发布时间:2019-08-05

《传承宝典》19——可持续投资

一段旅程, 而不是目的地

English Version

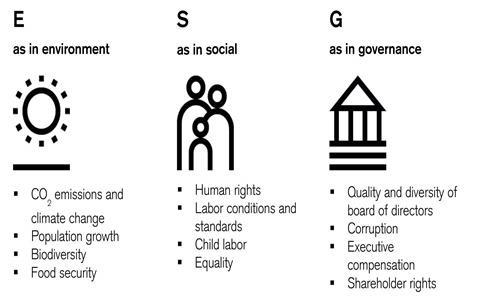

Investing in companies top-rated for environmental, social and governance (ESG) metrics is very often not where the best social outcomes can be made. Indeed, despite much new product in the sustainable investment world allocating capital to today’s ‘best in class’, evidence suggests that the greatest gains are made not when those already best in class improve incrementally, but when today’s less sustainable companies make big step changes in their practices.

By incrementally allocating more capital to them and rewarding those companies who are embracing their journey towards greater sustainability, better outcomes are achievable for society. The downside of this approach is that the ESG scores for portfolios may look less impressive initially because they cannot reflect the work behind the scenes by institutional investors engaging with management teams and pushing sustainability policies further up the agenda.

The same shift in mind-set is required with Emerging Markets. Investors should judge companies according to their peer group and take care not to view them through the filter of western values. As a sector, Emerging Markets is characterized by strong latent economic growth which, though accompanied by greater political and operational risks, promises impressive potential investment returns. Given GDP per capita is far lower in these markets, when it comes to ESG, the onus is on investors to help these economies grow and improve the quality of life and create opportunity for their citizens while also encouraging them to reduce pollution.

ESG outcomes aside, the added investment value associated with this approach is considerable. In today’s market, companies with better ESG credentials are likely to have higher valuations. By seeking out companies early in their ESG journey, active managers can find opportunities - companies which may only otherwise have caught the eye of the wider market once their burgeoning credentials had been realized.

Those few passive investors who have developed policies around stewardship and participate in engagement with investee companies have a role to play in sustainable portfolios. But for value managers who scour the market for companies generally overlooked by the market and who are prepared to take the long view when it comes to ESG, there are some compelling opportunities out there.

该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com