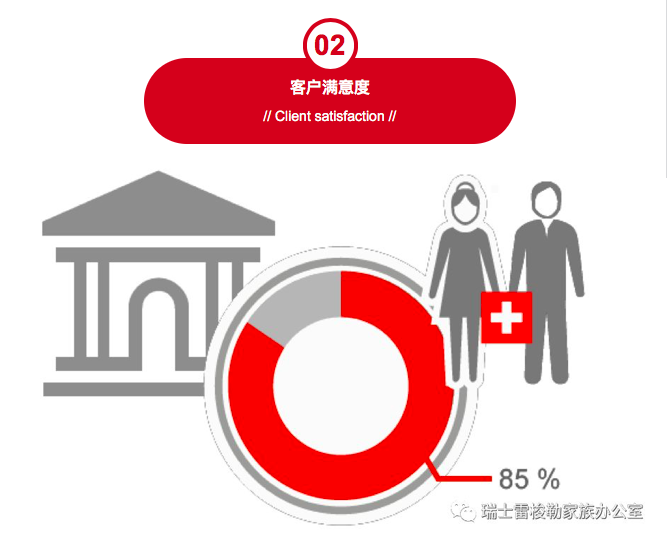

➣ 85% of Swiss private clients are satisfied or very satisfied with their bank

➤ 85%的瑞士私人客户对银行服务满意或非常满意。

◆ Neutrality in foreign policy

外交政策中保持中立

◆ Legal stability

法律稳定性

◆ Stability in labour market relations

劳动力市场关系的稳定性

◆ Monetary stability

金融体制的稳定性

◆ System stability/stability of the banking system

系统稳定性或银行系统稳定性

◆ Comprehensive range of services and products

全方位的服务和产品

◆ High level of diversification in business activities and financial service providers

商业活动和金融服务提供者的高水平多样化

◆ Open and globally networked

开放和全球网络化

◆ Linguistic and cultural plurality

语言和文化多元化

◆ Globality

全球性

◆ Tax-compliant

守法纳税

◆ Exemplary due diligence requirements

规范的尽职调查要求

◆ Responsible attitude towards environment and society

对环境和社会负责的态度

◆ Risk-aware

风险意识

◆ Right to protection of financial privacy

保护财务隐私的权利

◆ Quality-conscious

质量第一

◆ Client-oriented

面向客户

◆ Professional

专业

◆ Skilled and talented

拥有技术与才能

◆ Innovative

创新

◆ Flexible and capable of reacting swiftly

灵活且具备快速应变能力

◆ Return and profit-oriented for clients and shareholders

回报并维护客户和股东利润

◆ Reputation 信誉

◆ Confidence 信任

◆ Security 安全

◆ Solidity 稳固

◆ Stability 稳定

◆ Reliability 可靠

◆ Continuity 持续

◆ Flexibility 灵活

◆ Efficiency 高效

◆ International touch 国际联系