发布时间:2024-09-12

导读:

上市房地产投资的前景正在发生变化。隆奥银行研究了全球前景,并为瑞士投资者探索了特殊的机会。

随着市场动态和全球利率周期的变化,房地产的相对吸引力也在变化。在过去18个月的大部分时间里,隆奥银行对这一资产类别持负面看法,这体现在股票敞口中对上市房地产投资信托基金(REITs)的减持。从宏观经济角度来看,隆奥银行预期利率环境将在更长时间内走高,因此也避开了对利率高度敏感的股票。与主权债券的无风险高利率和收入相比,房地产投资信托基金的收益率缺乏吸引力,其估值看起来很脆弱。该行业处于持续下行趋势,在投资者增加“另类”资产配置十多年后,隆奥银行预计资金外流将持续下去。

也许令人惊讶的是,在负面新闻的背景下,除了一些写字楼供应过剩,以及一些不值得为满足更严格的环保标准而改造的项目以外,房地产资产的经营基本面似乎不那么令人担忧。投机性建筑活动的缺乏,意味着大多数房地产细分市场(包括住宅、工业仓库和酒店)的空置率仍然很低,租金依旧在继续增长。

选择性机会出现

考虑到这一点,隆奥银行在7月份将对房地产投资信托基金的立场从负面调整为中性。那么,究竟改变了什么?首先,全球利率周期正在转变,这是通胀正常化和增长放缓的结果,而不是令人担忧的经济低迷。虽然隆奥银行认为最近对美国经济衰退的担忧被夸大了,但预计美联储将加入其他主要央行的行列,从9月份开始降息,因为通胀回到目标水平,劳动力市场疲软。发达市场利率的下降应该会为房地产投资提供有利条件,投资者有时会像看待债券一样看待房地产投资。利率下降还应缓解人们对商业房地产债务再融资和银行对该行业敞口的一些担忧。

商业地产估值目前已降至一个点,一些长期投资者已开始购买有吸引力的资产。今年4月,黑石集团收购了一家价值100亿美元的房地产投资信托基金,专门从事多户住宅。8月份,上市房地产投资信托基金(REIT)收购了7年来最大的一笔美国公寓投资组合,价值超过10亿美元。英国房地产投资信托行业今年出现了一波收购和合并浪潮。根据我们的经验,这样的时刻往往伴随着周期的触底和前景的改善。隆奥银行还看到,投资者从房地产基金外流和赎回的速度有所放缓,这表明一个更健康的背景正在形成。综上所述,隆奥银行认为投资情况有所改善,眼光长远的投资者现在应该寻找有选择性的机会。

瑞士房地产的案例

瑞士房地产市场受益于一些有利因素。在创纪录的移民数量下,市场对住宅公寓的需求强劲。与此同时,新建筑的建设受到限制。考虑到国家的规模,可用土地供应短缺,而该国的《空间规划法》(Spatial Planning Act)倾向于在大都市地区建设,以保护未开发的土地,而且建设许可需要时间,各州的程序各不相同。瑞士联邦统计局(Swiss Federal Statistics Office)的数据显示,瑞士公寓空置率继续下降,到2023年,全国公寓空置率将达到1.15%的新低。隆奥银行还认为,在通胀仍为正、参考利率为1.75%的情况下,今年至少有四分之一的住宅公寓可能会提高租金。这个基于抵押贷款信贷的市场利率用于计算租金,并没有随着瑞士国家银行(SNB)政策利率的下降而下降。

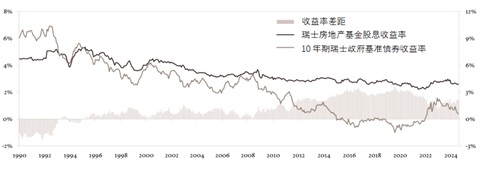

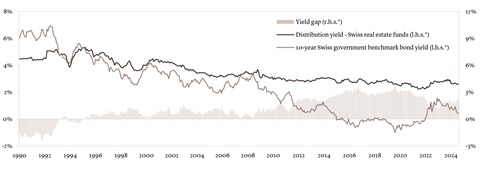

与此同时,瑞士上市房地产基金目前约2.6%的收益率为主权债券提供了提振,而截至7月底,10年期联邦债券的收益率仅为0.45%(见图1)。鉴于隆奥银行预计瑞士央行将在9月份进一步降息25个基点,这一利差应该会进一步扩大。主权债券收益率不断下降,应会对实物房地产资产的估值产生积极影响,并最终对持有这些资产的基金产生积极影响。在这里,延迟可以从6-12个月不等,这取决于基金净资产价值的计算频率。

图1:瑞士房地产基金的分配收益率与10年期瑞士国债收益率

数据来源:彭博社,隆奥银行

瑞士房地产基金内部的动态看起来也很有利。这些基金的资本增加在一年中往往有两个高峰:春季和秋季。平均而言,在过去10年里,这导致基金价值在8月至10月间下降了约2.15%。今年以来,从7月底上市基金指数的业绩峰值来看,跌幅约为2.7%。这让隆奥银行相信,此类基金的传统秋季估值可能已经触底。展望未来,瑞士房地产基金的年终表现通常是积极的。因此,投资者的年终税收规划可能会导致对财务收益更高的房地产基金的需求增加。

Original English Text

Swiss real estate offers opportunities as interest rates decline

Key takeaways

The outlook for listed real estate investments is shifting. We examine the global outlook and explore particular opportunities for Swiss-based investors.

As market dynamics and global interest rate cycles change, so do the relative attractions of real estate. Over much of the last 18 months, we have had a negative view on the asset class, expressed via an underweight allocation to listed real estate investment trusts (REITs) within our equity exposures. From a macroeconomic perspective, our expectation of a higher-for-longer interest rate environment means we have avoided stocks with a high sensitivity to rates. REIT valuations looked vulnerable, given unattractive yields in comparison to the high risk-free rates and income available on sovereign bonds. The sector traded in a persistent downtrend, and we expected outflows to persist after more than a decade of investors increasing allocations to ‘alternative’ assets.

Perhaps surprisingly given negative headlines, the operating fundamentals of real estate assets appeared less of a concern, with the exception of some overcapacity in offices, and some that were not worth retrofitting to meet tighter environmental standards. The lack of speculative construction activity meant that vacancy rates remained rather low in most real estate sub-segments – including residential housing, industrial warehouses and, to some extent, hotels – and rental growth continued.

Selective opportunities emerging

Taking this into account, in July we shifted our stance on REITs from negative to neutral. What changed? First, the global rate cycle is turning, as a result of normalising inflation and slackening growth rather than a worrying downturn. Whilst we believe that recent US recession fears are overblown, we expect the Federal Reserve (Fed) to join other major central banks in cutting interest rates from September, as inflation reverts to target and labour markets weaken. Declining rates in developed markets should provide a tailwind for real estate investments, which investors sometimes view in a similar way to bonds. Falling rates should also alleviate some concerns on commercial real estate debt refinancing and banks’ exposures to the sector.

Commercial real estate valuations have now fallen to a point where some long-term investors have started buying attractive assets. Blackstone acquired an REIT worth USD 10 billion specialised in multi-family residential housing in April. August saw the largest purchase of a US apartment portfolio by a listed REIT in seven years, valued at over USD 1 billion. The UK REIT sector has seen a wave of takeovers and mergers this year. In our experience, such moments often coincide with the bottoming of the cycle, and an improving outlook. We have also seen a slowdown in investor outflows and redemptions from real estate funds, suggesting a healthier backdrop is emerging. Taken together, we believe the investment case has improved and investors with a long-term horizon should now be on the lookout for selective opportunities.

The case for Swiss real estate

The Swiss real estate market benefits from some favourable dynamics. Demand for residential apartments is strong, amid record immigration levels. Meanwhile, the construction of new buildings is limited. Available land is in short supply given the size of the country, while the nation’s Spatial Planning Act favours building in metropolitan areas to protect undeveloped land and construction permits take time, with procedures varying between cantons. Swiss apartment vacancy rates continue to fall, reaching a new low of 1.15% countrywide in 2023, according to the Swiss Federal Statistical Office. We also see the potential for at least a quarter of residential apartments to increase rents this year, amid still-positive inflation, and a ‘reference rate’ of 1.75%. This market-based rate, based on mortgage credit, is used for calculating rents, and has not yet fallen with the decline in the Swiss National Bank’s (SNB) policy rates.

At the same time, yields of around 2.6% on listed Swiss real estate funds currently offer an uplift on sovereigns, with 10-year Confederation bonds yielding just 0.45% as of end-July (see chart 1). This differential should receive a further boost given our expectation of the SNB cutting rates by a further 25 basis points in September. Falling sovereign yields should have a positive impact on the valuations of physical real estate assets and, in time, on the funds that own them. Here the delay can be from 6-12 months depending on how often the funds’ net asset value is calculated.

Chart 1: Swiss real estate fund’s distribution yield vs 10-year-Swiss government bond yield

Sources: Bloomberg, Lombard Odier

Dynamics within Swiss real estate funds also look favourable. Capital increases by these funds tend to have two peaks during the year: in spring and in autumn. On average, over the last 10 years, this has led the value of funds to fall by around 2.15% between August and October. This year, from the performance peak in the listed fund index at the end of July, the decline has been about 2.7%. This leads us to believe that the traditional autumn valuation floor for such funds may already have been reached. Looking further ahead, the year-end period is typically positive for the performance of Swiss real estate funds. Here, year-end tax planning by investors can lead to increased demand for fiscally efficient real estate funds.

本文转载自瑞士雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)投资咨询

4)企业服务 5)居留计划 6)国际教育

更多资讯请登录网站 www.sooswiss.com