发布时间:2021-03-03

瑞士生活指南(二):医疗保险

在上一期的“瑞士生活指南”中,我们为您详细介绍了登陆瑞士后,如何办理瑞士居留证(B证)。获得瑞士居留证后一项必须要做的事情,就是要投保医疗保险以及家庭财产保险。本期公众号,我们将为您详解瑞士的医疗保险系统,以及如何投保。

瑞士医疗保险系统简介

瑞士医疗保险系统不是公共医疗保险,都是由私人保险公司承担。以下为三家瑞士最知名的保险公司:

Helsana

CSS

Groupe Mutuel

所有在瑞士居住的人(包括持有国籍者和持有居住证者)都必须购买基础医疗保险。这是强制性的规定。虽然瑞士的医疗系统是全民化的,但瑞士并没有免费的公共医疗。在瑞士居住的个人都要自己按月缴付医疗保险。

除了基础保险外,还可根据个人需求增加额外的保险项目。

基础医疗保险

基础医疗险是强制性的,保险范围也都是统一的,不会根据所选保险公司而变化。但是保费价格因所居住的州、投保人年龄和所选择的项目不同而有所差异。下面我们将会对几个保险选项逐一详细说明。

基础医疗险都是一年一续,从每年的1月1日算起。每年的保险费用可能会有小幅浮动。如果投保人愿意,可以在每年年底更换保险公司(11月30日前),但是我们不建议频繁更换保险公司。因为合同的签署周期是一年,所有的费用都是按年来计算的。

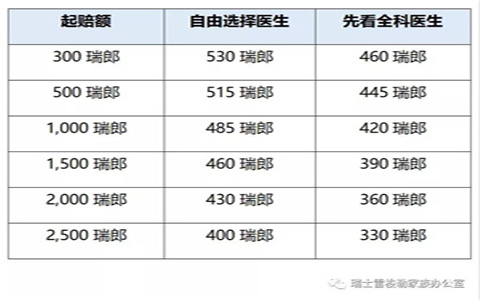

选项一:起赔额

当产生了医疗费用,保险公司不会马上直接支付,而是由投保人先支付部分费用,这个数额可由投保人来选择支付多少,也被称为起赔额(Deductible)。投保人需要支付起赔额以内的医药费,超出部分保险公司才会进行赔付。起赔额的高低也决定着每个月保险费用的高低。

投保人可选择6个不同额度的起赔额 (瑞郎):

300瑞郎

500瑞郎

1,000瑞郎

1,500瑞郎

2,000瑞郎

2,500瑞郎

一旦所支付医药费达到起赔额,投保人将只需支付医药账单的10%,最多每年700瑞郎。

若选择了300瑞郎的起赔额,在产生医药费时,投保人将要支付一年医疗费用中最初的300瑞郎,超出300瑞郎的部分仅需支付10%。起赔额越低会导致月保险费更高,因为投保人本身在医疗上需要支出的费用很少(300瑞郎)。

相反,如果选择了更高的起赔额起点,比如2500瑞郎,在产生医药费时,投保人将会先支付2500的医药费,超出部分仅需支付医药费的10%。起赔额高会使得投保人每月支付的保险费更低,因为其已经承担了高额的医疗费用。

因此,低起赔额适用于有医疗费用较高的人群 (比如有健康问题的人群和老年人),因为即使这样他们每月需要支付更多保费,其医疗费用可由保险公司支付 (超出起赔额部分)。相反,对于不常看医生、医疗费用较少(少于2000瑞郎每年)的年轻而健康的人群而言,建议选择高起赔额,这样可以降低每月保费支出。

医疗费用账单的制作由保险公司完成。产生过费用的医疗诊所会将投保人的账单发送给保险公司,在扣除对应的起赔额后,保险公司会将所需支付的费用账单发送至投保人。因此就诊时需随身携带医保卡。

选项二:保险形式

尽管所有保险覆盖同样的内容,但还是存在几种不同的保险形式,在问诊的自由度上有大有小,因此每月保费也存在一定差别。每家保险公司提供的具体保险形式可能稍有不同,但大致可分为以下4种:

自由选择医生的权力

生病时,投保人可以自由选择医生,在需要就医时可以直接到此病症专家(专科医生)处,无须先去全科医生处问诊。这种形式的月保费最高,适合经常需要就医和问诊专科医生的人群。

先去问诊全科医生

生病时,投保人需要先去问诊全科医生,类似于家庭医生,然后再去全科医生指定的专科医生处问诊。除非是急诊,投保人都需先由家庭医生进行初步诊断,问诊后如有需要,再去专科医生处。这种形式可以让月保费降低10%,建议身体健康的人群选择这个形式。

24小时热线预诊

生病时,投保人需要首先打电话热线进行预诊,热线上的医生会给出非强制性医疗建议。就是说,根据热线医生的预诊结果,投保人还可以自由选择医生继续就医。这种形式可以使月

热线电话医生保费降低8%。但是出于语言不便的考虑,不推荐选择这种方式。

热线电话医生

这种形式的热线电话医生,他们的问诊结果是有强制性的,投保人要遵循热线医生的问诊结果,如果需要再看专科医生,需要热线医生的指定。这种形式可降低15%的月保费。但是出于语言不便的考虑,不推荐选择这种方式。

须知

不论选择了何种形式,投保人都可以自己决定是否直接去看专科医生还是先问诊通科医生。只是费用支付上的差别。区别在于,如果投保人遵循投保形式完成就诊,保险公司会按所选形式支付医疗费用,如果没有遵守,将由个人支付医疗费用。

基础医疗保险费用评估

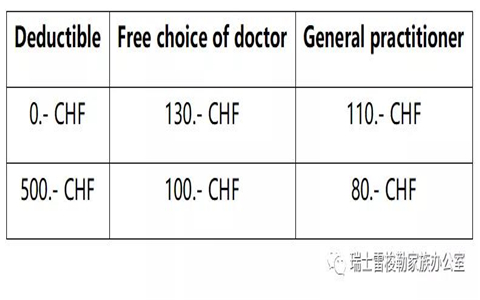

以居住在纳沙泰尔州48岁女性为例,月度保费如下:

附加健康保险

健康附加险让投保人可以享受基本健康保险不覆盖或不完全覆盖的项目。比如,替代医学(针灸、按摩、自然疗法等)、配眼镜、牙医、特殊医药和疾病预防等。还有其他的附加险提供更舒适的住院条件,比如自由选择医院的权利、单间病房等。各种不同的附加险根据每个投保人不同的需求而进行决定。如有购买附加险的需求,可向雷梭勒团队咨询相关信息。

未成年人医疗保险

除以下两点外,18岁以下未成年人的医疗保险与成年人的医疗保险相同:

起赔额仅设两档:

0瑞郎 (推荐)

500瑞郎

超出起赔额部分每年需支付最多350瑞郎(成年人为700瑞郎)。超出起赔额后的每单医疗费仍需要支付10%(与成年人相同)。

未成年人保险覆盖范围与成年人完全相同。若全家在同一家保险公司投保,儿童还可以享受折扣。

以居住在纳沙泰尔州0-18岁儿童为例,月度保费如下:

青年(19-25岁)也可享受相较于成人更低的月保费(约为成人保费的80%),但是与成人待遇完全相同。

雷梭勒团队将为客户提供有关瑞士医疗保险的咨询并协助投保。如您需要了解更多详细资讯,欢迎联系瑞士雷梭勒家族办公室:400-006-7726。

Health insurance in Switzerland

A. Introduction

The Swiss health insurance system is private and there are many insurance companies on the market. The three main insurance companies are:

1. Helsana

2. CSS

3. Groupe Mutuel

All Swiss residents (nationals and permit holders) must have a basic insurance. It is mandatory and cannot be avoided. Even though Switzerland’s healthcare system is universal, there is no free public healthcare. Instead, all Swiss residents must pay for their own private health insurance on a monthly basis.

In addition to the compulsory basic insurance, for a better coverage, it is possible to contract supplementary insurances depending on your needs.

B. Basic health insurance

The basic health insurance is mandatory and its coverage is the same for everyone and for each insurance company. However, the price varies depending on the commune of domicile, the age of the person and the options chosen. The options are explained below.

The basic health insurance is always conducted for one year, starting January 1st. Each year, the price might slightly change. It is possible to change the insurance company at the end of each year (before 30th of November). However, we do not recommend it. Because the duration of the contract is one year, all the expenses are always calculated on a yearly basis.

1. Option 1: Deductible

When a medical invoice is issued and falls under the coverage of the insurance, the insurance company will not pay the full amount straight away. You will have to pay part of your medical costs. You can choose the amount you are ready to pay, this is called the deductible. Until the amount of the deductible is not reached, all the medical bills have to be paid by you. The amount of the deductible will have an impact over the monthly price of the insurance.

You can choose between the 6 following deductibles:

o 300.- CHF

o 500.- CHF

o 1’000.-CHF

o 1’500.- CHF

o 2’000.- CHF

o 2’500.- CHF

Once the deductible has been reached, you will have to pay 10% of the medical bills, but max. 700.- CHF/year.

Therefore, by choosing a deductible of 300.- CHF, you will pay the first 300.- CHF of the total amount of your medical expenses of the year. Once the threshold of 300.- CHF has been reached, you only pay 10% of the expenses. This deductible will trigger a high monthly price because you spend little money (300.-) for your medical expenses.

On the other hand, by choosing a deductible of 2’500.- CHF, you will pay the first 2’500.- CHF of the total amount of your medical expenses of the year. After this amount has been reached, you will pay 10% of your expenses. This deductible on the contrary will trigger a low monthly price because you take a higher responsibility of your medical expenses.

Therefore, a low deductible is recommended for people who have a lot of medical expenses (for ex. health problem, elder people, etc.) because even though the monthly price is higher, all the expenses are taken in charge by the insurance company (after the deductible). On the contrary, people with very low medical expenses (less than 2’000.- a year) (for ex. young and healthy) will prefer the highest deductible because the monthly price is lower and they rarely go to the doctor.

calculations of the bills are made by the insurance company. All the medical institutions that you might consult will send the bills to your insurance company. After applying the necessary deductions, the insurance company will send you the amount which corresponds to your participation to the costs. It is therefore important to always carry your insurance card with you.

2. Option 2: insurance model

Although the coverage of the insurance is the same for everyone, there are different models that give you more or less freedom and therefore have an impact on the monthly price. The models and their details depend on each insurance company but in general we can identify 4 different models:

1) Free choice of doctor

In the event of a medical concern, you can freely choose any doctor and have direct access to any specialist. This model is the most expensive one and is recommended for people with health problems that often need to consult doctors and specialists.

2) General practitioner (doctor)

In the event of a medical concern, you first have to go to your general practitioner, which can be compared to a family doctor, unless it is an emergency. Your family doctor will do a first analysis of your health issue and then transfer you to a specialist if necessary. This model offers a discount of at least 10% on the monthly price and is recommended for people in good health.

3) Premed-24

In the event of a medical concern, you first have to call a medical hotline who will provide a free non-binding advice on the treatment. Following the consultation with the medical hotline, you are free to choose the doctor. This model offers a discount of at least 8% on the monthly price. However, we do not recommend this model because of the language barrier.

4) Telemedicine

In the event of a medical concern, you have to call a medical hotline who will provide a binding treatment to follow. If necessary, the medical online can transfer you to a specialist. This model offers a discount of at least 15% on the monthly price. However, we do not recommend this model because of the language barrier.

3. Important to know

It is important to know that no matter which model is chosen, it is always possible to consult a doctor or specialist of your choice (provided he accepts the patient). It is a matter of price. If you follow the instructions of the insurance model you choose, the insurance company will pay the bill according to the aforementioned. If you do not follow the instructions, you will have to pay it by yourself.

4. Estimated price for the mandatory insurance

The prices displayed below are an example for a 48 years old woman domiciled in the canton of Neuchâtel. The prices correspond to the monthly premium.

C. Supplementary health insurance

Supplementary insurances allow you to be insured for benefits that are not, or partly, covered by the basic insurance. There are supplementary insurances covering medical areas, such as alternative medicine, glasses, dental care, special medication, prevention, etc. Other supplementary insurances offer more coverage in case of hospitalization, such as free choice of hospital, comfort level and private space, etc. There are a multitude of supplementary insurances and the choice has to be made case by case depending on your needs. If you are interested in supplementary insurances, please contact La Soleille who will be happy to advise you.

D. Health insurance for children (0-18 years old)

The health insurance for children until 18 years old is the same as for the adults except for the two following points:

1. There are only two deductibles possible:

o 0.- CHF (recommended)

o 500.- CHF

2. The maximum amount payable per year after the deductible is 350.- CHF (instead of 700.- CHF for the adults). The 10% on each bill after the deductible are also due (same as for adults).

The coverage of the insurance is exactly the same as for adults. When a family is insured by the same insurance company, children can benefit from discounts.

The prices displayed below are an example for a child between 0 and 18 domiciled in the Canton of Neuchâtel. The prices correspond to the monthly premium.

Young adults (19-25 years old) also benefit from lower monthly prices (around 20% discount on adults’ monthly premium). However, they are considered and are treated as adults.

La Soleille will be happy to advise you and do all the necessary procedures for you. In case of any enquiries, please do not hesitate to contact our team.

本文章转载自雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)瑞士投资

4)居留计划 5)税务优化 6)家族治理

更多资讯请登录网站 www.sooswiss.com