发布时间:2019-08-12

2019年7月资产管理月度简报

7月份:企业利润和美联储的行动

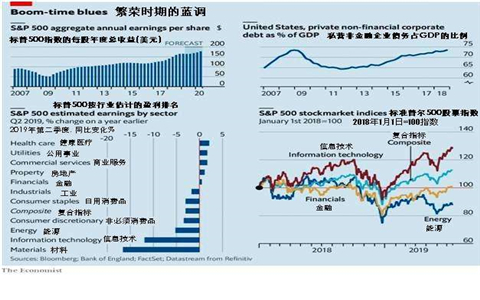

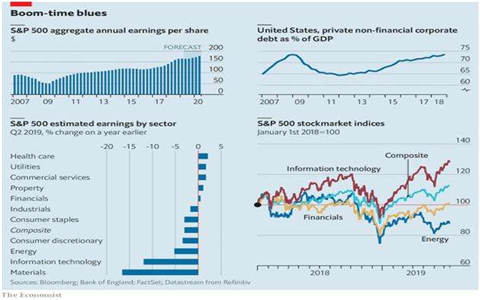

美国联邦储备委员会(即:美联储,简称Fed)已将关键利率下调了¼%(降息25个基点),正如预期的那样;而跨国公司的第二季度利润也均普遍好于预期,尽管许多行业的利润出现下滑(见下图)。这足以推动美国市场再创新高,标准普尔500指数(S&P500)首次突破了3000点。美国国债的收益率曲线是反向倒挂的,各主要经济体的PMI指数正在下降,中国和欧元区的PMI指数实际跌破了50。这些指标通常预示着经济衰退。与此同时,人民币兑美元汇率已跌至1美元兑7元人民币。中国能否通过贬值人民币来对抗美国的关税呢?

7月份的牛市趋势会持续下去吗?

由于没有在6月底回购,我们在7月份的业绩损失了6%左右,扣除交易成本后损失了4%。但我们锁定了上半年+10.1%的表现。在特朗普总统威胁要对中国征收更多关税后,市场进行了修正,标准普尔500指数从7月26日的高点下跌3.1%。因此,我们连今年迄今的成本几乎都扣除后,仍有10%年化收益。我们将需要一个令人信服的底部,或者一个经过考验的新高,来重新投资。

迄今为止,2019年表现最好的国家股票指数是:俄罗斯(上涨26.0%),其次是上海(上涨20.7%)、美国标准普尔500指数(上涨18.9%)和瑞士(上涨17.7%)。其他所有市场都低于MSCI全球指数+16.1%。值得注意的是,俄罗斯经济与大宗商品走弱有关;而瑞士经济则取决于其对欧盟出口的放缓:基本面又一次无法解释股票市场的趋势。在5月31日出售所有头寸后,我们保持着100%的现金。我们将耐心等待,直到股价出现可信的底部,或一个新的高点得到检验和确认。

James Cunningham

Chief Investment Officer

首席投资官

La Soleille Family Office (Suisse) SA

瑞士雷梭勒家族办公室

July 31st, 2019

2019年7月31日

English Version

July: corporate profits and Fed action

The US Federal Reserve didcut its key interest rate by ¼% as expected, and multinationals’ second-quarter profits were generally better than expected although many sectors show falling profits (see chart below). This was enough to push US markets to further new records, with the S&P 500 index exceeding 3,000 forthe first time. The yield curve for US Treasuries is inverted, and PMI indices are falling in the main economies, indeed to below 50 in China and the Eurozone. Such indicators usually presage a recession. Meanwhile, the Chinese Yuan has fallen to 7 to the US dollar. Could China resort to weakening its currency to counter US tariffs?

By not buying back in late June, we have missed some 6% in performance in July, or 4% after trading costs. But we locked in a first-half performance of +10.1%. After President Trump threatened China with further tariffs, markets corrected, with the S&P 500 down 3.1% from its July 26 peak. So we are nearly even year-to-date net of costs. We will need a convincing bottom, or a tested new high, to reinvest.

该文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com