发布时间:2022-11-02

导读:

市场整体仍然聚焦于全球通胀趋势及其对未来利率和经济增长的影响。刚过去的这个夏天,美国通胀持续而顽固,这成为了投资者焦虑的主要原因。盖然性权衡显示,未来6-12个月更有可能表现为低通胀。

本文内容由雷梭勒家族办公室根据Stonehage Fleming文章编译整理,版权归原作者所有。

经济滞后的一个很好的指标就是通胀。有关通胀的报导被你听到时就已是过时的消息,因为它告诉的只不过是已经发生的事。2021年,美联储还愿意对价格压力的这种马后炮式的评定做一些前瞻性点评,说当时通胀上扬是“暂时性的”。这说明在当时高增长高通胀的情况下政策仍然非常宽松。至2021年末,通胀居高不下,证明美联储在该问题上过于轻率,于是他们不得不进行急剧回调。最近几个月的措施极为不同,反映出当局更关注将抑制通胀落到实处。

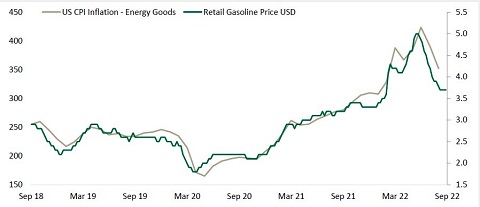

我们在上个季度认为,"种种迹象表明,许多新冠疫情导致的通胀因素,如商品需求的上升和供应链的中断,都得到了很大的改善"。刚过去的夏季尽管有一些高得惊人的数据,但有证据表明这个说法仍然成立。汽油价格自6月中旬以来下降了约25%,就有利于通胀回落(见图表),但预计未来几个月通胀消退的主要原因是去年供应链中断的问题得到了解决。

所有证据表明,航运、批发商的交货时间、库存水平和生产者的投入价格都有很大的改善。在某些情况下,供应链压力的指标已经恢复到疫情之前的标准。

六月以来汽油价格下跌抑制了通胀

数据来源: Bloomberg, 2022年9月30日

为何通胀依然如此之高?

通胀率仍然居高不下的原因是,价格需要时间调整,尤其是从高位调整会更久。这里的一个关键因素是批发和零售市场的利润率。去年的 “瓶颈经济”导致一些需求大于供给的行业的总体标价大幅上扬。美国的汽车行业就是一个很好的例子。装配线上关键部件的短缺导致汽车经销商的利润率大幅提升,对消费者而言,价格的膨胀甚至超过了供给方投入成本的增加。

利润率最终会恢复到更为正常的水平,这将成为通胀的阻力。美联储副主席莱尔·布雷纳德(Lael Brainard)赞同这一观点,他说:“降低目前高涨的利润率可以为减少消费品的通胀压力做出重要贡献”(数据来源:美联储副主席莱尔·布雷纳德的演讲,《让通胀降下来》,2022年9月7日)。

其他因素也是关键,包括租金通胀有多快消退以及能源价格的下跌是否持续。然而,我们进行盖然性权衡评估后仍然认为,未来6-12个月的通胀率将低于过去6-12个月。因此,应该不太会出现20世纪70年代那样的通胀螺旋式上升的情况。

免责声明:本篇文章仅为提供信息之用。任何第三方所表达的意见和观点仅供参考,如有变化,恕不另行通知。虽然我们尽力确保所提供的信息是准确和最新的,但由于任何变化,一些信息在未来可能会变得不准确。

所有投资都有资本损失的风险。投资标的价值可能上下波动,您可能无法收回最初投资的全部价值。汇率变化可能导致投资价值起伏。此处信息不构成建议或投资研究,不应依赖这些信息来进行交易或作出任何投资决定。

Original English Text

Has Inflation Finally Peaked in the US?

Balance of probabilities points towards lower inflation in the next 6-12 months

Broad market focus remains on global inflationary trends and their impact on the future path of interest rates and growth. The stubborn persistence of US inflation has been a primary source of investor anxiety over the summer months.

Inflation is a good example of a lagging economic indicator. By the time it is reported it is already old news, telling us only what has already happened. In 2021, the Federal Reserve were willing to add some forward looking commentary to this rear-view mirror assessment of price pressures, describing the inflationary surge at the time as 'transitory'. This justified remaining extremely accommodative in their policy stance, despite strong economic growth and high inflation. By the end of last year they were forced to back pedal in dramatic fashion, as inflation trends proved them far too cavalier on the issue. The approach taken in recent months has been quite different - it is a case of 'show me don't tell me' inflation is falling.

We argued last quarter that "the signs suggest many pandemic-related inflationary factors such as elevated demand for goods and supply chain disruption are much improved". Despite some surprisingly high readings over the summer, this statement continues to be backed by the evidence. A c.25% fall in gasoline prices since the middle of June has helped (see chart), but the main reason to expect subsiding inflation in the months to come is the resolution to last year's supply chain disruption.

All the evidence points to a considerable improvement in shipping, delivery times for wholesalers, inventory levels and producer input prices. In some cases, indicators of supply chain stress are back to pre-Covid norms.

Falling gasoline prices since June are dis-inflationary

Source: Bloomberg, 30 September 2022

Why is inflation still so high?

The reason inflation is still so high is because it takes time for prices to adjust, particularly from very high levels. A critical factor here is gross margins in the wholesale and retail market. Last year's 'bottleneck economy' resulted in a significant increase in aggregate mark ups in industries where demand outstripped supply. The US auto industry is a good example. Shortages in key components on the assembly line resulted in a huge widening in auto dealers margins, inflating prices for the consumer even more than the rise in input costs would imply.

Ultimately, margins have to revert to more normal levels, which will act as a headwind to inflation. Lael Brainard, Vice-Chair of the Federal Reserve, shares this view, stating "a reduction in currently elevated margins could make an important contribution to reduced inflation pressures in consumer goods" (Source: Federal Reserve, Speech by Vice Chair Lael Brainard, "Bringing Inflation Down", 07 September 2022).

Other factors will also be key, including how quickly rent inflation subsides and whether the decline in energy prices is sustained. However, our assessment of the balance of probabilities continues to point to lower inflation in the next 6-12 months than the past 6-12 months. Expectations of a 1970s inflationary spiral should look less realistic as a result.

Disclaimer: This article has been prepared for information only. The opinions and views expressed on any third party are for information purposes only, and are subject to change without notice. Whilst every effort is made to ensure that the information provided is accurate and up to date, some of the information may be rendered inaccurate in the future due to any changes.

All investments risk the loss of capital. The value of investments may go down as well as up and, you may not receive back the full value of your initial investment. Changes in the rates of exchange between currencies may cause the value of investments to go up or down. We do not intend for this information to constitute advice or investment research and it should not be relied on as such to enter into a transaction or for any investment decision.

本文转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com