《传承宝典》14: 收藏品是一项好的投资吗?

发布时间:2019-06-27

《传承宝典》14

收藏品是一项好的投资吗?

艺术品、名酒和老爷车等收藏品的审美魅力令人难以抗拒。对于高净值或超高净值的投资者们来说,将追求潜在增值的可能、与个人激情或爱好相结合,具有巨大的吸引力。然而,那些认为自己可以像投资股票或债券一样投资于收藏品的人,可能会遇到一些意想不到的挑战。考虑到这一点,这里有一些最佳的实操做法,分享给那些有兴趣于(或目前已持有)重大收藏资产的朋友:

1.买您喜欢的,并希望是最好的

纽约梅隆银行私人银行解决方案董事总经理比尔•约翰斯顿表示:“从金融安全的角度来看,一般来说,最好将收藏品更多地视为一种爱好,而不是一种赚钱的方式。”从本质上讲,从收藏品中获得的任何潜在的金钱收益,都最好被视为一种附加利益,一份证明收藏家敏锐眼光和良好品味的奖金。

2.保存一份详细的收藏品清单

梅隆财富管理高级副总裁兼遗产规划专家基尔•多伊尔表示:“收藏者绝对应该有一份清单或是编目,能够采集到其收藏品的相关重要细节。”“它应该包括这件收藏品是在哪里买的、从谁那里够得的、花了多少钱、以及任何其他与众不同的特色。”

3.维持您收藏品的价值

即使您建立一项收藏的主要动机仅为满足个人享受,也必须考虑采取措施保护并维护您的收藏品——如:购买专门的保险;让您的藏品获得专家们的认证评估;准备好环境适当的长期储存之地,无论是放在家、还是一处专业的存储设施中,定期对光线、湿度和温度进行监控是良好的收藏管理的一部分。“我们经常要训练家政人员如何照看艺术品。”——StonehageFleming艺术管理公司的执行主席Maria de Peverelli如是说。

4.规划时别忘了收藏

在决定你的财富和遗产计划时,万一没有考虑到收藏品,可能会带来严重的财务后果。就像你对待任何其他金融资产一样,重要的是要认识到它们的价值,并对其入账登记。

5.考虑捐赠你的收藏品

向慈善机构捐赠有价值的收藏品,是支持你所关心的事业的好方法,而且还能享受到可观的税收减免。此外,将全部收藏品捐给慈善机构或其他非盈利机构,可以帮助避免遗产税所带来的潜在流动性问题,并为你的激情人生保留下一份持久的遗产。

最有可能从收藏品的长期增值中获益的人,是那些从家庭成员那里继承现有收藏品的人,或者是那些通过追求自己热衷的爱好、进而积累起收了藏品的人。”

投资收藏品时要谨慎

1.了解独特的风险

收藏品使投资者面临传统投资中不常见的风险,包括丢失、盗窃、损坏和伪造。收藏品市场也很不稳定,受流行文化趋势、个人品味甚至政治因素的影响很大。

2. 考虑税收后果

出售持有一年以上的收藏品,所获得的利润,将最高对应28%的美国联邦税率;许多纳税人通常为传统投资的长期性资本收益,仅支付20%左右。此外,在美国各州政府和联邦政府层面,对巨额、有价值的收藏品所征收的遗产税也令人担忧。

当大多数投资者在寻求财务回报时,收藏者获得的收益超过了他们收藏品的货币价值。收藏品使投资者能够追求个人利益,并围绕共同的文化或智力好奇心,来发展伙伴、圈层关系。随着时间的推移,这或许比可能的经济收益更有回报。

Are Collectibles A Good Investment?

The aesthetic allure of collectibles like artwork, fine wines and classic cars can be hard to resist. For highor ultra-high net worth investors, the ability to combine the pursuit of potential growth with their personal passions or hobbies holds a lot of appeal.

However, those who think they can invest in collectibles the same way they invest in stocks or bonds may encounter some unexpected challenges. With thisin mind, here are some best practices for those interested in or currently holding significant collectible assets:

1. Buy What You Like and Hope for the Best

“From a financial safety perspective, it's generally best to view collectibles more as a hobby than as a way to make money," says Bill Johnston, Managing Director and Head of Private Banking Solutions. In essence, any potential monetary gains from collectibles are best viewed as a fringe benefit,a bonus that serves as a validation of the collector's keen eye and good taste.

2. Keep a Detailed Inventory of Your Collectibles

“Collectors should absolutely have an inventory or catalog that captures important details about their collectibles," says Jere Doyle, Senior Vice President and Estate Planning Specialist. “It should include where and from whom they bought them, for how much, and any other distinguishing features of the item."

3. Preserve the Value of Your Collection

Even if your primary motivation for building a collection is personal enjoyment, consider taking steps to preserve and safeguard your collectibles —such as purchasing specialized insurance, having your items appraised by acertified expert and making accommodations for proper, long-term storage, whether in your home or in a professional storage facility. Regular monitoring of light, humidity and temperature control is part of good collection management. "We often have to train domestic staff on how to look after the artworks."-- said Maria de Peverelli, the Executive Chairman of Stonehage Fleming Art Management in London.

4. Don't Forget Your Collection When Planning

Failing to take collections into account when making decisions about your wealth and estate plans can have serious financial consequences. It's important to recognize and account for their value as you would any other financial asset.

5. Consider Donating your Collection

Donating valuable collectibles to a charitable organization is a great way to support a cause you care about and take advantage of a significant tax deduction. Additionally, gifting an entire collection to a charity or other non-profit can help to avoid potential liquidity issues around the estate tax and create a lasting legacy for your life's passion.

The people in the best position to potentially benefit from the long-term appreciation of collectibles are those who inherit existing collections from family members, or those who have amassed a collection through the pursuit of a hobby they are passionate about."

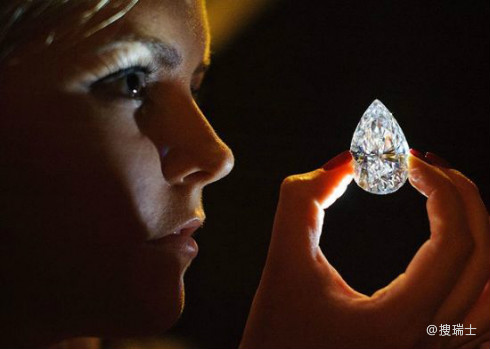

Luxury collectibles can fetch a pretty penny at auction. Here are some of the biggest sales in a few of the most notable classes of collectibles:

Use caution when investing in collectibles.

1.Understand the unique risks

Collectibles expose investors to risks not commonly encountered when making traditional investments, including loss, theft, damage and counterfeiting. Collectible markets are also very volatile, and greatly influenced by pop culture trends, shifting personal tastes and even politics.

2. Consider the tax consequences

Profits on the sale of collectible items held for more than a year are subject to a maximum 28% federal tax rate; many taxpayers typically pay around 20% on long-term realized capital gains from traditional investments. There are also state-level and federal estate tax concerns associated with large, valuable collections.

3.Don't lose sight of what's important

While most investors seek financial returns, collectors reap benefits beyond their collection's monetary value. Collectibles enable investors to pursue personal interests and develop relationships around shared cultural orintellectual curiosities. Over time, this may be more rewarding than the possible financial gain.

该文章为搜瑞士网站原创,如需转载,敬请注明出处。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com

相关新闻