发布时间:2023-02-28

瑞士博浩特银行(Bonhote Bank):2023年金融市场预期走势向好

导言

近日,雷梭勒陪同我们一位家族客户参访了位于瑞士的博浩特银行(Bonhote Bank)。参访过程中,该行的一位高管简要回顾了该客户的投资组合在2022年的业绩表现,并分享了2023年的投资策略。预计2023年股市将出现反弹,而债市则较为低迷。然而,投资者应继续持审慎态度,并对市场环境和全球事件的变化保持关注。

本文观点仅代表瑞士博浩特银行的意见,不作为投资建议,也未考虑任何个人的财务状况或潜在投资者的需求。

上周,雷梭勒团队陪同我们的一个家族客户来到博浩特银行,对其投资组合业绩进行了年度总结。银行的一位高管接待了我们。

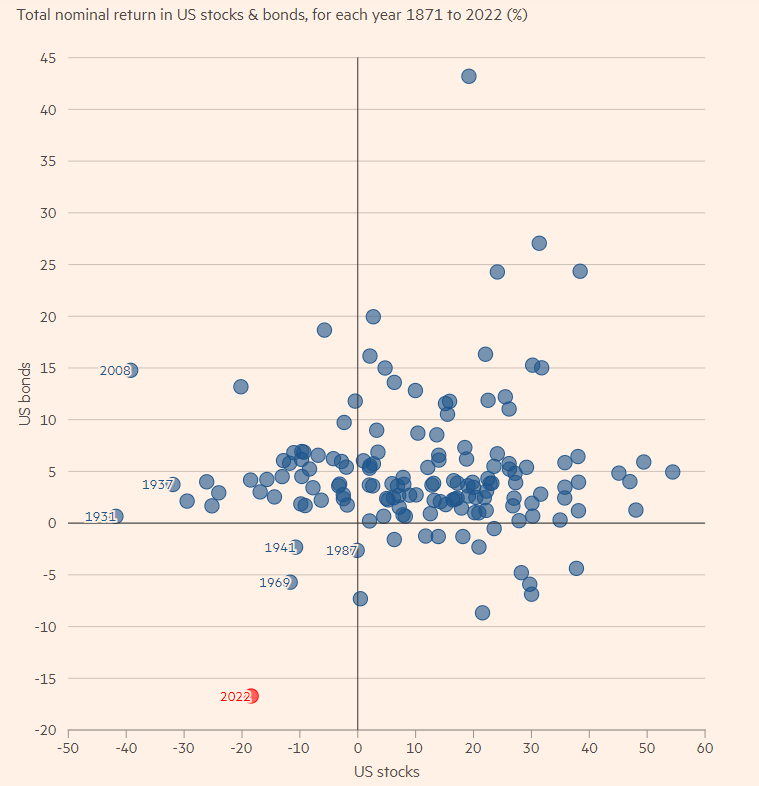

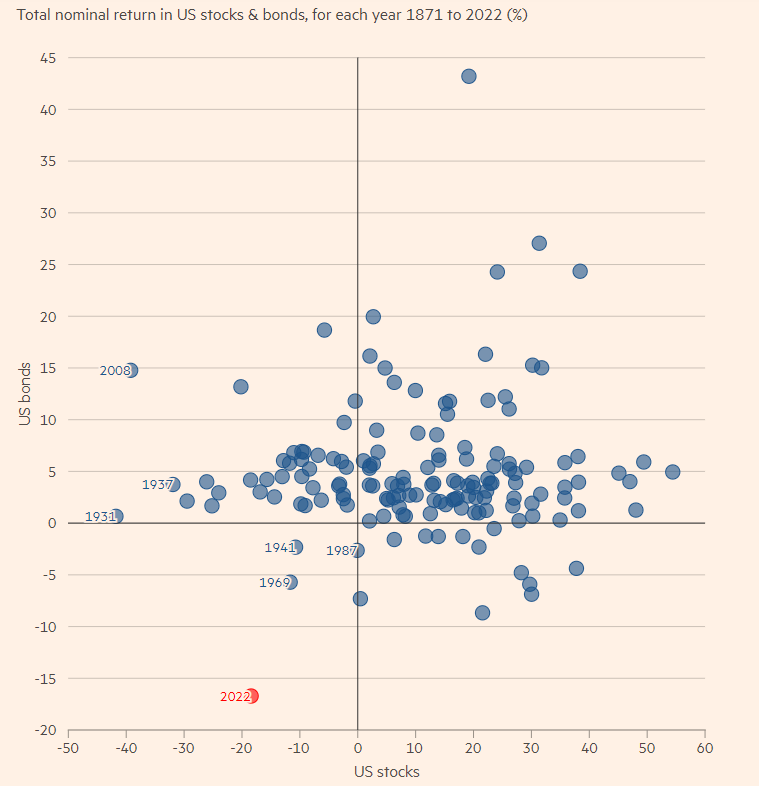

“2022年是自1871年以来股票和债券市场表现最差的一年,无论是哪种资产类别,均未能成为投资的避风港。” 对于该家族投资组合的不良业绩,这位高管在解释时展示了如下的图表,图中每个点代表过去每一年的金融业绩,2022年在左下象限跌至谷底,它标志着这一年的股票和债券业绩都在急剧下跌。

1871年-2022年美国股票和债券的名义回报率

资料来源:《金融时报》

“相应地,我们在年中调整了投资策略,”这位高管随后解释了为何必须将40%的资产分配在现金中。“我们一看到股市在大幅跳水,就做出了反应”。

在2022年终,该投资组合情况如下:

2022年,每一类资产都大幅缩水;全球通胀和利率上升、欧洲俄乌战争,以及年底大型科技公司大规模裁员,都是造成经济严重下滑的原因。

“好消息是,我们注意到2023年初以来有不错的复苏迹象。”自2023年2月中旬起,该家族的投资组合就保持着3.4%的增长率,这主要是由于股市出现了反弹。这位高管表示他对2023年金融市场的表现充满信心,同时对近期中国开放出入境举措表示赞赏。

“由于全球经济复苏,当然也包括中国近期开放出入境的政策因素,股市预计会有反弹并保持强劲态势。企业预计将从消费和商业活动复苏中受益,从而推动盈利增长,并提升股价。

债市则预计较为低迷。不过总而言之,2023年金融市场有可能保持其积极走势。”

对于正在进行的投资组合,这位高管建议该家族客户在权益类投资方面保持原有板块配置不变,对此,雷梭勒和客户都表示赞同。这些板块的分布情况如下:

- 市场类 37%

- 医疗卫生类 20%

- 消费类 16%

- 科技类 13%

- 金融类 10%

- 周期型 4%

投资者应继续持审慎态度,并对市场环境和全球事件的变化保持关注。成功投资的关键是保持投资对象多样化、严守纪律,并坚持以长期视角对待投资。

Original English Text

Positive Trajectory in 2023 is Expected for the Financial Market

Overview

During a recent visit to Bonhote Bank, an exetutive from the bank gave us a recap of the performance of one of our families’ portfolio in 2022 and shared with us their investment strategy in 2023. A bounce back is expected for the equity market while the bond will be more subdued. However, investors should remain cautious and stay attuned to changes in market conditions and global events.

The views expressed in this article only represents the opinions of Bonhote Bank, and are not intended as investment advice or in consideration of any specific individual’s financial situation or potential investor’s demands.

Last week, La Soleille’s team accompanied a client family to the Bonhote Bank for their annual portfolio review.One of the executives from the bank received us.

“2022 was the worst year for stock and bond marketcombined since 1871. Unfortunately, there was nowhere to hide in the different asset classes last year.” While explaining the negative performance of the family’s portfolio, the bank executive showed a graphic as above where each dot represented a year’s financial perfomance in the history, 2022 fell bottom in the left lower quadrant, it signifies both a steep decrease in stock and bond performance of the year.

Nominal return for US stocks and bonds from 1871-2022

Source: Financial Times

“Accordingly we adjusted the investment strategy in the middle of the year”, the bank executive then explained why 40% of the asset had to be allocated in cash. “As soon as we saw the drastic drop in stock market, we reacted.”

At the year-end standing, the portfolio read as:

Every single asset class was down significantly in 2022; global rising inflation and interest rates, the Russia-Ukrain war in Europe, and the massive layoffs from big techs towards the end of year, were to blame for the toughest decline.

“Good news is since thebeginning of 2023, we’ve been noticing a nice bounce back.” The family portfolio has been seeing a 3.4% increase as of mid February 2023, largely due to the rebound in the stock market. the executive expressed his confidence in the 2023 financial market performance, while complimented the recent boarder opening from China.

“For the equity market, a bounce back is expected and it will remain strong, supported by a global economic recovery, which obviously included China’s recent boarder opening. Companies are expected to benefit from the rebound in consumer spending and business activity, and this should drive earnings growth and support higher stock prices.

For the bond market, it is expected to be more subdued. But in conclusion, the financial market is likely to continue their positive trajectory in 2023.”

For the ongoing potfolio,the executive suggested the family hold the same sector allocation in terms of equities, to which La Soleille and the clients were in favor of. To give a bit of idea to our readers, the sectors are spread out in:

Investors should remain cautious and stay attuned to changes in market conditions and global events. The key to successful investing is to remain diversified, stay disciplined, and maintain a long-term investment perspective.

本文转载自瑞士雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)投资咨询

4)企业服务 5)居留计划 6)国际教育

更多资讯请登录网站 www.sooswiss.com