发布时间:2023-06-20

瑞士博浩特银行(Bonhôte bank):全球经济与美元渐行渐远

本文内容由雷梭勒家族办公室根据Banque Bonhote英语文章翻译整理,版权归原作者所有。更多信息可以访问银行官网:https://www.Bonhote.ch/en/

美元走弱这个话题最近被反复提及,那么这一明显趋势背后的推动力量有哪些呢?

我们写过,美元是全球贸易和金融资产流动中使用最广泛的货币。但一些观察者现在认为,在不久的将来,美元在全球经济中的主导地位可能被削弱。

为了理解美元为何占有这样的主导地位,我们需要回过头来,看看过去发生了什么,尤其是在政治方面。

一个多世纪以来,美国都是世界上最大的经济体,而且自从第二次世界大战结束以来,美国一直保有全球最重要的军事力量。这两个因素使得美元既具有避险性质,又是储备货币。

各国央行都持有巨额美元储备,以对冲汇率波动和政治风险。美国债券市场是目前世界上流动性最大的(超过50万亿美元),这样的规模使得投资和提取大额资金较为容易。

几乎所有商品的跨境贸易,尤其是石油,都是用美元,即使交易各方不是来自美国也是如此。2022年,美元在外汇市场88%的交易中发挥了作用。根据国际清算银行数据,外汇市场是世界上规模最大的金融市场。

但美元或许不会永远占据主导地位。许多国家正在积极努力,减少对美元的依赖,这主要是为了避免因为政治原因受到美元相关的制裁。美国往往以美元为武器,对不符合其外交政策的公司和国家实施制裁,这一点并不陌生。遭受美国制裁的公司或银行将无法用美元交易,这可能给跨境业务带来巨大的障碍。

如果用一个技术名词描述这一过程,那就是“去美元化”,它意味着减少对美元作为交易媒介的依赖。

如今,全球超过一半的人口生活在非民主国家。因此,世界上有很多地区的治理规则并不符合美国价值观,从而让相关国家有可能遭受制裁。

黄金再受追捧

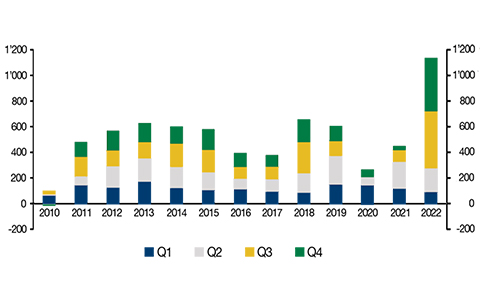

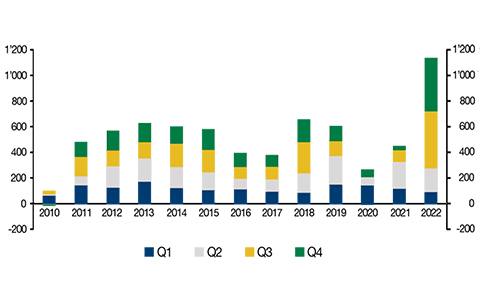

多国央行正在让自身资产多元化,其手段往往是购买黄金。2022年,黄金购买量猛增150%,达到1,136吨,而过去十二年来,每年黄金购买量为500吨。除了对冲通胀,黄金也是一种规避美元挂钩的制裁的方式。俄罗斯就是一个很好的例子。俄罗斯入侵乌克兰后,西方国家将其从全球金融体系中剔除,冻结了其央行存放在世界各地机构的资产。但俄罗斯的黄金储备由于是在国内持有而丝毫未受影响。

中国在2022年11月和12月总共购买了62吨黄金,目前其金库中拥有超过2000吨黄金(相当于1150亿瑞郎)。同样值得注意的是,土耳其的黄金储备为542吨。

中国是去美元化背后的推动力量。由于几个主要石油供应国受到美国的制裁(俄罗斯、委内瑞拉、伊朗),中国当局只能用除美元之外的货币进行结算。2018年,中国推出了自己的商品交易所。虽然该平台的交易量目前仅占全球交易量的5%,但交易媒介是人民币。

巴西也想要用人民币支付从中国购买的商品,并且鼓励其他新兴经济体加入这一行列。

然而,尽管有这些举措,各国央行也在努力将其资产基础多元化,但美元仍占据主导地位。这是由于没有其他替代品。鉴于中国经济的重要性越来越凸显,人民币(又称“元”,该货币的记账单位)有朝一日可能成为候选货币。不过,在外国投资者看来,中国的法律体系还需要更加安全才行。至于比特币和以太坊这类虚拟货币,它们只占全球金融系统中极小的一部分。

因此,尽管一些国家在努力减少对美元的依赖,但在未来的许多年里,美元仍可能继续占据主导地位。

全球央行2010至2022年间黄金购买量

Original English Text

Shift away from dollar in global economy

Video produced in collaboration with Le Temps

The waning power of the dollar is a recurring theme these days. What are the driving forces behind this apparent trend?

As we write, the dollar is the most widely used currency in global trade and financial asset movements. But some observers now believe that its dominant position in the global economy could be undermined in the not-too-distant future.

To understand why the dollar is indeed so dominant, we need to look back in time to see what has happened, especially on the political front.

For more than a century, the US has been the world’s largest economic force and, since the end of the Second World War, the foremost military power. These two factors make the dollar both a haven and a reserve currency.

Central banks hold huge dollar reserves to hedge against currency fluctuations and political risks. The size of the US bond market, by far the most liquid in the world (over USD 50 trillion), makes it easy to invest and withdraw large sums of money.

Cross-border trade in virtually all commodities, especially oil, is conducted in dollars, even if the parties to the trade are not American. In 2022, the dollar was instrumental in 88% of all transactions in the foreign exchange market, which is the largest financial market in the world according to the Bank for International Settlements.

But the dollar’s dominance may not last forever. Many countries are actively working to reduce their reliance on the greenback, mainly because of the use of dollar-related sanctions for political purposes. It is not unknown for the US to use the dollar as a weapon, imposing sanctions on companies and countries that are out of line with its foreign policy. A company or bank hit by US sanctions will not be able to transact in dollars, which may result in huge barriers to cross-border business.

“Dedollarisation”, to give the process its technical name, therefore means reducing reliance on the dollar as a medium of exchange.

Today, more than half of the global population lives in a non-democratic country. As such, vast swathes of the planet are governed by rules that are not in line with American values, potentially exposing such countries to sanctions.

Gold making a comeback

Several central banks are diversifying their assets, often by buying gold. In 2022, gold purchases jumped 150% to 1,136 tonnes compared with 500 tonnes a year in the previous 12 years. As well as a hedge against inflation, gold is also a way of circumventing dollar-linked sanctions. Russia is a case in point. After Russia invaded Ukraine, Western countries cut it off from the global financial system by freezing USD 300 billion of its central bank’s assets held by various institutions around the world. But Russia’s gold reserves were untouched because they are held domestically.

China bought a total of 62 tonnes of gold in November and December 2022 and now has more than 2,000 tonnes in its vaults (equivalent to CHF 115 billion). Similarly of note, Turkey’s gold reserves stand at 542 tonnes.

China is a driving force behind dedollarisation. Some of its main oil suppliers are under US sanctions (Russia, Venezuela and Iran), meaning that Beijing has to use currencies other than the dollar for settlements. In 2018, China launched its own commodities exchange. Although the trading volume on this platform so far represents only 5% of global volumes, the medium of exchange is renminbi.

Brazil also wants to pay for its purchases from China in renminbi and is encouraging other emerging economies to jump on the bandwagon.

But despite these initiatives and central banks’ efforts to diversify their asset base, the dollar remains dominant. This is due to a lack of alternatives. The renminbi (also known as the yuan, the unit of account for the currency) could one day be a candidate, given the growing importance of the Chinese economy. However, the Chinese legal system is not considered safe by foreign investors. As for cryptocurrencies such as Bitcoin and Ethereum, they represent only a tiny part of the global financial system.

So despite efforts by some countries to reduce their reliance on the dollar, it is likely to retain its dominant position for many years to come.

Central bank gold purchases between 2010 and 2022

本文转载自瑞士雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)投资咨询

4)企业服务 5)居留计划 6)国际教育

更多资讯请登录网站 www.sooswiss.com