发布时间:2023-03-09

瑞士博浩特银行(Bonhôte bank):经济趋势可能在2023年中发生转变

本文内容由雷梭勒家族办公室根据Banque Bonhôte英语文章翻译整理,版权归原作者所有。更多信息可以访问银行官网:https://www.bonhote.ch/en/

疫情的减退,给全球经济解除了桎梏,商品和服务需求因此得以复苏,而通胀已然高启。

长期的停滞已经扰乱了多个经济领域,造成了严重的物流障碍和瓶颈。更糟糕的是,乌克兰和俄罗斯之间突然发生军事冲突,让天然气和石油价格飙升,引发了整个欧洲的能源危机。

为遏制失控的通胀,各国央行转而采用限制性货币政策,稳步提高利率,从而为全球经济增长踩下了刹车。根据央行的风险理念,过度紧缩总比让通胀任意发展的危险要小。目前短期利率高于长期利率,这预示着在未来几个季度,欧洲和美国面临经济衰退的风险加剧。

限制性货币政策的影响在实体经济中体现出来需要时间。美国就业市场强劲,失业率为3.7%,是50年来的最低水平,而最近的工资增长则继续刺激着消费支出。平均每个求职者有两个职位空缺,因此员工仍有强大的议价力。但现在,面对迫在眉睫的经济衰退,一些公司开始宣布裁员了。

欧元区去年11月的通胀率为10%,政府有可能继续通过财政援助和价格上限管制(price caps)保护家庭和公司免受能源价格上涨的影响。这些措施对于维持社会凝聚力是必要的,但会阻止通胀率回落到目标水平,并迫使央行更加收紧。

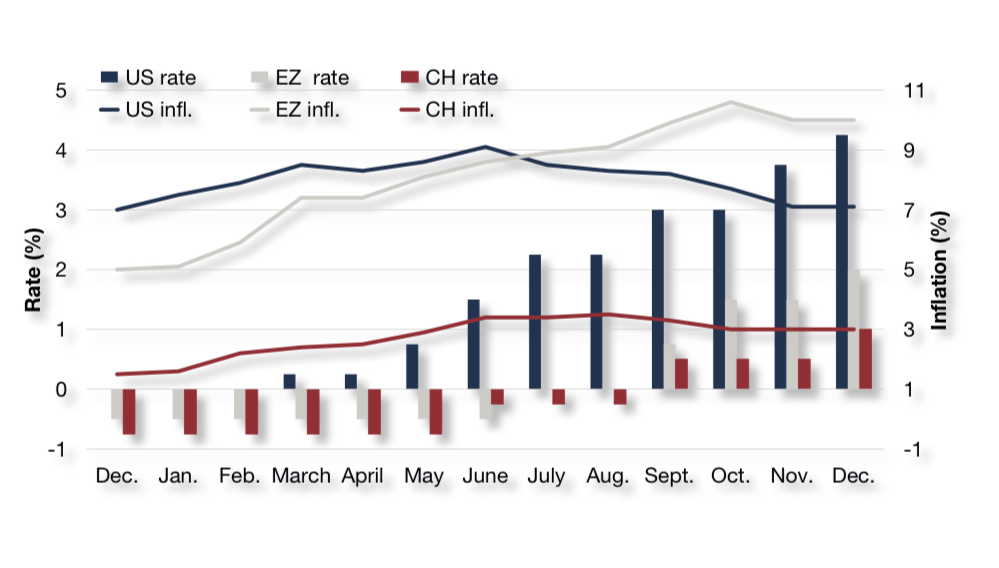

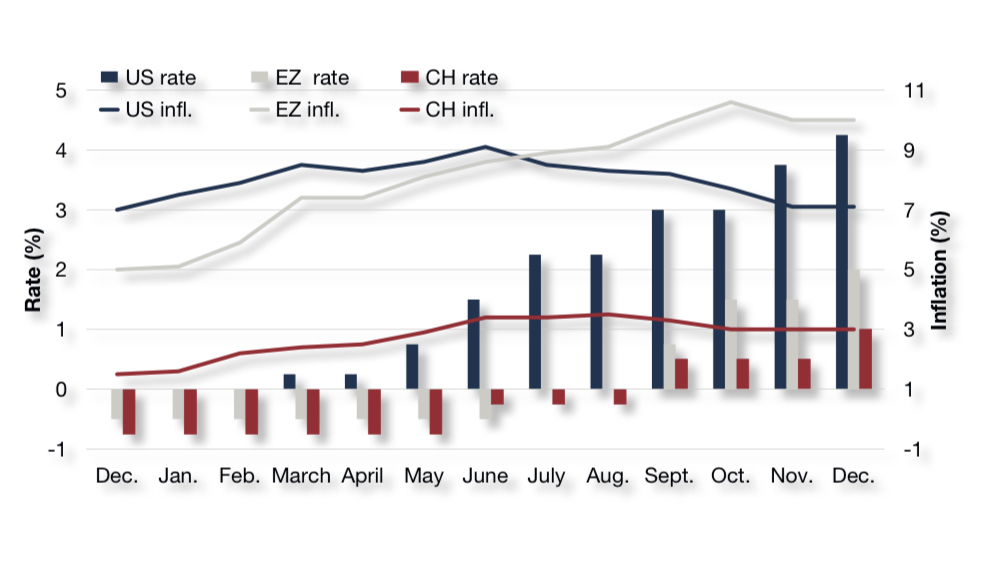

基准利率和通胀率

资料来源:彭博(Bloomberg)

瑞士的情况则完全不同,其通胀率尚未超过3%。这要归功于瑞郎的坚挺压制了输入型通胀(译者注:imported inflation,指由于国外商品或生产要素价格上涨,导致国内物价持续上涨的现象)。问题是,几近饱和的劳动力市场(失业率仅为2%)抑制了工资水平,从而让瑞士国家银行(SNB)不得不提高其基准利率。我们预计瑞士利率将在2023年中达到1.75%-2.0%的峰值。

经济展望

能源和食品价格终将会在未来12个月内稳定下来甚至下降,从而有利于通胀率在2024年底或2025年初回落到各国央行的目标值。

目前,各国央行仍然不为所动。未来几个月政策的持续收紧,可能会让利率在2023年中达到峰值。预计美国和欧洲的终端利率(译者注:terminal rate, 指升息周期的最终利率)将分别高于5%和3%。全球经济软着陆的可能性仍然存在,但这需要通胀率下降幅度大于目前的预期值才能实现。

因此,2023年全球经济增长率预计仅为2%左右,这将给企业未来利润带来不利影响。

那些迄今受益于家庭高储蓄率和低借贷成本的企业都能够保持其利润水平。

如果明年(译者注:原文为next year,指2023年)真的发生经济衰退,则很可能预示着价格下跌的开始,从而导致货币政策的改变。我们预计到明年(译者注:指2023年)下半年,通胀率一旦下降到4%以下,美联储就会转变策略。

一旦投资者认为自己确定了这一转折点,就可能引起股市和债市止跌回升。

政府债券或投资级公司债券等固定收益投资的魅力重现,这样的收益率在一年前我们是完全想不到的。

Original English Text

Potential change of course in mid-2023

The shackles were removed from the global economy once the pandemic abated, sparking a brisk recovery in demand for goods and services that has sent inflation soaring.

The prolonged period of inactivity has disrupted several economic sectors, causing serious logistical glitches and bottlenecks – particularly in China, where restrictions have been left in place for longer. Making matters worse, the sudden military conflict between Ukraine and Russia has triggered an energy crisis across Europe as gas and oil prices have surged.

To curb the runaway inflation, central banks have switched to restrictive monetary policies by steadily raising interest rates, thus applying the brakes to global economic growth. According to central banks’ risk philosophy, excessive tightening is always less perilous than letting inflation run out of control. Short-term rates are now higher than their long-term counterpart, signalling a heightened risk of recession within Europe and the US in the quarters ahead.

The effects of restrictive monetary policies are taking time to materialise in the real economy. In the US, the job market is robust. At 3.7%, the unemployment rate is the lowest in 50 years, and recent wage increases continue to fuel consumer spending. Employees still have strong bargaining power, considering that there are two vacancies for every job seeker. But now companies are starting to announce job cuts in the face of the looming economic downturn.

In the Eurozone, where inflation was 10% in November, governments are likely to continue shielding households and companies from energy price rises through fiscal help and price caps. Such measures are necessary to maintain social cohesion, but this is preventing inflation from ebbing to target levels and forcing central banks to tighten more than they would otherwise.

The context is quite different in Switzerland, where inflation has not risen above 3%. This is thanks to the strength of the Swiss franc, which is keeping a lid on imported inflation. The problem is that the tight labour market – with unemployment at only 2% – is putting pressure on wages, which is forcing the SNB to raise its benchmark rate. We expect the Swiss rate to peak at 1.75-2.0% in mid-2023.

Economic outlook

Energy and food prices should eventually stabilise or even subside in the next 12 months, helping to bring inflation back into line with central banks’ targets by the end of 2024 or early 2025.

Central banks remain undaunted, for now. The continued tightening in policy over the coming months is likely to produce a peak around mid-2023. Terminal rates are expected somewhere upwards of 5% and 3% in the US and Europe, respectively. A soft landing for the global economy is still a possibility, but this would require a sharper decline in inflation than is currently anticipated.

Global economic growth is therefore expected around a paltry 2% in 2023, which will have a negative impact on companies’ profit forecasts.

Those companies so far benefiting from high household savings and low borrowing costs have been able to shield their margins.

The onset of recession – if this does occur next year – would probably signal the start of a price decline, leading to changes in monetary policy. We expect the Fed to pivot in the second half of next year, once inflation has started falling below 4%.

A rally could be sparked in both equity and bond markets once investors think they have identified that specific turning point.

Fixed-income investments such as government bonds or investment-grade corporate bonds have once again become attractive, exhibiting yields we would not have even dreamed of a year ago.

Benchmark and inflation rates

Source: Bloomberg

For more detailed information on Bonhôte bank: https://www.bonhote.ch/en/

本文转载自瑞士雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)投资咨询

4)企业服务 5)居留计划 6)国际教育

更多资讯请登录网站 www.sooswiss.com