发布时间:2024-02-01

瑞士博浩特银行丨瑞士房地产市场反常现象分析

导读:

目前,瑞士房地产市场的现状颇为反常。通常情况下,我们认为瑞士房价可能会下降,但事实上房价非常坚挺,有些地方的房价甚至还在上涨。这种反常现象背后有一股力量在推动,而这股力量似乎会持续下去。

本文内容由雷梭勒家族办公室根据博浩特银行(Banque Bonhôte)英语文章翻译整理,版权归原作者所有。更多信息可以访问银行官网:https://www.Bonhote.ch/en/

一般来说,瑞士国家银行决定提高利率后,房价会因为融资成本上升而得到抑制。然而,从2022年夏季到2023年夏季,共有产权公寓的售价上涨了3.4%,而独栋住宅的价格则上涨了1.2%。

造成这一市场悖论的主要因素有两个。首先,住宅市场的空置率极低。例如,6 月份沃州的空置率为0.98%,伯尔尼市则低至0.45%。其次,新建筑,尤其是热门地区的新建筑确实短缺。近几个月来,瑞士仅发放了10,000份建筑许可证,其中近6,000份分配给了独栋住宅。进入市场的房产供应有限,这刺激了需求,从而支撑了价格水平。此外,值得注意的是,利率上升导致的租金上涨,在一定程度上缓解了房价的下行压力。

租金涨价有风险

要深入了解这一现象,我们就必须承认,利率上扬抬高了租金参考价格。根据瑞士已交按揭贷款计算,这一利率自6月1日起为1.5%,上升了0.25%。此外,在通胀影响之下,房租很可能会持续上涨。

尽管对房东而言,房租的确有一定上涨空间(最多可涨到消费物价指数的40%),但他们必须谨慎行事,以免租金水平让租户招架不住或难以长期承受。据报道,新建住宅租金已然高企,这意味着房东很难将这些房屋悉数租出。最终,供需情况将决定租金水平,如果房价下降或开发商降低利润率,租金水平可能会发生变化。

从财务上看,一个奇特现象出现了:现在租房已成为比买房更具吸引力的选择。考虑到按揭成本、物业维护费用、债务成本和投资资本回报,租用一套100平米的公寓比直接购买更便宜。这与前几年的情况有所不同,当时按揭贷款利率处于历史低位,因此持有房产在经济上更有优势。如果利率不出现大幅下降,房地产市场的这种情况可能会持续下去。

长远考虑

直接所有权成本与租房成本的对比评估只是一部分因素。从长远来看,拥有房产通常能获得资产的增值。在瑞士,住宅价值估计每30年翻一番,而投资性房地产的情况则有所不同。在不少房地产项目竭力寻找买家的情况下,房价正在经历小幅下跌。

在投资性房地产市场,关注的焦点正从售价转向收益率,即业主期望通过租金收入获得的回报。卖家仍希望以买家不愿支付的价格成交,尤其是在利率不断上升的情况下。没人愿意支付3%的利息,却只有3%的毛收益率,因为扣除各项费用和税费后,净回报率会更低。

较之近两年平均水平,估计瑞士的房产交易量已下降20-25%。因此,目前供过于求。不过,房价并未出现大幅下跌。这是因为经济因素并不是购房的唯一决定因素。情感因素,比如拥有自己住宅的愿望,继续左右着投资过程。

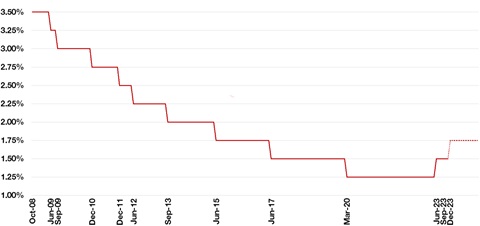

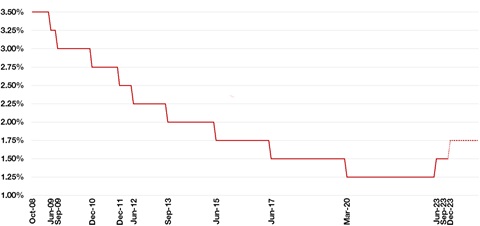

过去15年的基准按揭利率

Original English Text

Navigating today’s strange property market

The property market’s current state is strikingly unconventional. Typically we might expect property prices to decline but instead, they are holding firm or even rising in places. This anomaly is driven by underlying dynamics that appear poised to persist.

One would assume that the Swiss National Bank’s decision to raise interest rates would act as a damper on property prices by increasing the cost of financing. Instead, between the summers of 2022 and 2023, the prices of apartments sold under commonhold arrangements increased by 3.4%, while single-family house prices rose by 1.2%.

Two primary factors contribute to this market paradox. Firstly, the residential sector maintains an exceptionally low vacancy rate. For instance, in June, it stood at 0.98% in the canton of Vaud and was as low as 0.45% in the city of Bern. Secondly, there has been a real shortage of new constructions, especially in highly sought-after areas. In recent months, Switzerland has issued just 10,000 building permits, with nearly 6,000 allocated to single-family houses. The limited supply of properties entering the market is fuelling demand and, consequently, supporting price levels. It is also worth noting that rising interest rates have led to higher rents, which have somewhat alleviated the downward pressure on property prices.

Raising rents at your peril

A deeper understanding of this phenomenon requires us to acknowledge that the uptick in interest rates has elevated the reference rate for leases. This rate’s calculation based on mortgages concluded in Switzerland, has been at 1.5% since 1 June, marking a 0.25% increase. Additionally, as rents are influenced by inflation, it is probable that rent hikes will persist.

While landlords do have the leeway to increase rents (by up to 40% of CPI), they must tread cautiously to avoid reaching levels that are indefensible or unsustainable for tenants. Rent rates for newly constructed homes are already high, meaning that landlords are reportedly having trouble filling them. Ultimately, supply and demand dynamics will dictate rent levels, and a shift may occur if property prices decrease or developers reduce their profit margins.

Curiously, from a financial perspective, renting has now become a more attractive option than owning property. Factoring in mortgage arrangement costs, property maintenance expenses, the cost of debt and the returns on the invested capital, it is cheaper to rent a 100 m2 flat than to own it outright. This marks a departure from previous years when historically low mortgage rates made ownership financially advantageous. This shift is likely to persist unless interest rates see a substantial decline.

A long-term play

Evaluating immediate ownership costs versus renting represents only a part of the equation. Over the long term, property ownership typically offers appreciation in asset values. In Switzerland, residential property values are estimated to double every 30 years. Investment properties, however, present a somewhat different picture. With many properties struggling to find buyers, prices are experiencing a modest decline.

In the investment property market, the focus is shifting from selling price to yield – the return expected by the owner through rental income. Sellers are still hoping to secure prices that buyers are unwilling to pay, especially amidst rising interest rates. No one wants to pay 3% interest for a gross yield of only 3%, which means an even lower net return after expenses and taxes.

Transaction volumes in Switzerland have plummeted by an estimated 20-25% compared to the two-year average. Consequently, supply currently outweighs demand. Nevertheless, prices are not experiencing a substantial freefall. This can be attributed to the fact that financial considerations are not the sole determinants in property acquisition. Emotional factors, such as the desire to own one’s own home, continue to sway the investment process.

本文转载自瑞士雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)投资咨询

4)企业服务 5)居留计划 6)国际教育

更多资讯请登录网站 www.sooswiss.com