发布时间:2023-08-04

传承宝典|家族的全面风险管理

导读

今天的超高净值家族面临着一个日益复杂、处处暗藏风险的世界。本文提出,对待风险,包括那些不太明显的风险和非财务风险,要采取一种更为广泛的管理方法,从而有效弥合家族成员之间的理解分歧,避免更大的风险发生。

本文内容由雷梭勒家族办公室根据Stonehage Fleming文章编译整理,版权归原作者所有。

过去20年来,推动财富管理行业增长的,是对客户承诺的一种新的、全面的战略方法。而这一主张的核心,是更为智能的风险管理。

一些富有创意的个人和机构为了发挥竞争优势,设计了许多新型风险管理工具。尽管其中有一些工具构思巧妙且有实用价值,但总体结果令人失望,因为多数这类创新产品仍停留在对投资组合波动性的关注上,却没有去处理那些影响家族财富的更广泛的风险:

现实情况是,今天的超高净值家族面临着一个日益复杂、处处暗藏风险的世界。本文提出,对待风险,包括那些不太明显的风险和非财务风险,要采取一种更为广泛的管理方法。它不像那些确立已久的研究方法那样具有充分的科学和学术依据,而是主要基于逻辑严谨的常识判断,以及一个简单的、确保所有风险都在其特定条件下得到处理的程序。

风险敞口

接下来不可避免的问题是,如何定义风险,以及如何识别和优先处理关键的风险敞口。对这个问题没有唯一正确的处理方法,而是取决于你的视角。对投资组合经理而言,合理的方式是主要关注投资组合的风险,并通过分散投资来实施风险管控。而相比之下,客户往往是企业家,他们通常集中投资于自己熟悉的少数几个领域来管理风险。

对于财富经理而言,在获得充分授权的情况下,进行风险分析首先需要了解家族的财富目标。如果程序中忽略了这一基础步骤,后续的所有考虑规划都是空中楼阁。

事实上,Stonehage Fleming最近的一份研究《二十一世纪资本的四大支柱》* 发现,大量家族一致认为,为自己的财富确定一个明确的目标,是代际财富传承的关键一步。

当然,挑战在于,每个家族的具体目标各有不同。不过,我们可以列出如下可能存在的目标层次:

财务风险和非财务风险

财务风险包括导致绝对损失、未能达成目标值或低于最低基准值的可能情况。而对许多超高净值家族而言,财富(即使全部财富的一大部分)发生绝对损失可能并不会对其生活品质带来严重损害,甚至不会对其实现主要目标的能力产生大的影响。

非财务风险可能包括对家族声誉的损害、重大家族纠纷、家族价值观和工作伦理的丧失,或家族传承的破坏。在很多层面,非财务风险更为重要。例如,与投资组合中的任何资产错配或未能保有有形资产相比,家族纠纷或缺乏家族领导力更有可能对财富造成重大破坏 。

当纯粹的财务风险模型提出,一家成功的家族企业需要分散持股时,继续拥有这家企业所带来的“非财务”收益是很难定价的。同样,家族团结和治理透明所带来的收益也难以量化。

然而,只要是对家族财富的长期威胁进行分析,就需要考虑这一事实:大多数的家族财富会在三代之内消散,而大量研究表明,给财富带来破坏的主要是那些经常被忽略的、无法衡量的风险。

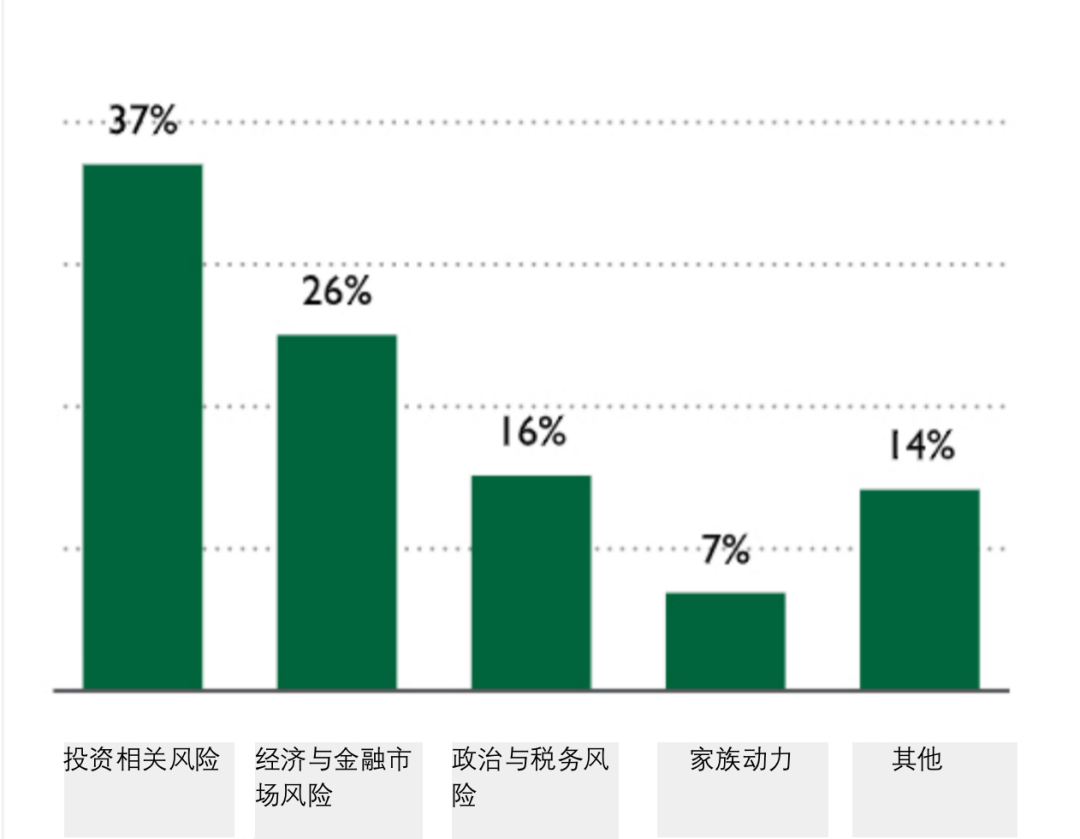

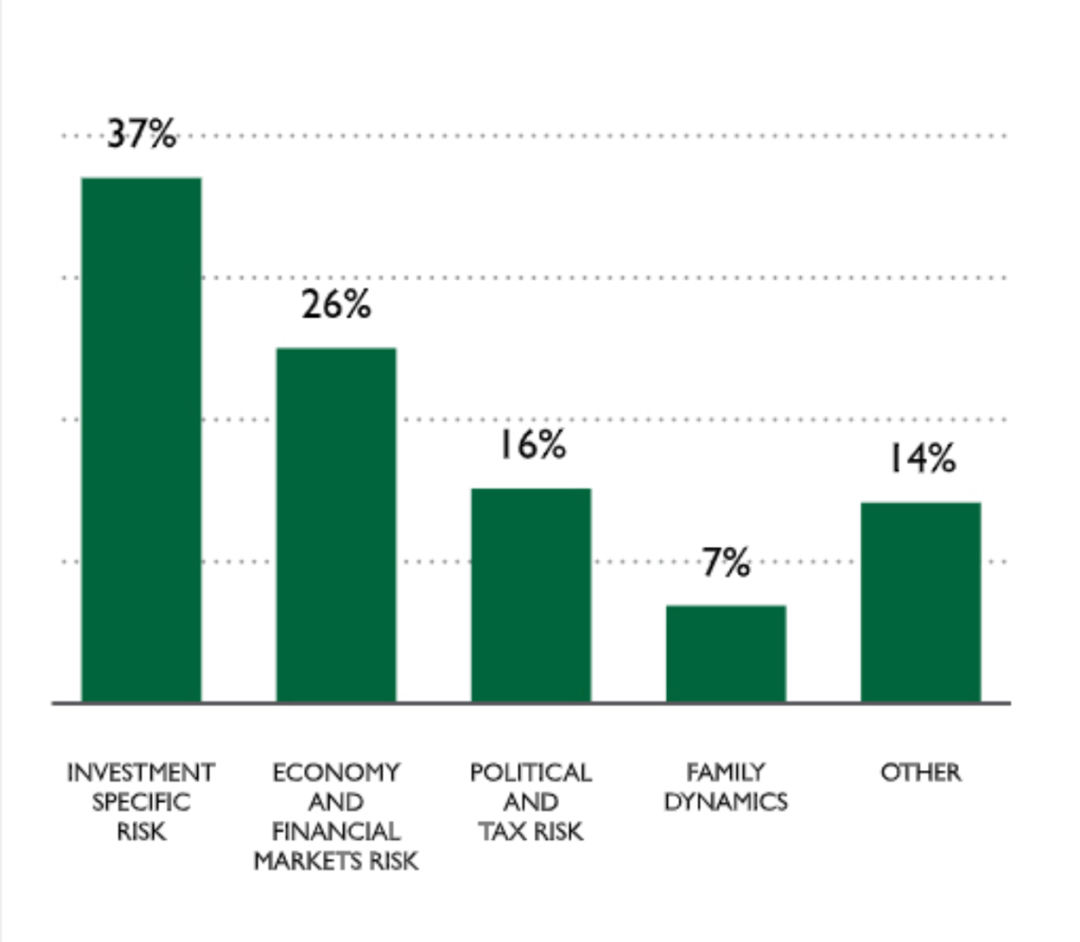

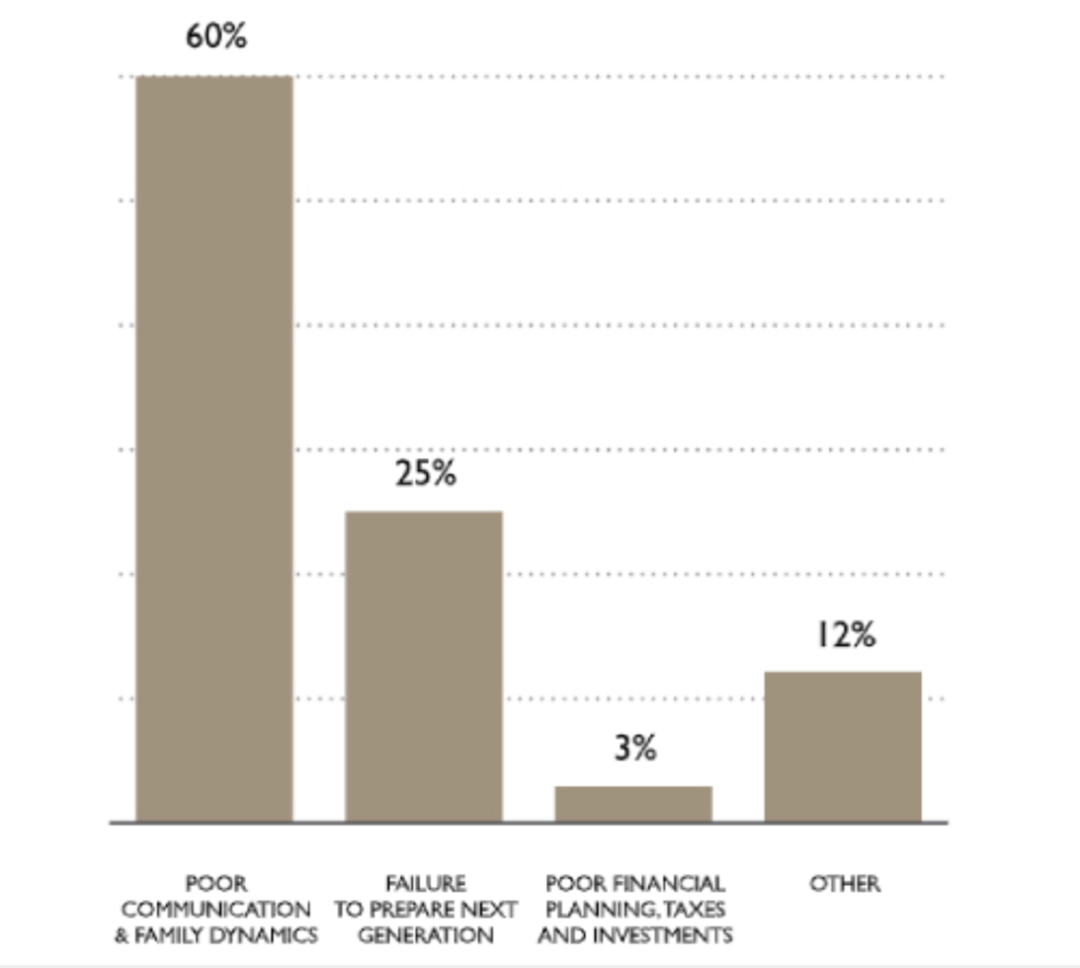

令人惊讶的是,许多家族仍然将投资风险视为主要风险敞口,尽管很少有家族纯粹因为投资管理不善而失去财富(图A)。

*《二十一世纪资本的四大支柱,代际成功的财富策略》,2015

图A:家族认识到的各类风险

(资料来源:家族办公室交流,2014)

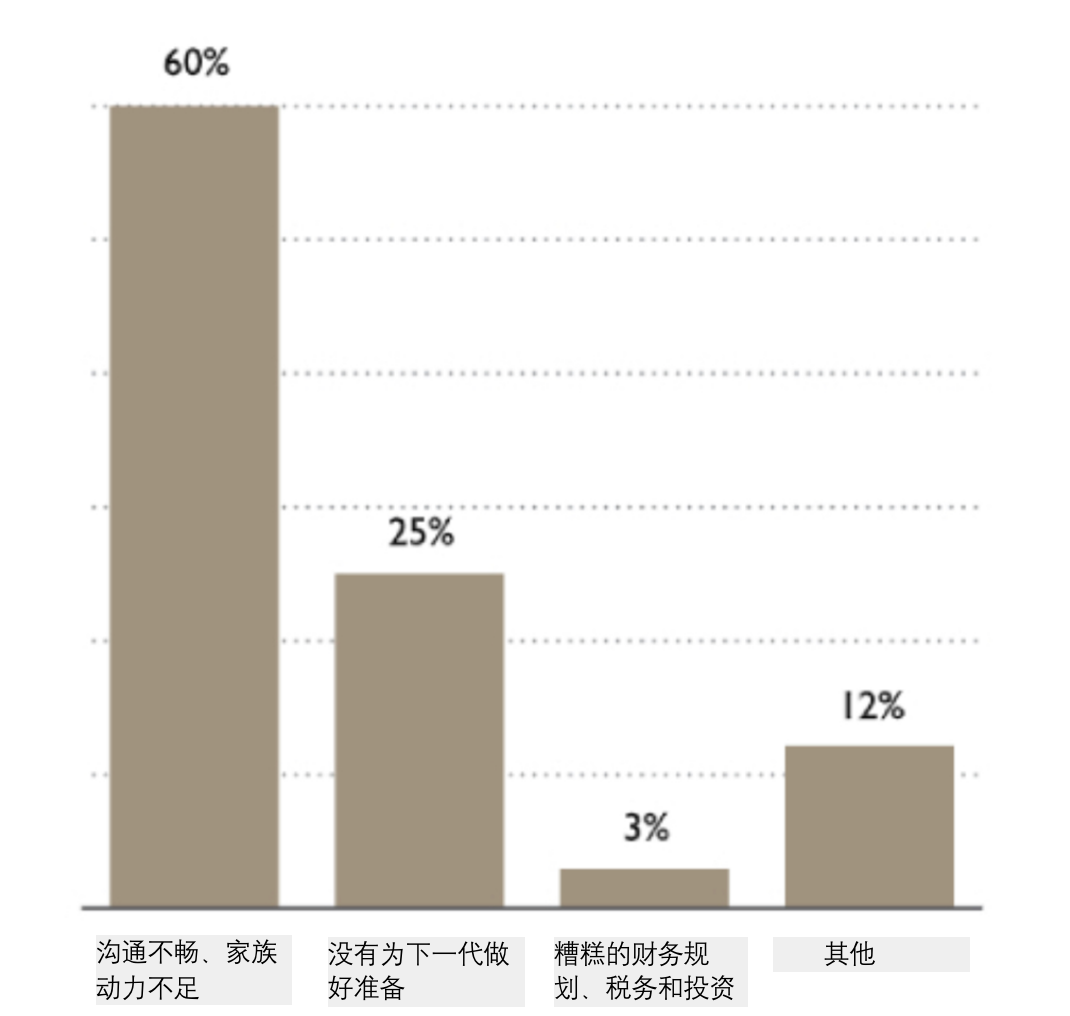

另一方面,事后对财富严重缩水的家族进行的研究表明,造成这种财富缩水的最常见原因是沟通不畅、家族动力不足以及没有为下一代做好准备(图B)。

图B:家族实际面临的各种风险

(资料来源:《准备接班人:家族财富和价值观成功传承的五个步骤》, Williams & Pressier, 2003)

当然,并非所有风险都能避免,但有条理的战略方法至少有助于降低风险,增加财富成功代代相传的可能性。

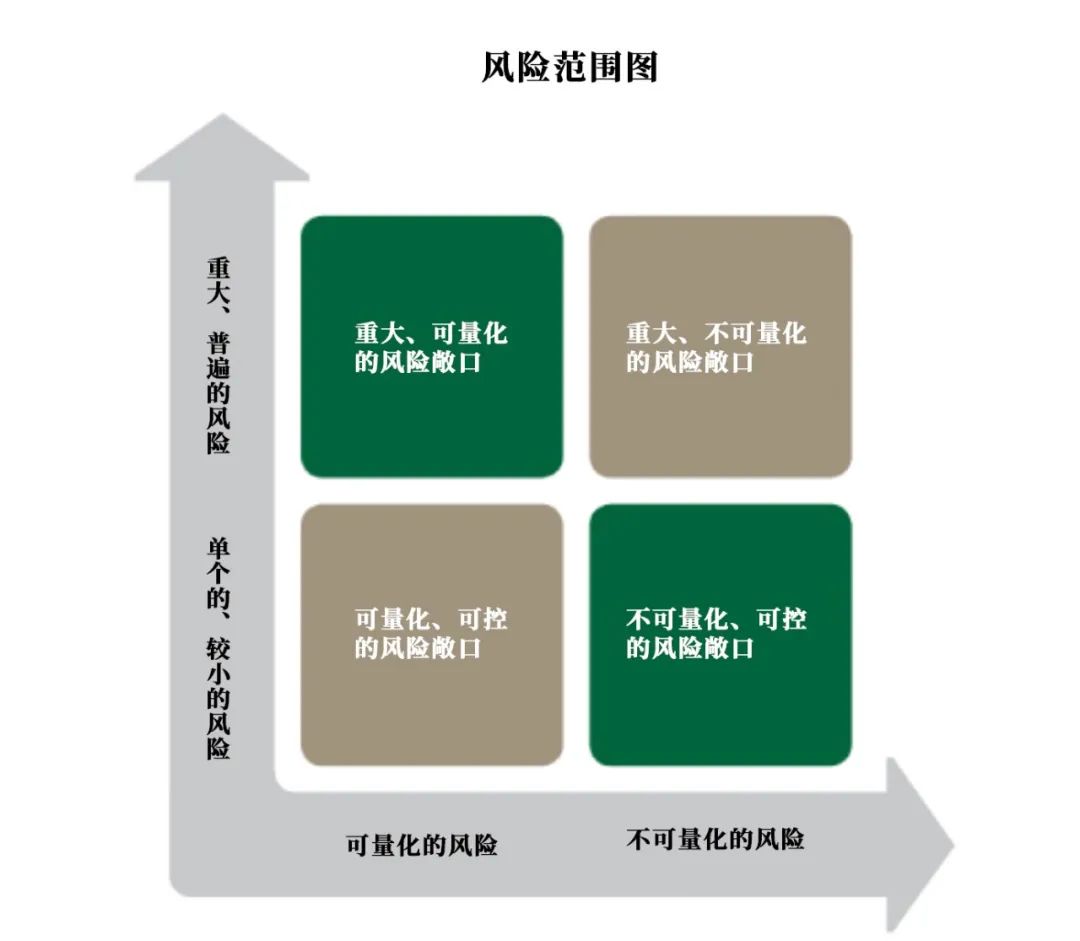

风险图谱分析

此家族风险管理方法可为家族带来一套分析和控制系统,它类似于企业和其他商业组织通常使用的风险管理流程。在某些方面,家族甚至比企业更需要这种程序上的约束,这是因为情感因素很容易导致重要问题的回避。

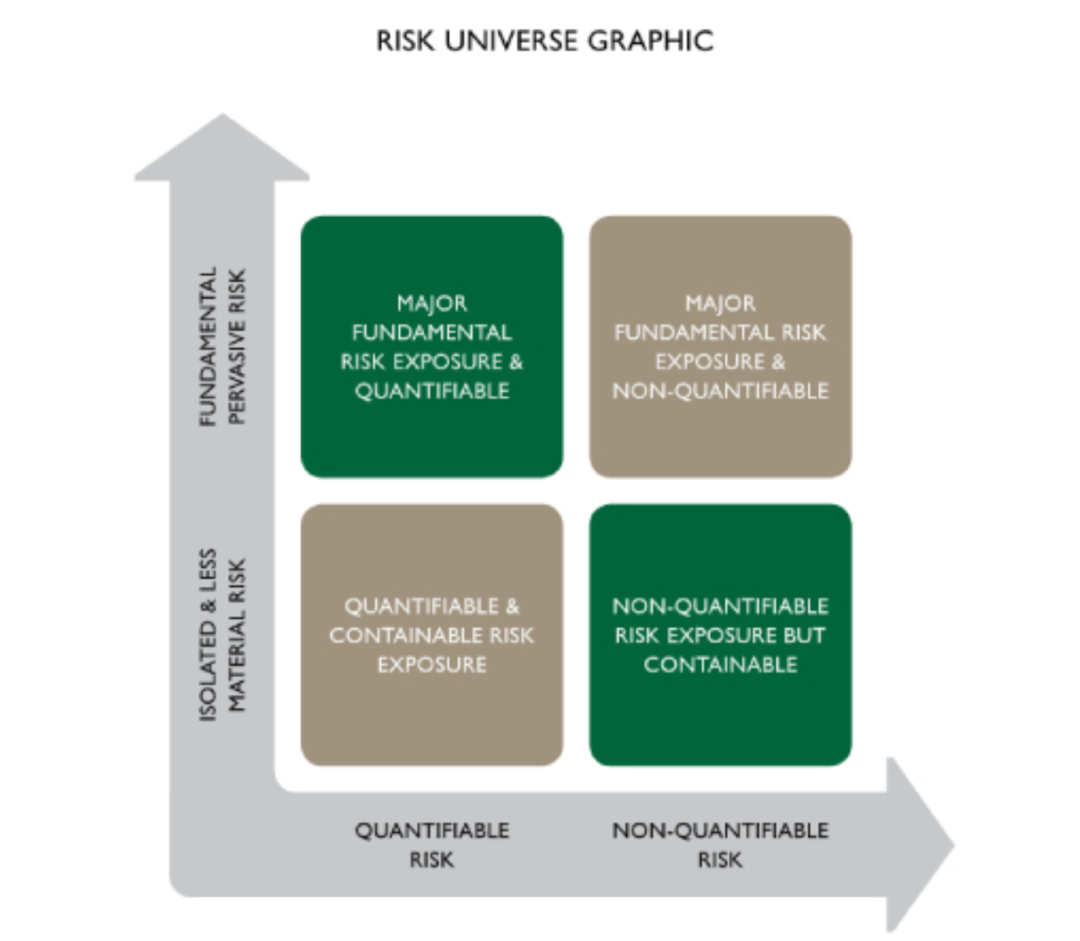

家族风险管理策略的制定应系统化,并考虑到财务风险和非财务风险:

(资料来源:Stonehage Fleming, 2016)

以这种方式评估家族的风险环境,可对单个风险的处理方法产生相当大的影响:

1.这种程序上的约束可确保所有风险都得到考虑而无一遗漏

2.对风险进行了优先级排序,因此关注点会集中在潜在影响最大的风险上

3.更具体地定义了风险,这有助于提出潜在的风险缓解措施

4.它可以推动记录风险缓解计划

5.它有助于确定可一起管理而不是单独管理的各个风险组

6.也许最重要的是,由于家庭成员之间对风险的理解可能有很大差异,这项工作有助于弥合这些差异,并制定统一的整体性方法

由此可对家族的风险环境形成智能评估,从而制定风险缓解计划,记录风险、概率、影响和缓解措施。

风险缓解计划最好是通过与家庭成员共同制定以获取其认同。应以动态视角看待该计划,并定期展开审查。

这种方法有助于将投资风险偏好、资产分配和可接受的投资时间跨度进行细化完善。

结论

我们认为,很多家族和他们的顾问主要关注的是那些有现成解决方案的有形风险,却没有关注那些更加复杂、更难衡量的无形风险,而这些风险往往导致家族财富损失惨重。

我们相信,这样的一套程序将带来更加全面、有效的方法,从而有助于保护家族财富和几代人的家庭幸福。也许最重要的是,它将有助于弥合家族成员之间的理解分歧,从而帮助避免更大的风险发生。

Original English Text

Holistic Risk Management for Families

The growth of the wealth management sector over the last 20 years has been fuelled by the promise to clients of a new, holistic and strategic approach. At the heart of the proposition is more intelligent risk management.

Many new risk management tools have been devised by innovative individuals and institutions, seeking to develop a competitive edge. Useful and ingenious though some of these tools are, the overall result is disappointing, in that most of the innovation has remained narrowly focused on the volatility of investment portfolios, without addressing the broader risks affecting family wealth:

For many clients, the investment portfolio represents only part of the family wealth. Any risk appraisal which does not take full account of wider business interests, and other assets is therefore incomplete.

The investment industry’s conventional approach to risk is mainly based on volatility and ignores the fact that there are many other ways of looking at investment risk, from the perspective of the family and taking into account a longer term horizon.

No account is taken of the intangible and unmeasurable risks, which numerous studies suggest are the main causes of family wealth destruction (refer Chart A and Chart B).

The reality is that today’s families face an increasingly complex world of potential risks. This paper suggests a broader approach to risk management, which includes those less tangible and non-financial exposures. It is not as scientific or academically well founded as established methodologies, but is essentially based on well-structured common sense combined with a simple process, which ensures all risks are addressed in their proper context.

The Risk Exposure

The inevitable follow-on question is how to define risk and to identify and prioritise key risk exposures. There is no single correct approach to this question as it depends on one’s perspective. For a portfolio manager it is legitimate to focus primarily on the risk of the investment portfolio and to manage that risk by diversifying across a range of investments. By contrast, however, the clients are frequently entrepreneurs, who often manage risk by concentrating their investments in a few sectors which they know and understand.

For the wealth manager, with a broad mandate, an analysis of risk requires an understanding of the family’s wealth objectives. If this basic foundation is omitted from the process, the result is that all subsequent considerations and planning are conducted in a vacuum.

Indeed, a recent study by Stonehage Fleming, “Four Pillars of Capital for the Twenty First Century”* found wide agreement among families that defining a clear purpose for their wealth is a crucial step for wealth preservation across generations.

The challenge, of course, is that no two family’s objectives will be the same. However, a potential hierarchy of objectives might be as follows:

To provide financially to ensure appropriate living standards for family members

To maintain a successful family business which provides significant employment and makes a contribution to the community

To maintain and grow the value of the overall family wealth

To preserve family unity and prevent dispute

To provide a fund which enables family members to make entrepreneurial investments or to pursue other beneficial activities

To provide a fund for philanthropic causes, which may or may not involve family members

To establish and uphold a lasting family legacy

FINANCIAL AND NON-FINANCIAL RISK

Financial risks include the possibility of an absolute loss, a failure to meet objectives or falling below minimum benchmarks. For many ultra-high net worth families, however, an absolute loss of wealth (even if a significant percentage of the whole) may not seriously damage lifestyles, nor even drastically impact on their ability to fulfil their main objectives.

Non-Financial risks, could include damage to the family reputation, a major family dispute, loss of family values and work ethic, or the destruction of a family legacy. In many senses the non-financial risks are the more important. For instance, a family dispute or lack of family leadership is far more likely to lead to a major destruction of financial wealth than any asset allocation mistakes in the investment portfolio, or the failure to insure a tangible asset.

It is also extremely difficult to put a price on the ‘non-financial’ benefits associated with continuing to own a successful family business, when a purely financial risk model may suggest the holding should be diversified. Equally the benefit of a united family with transparent governance is hard to quantify.

However, any analysis of long-term threats to family wealth should take account of the fact that most family fortunes are dissipated within three generations and, according to numerous studies, the principal causes of wealth destruction arise from those unmeasurable risks which are so often overlooked.

Surprisingly, many families continue to identify investment risk as their primary area of exposure, despite the fact that very few have ever lost their wealth purely through poor investment management (Chart A).

* Four Pillars of Capital for the Twenty First Century, Wealth Strategies for Intergenerational Success, 2015

CHART A: FAMILY PERCEIVED RISKS

(Source: Family Office Exchange, 2014)

On the other hand studies conducted after the event, on families whose wealth had been severely dissipated, indicate that such wealth destruction was most frequently caused by poor communication and family dynamics and a failure to prepare the next generation (Chart B).

Chart B: Actual Family Risks

(Source: Preparing Heirs: Five Steps to a Successful Transition of Family Wealth and Values, Williams & Pressier, 2003)

Of course not all risks can be avoided, but a structured and strategic approach will at least help to mitigate the risks and add to the likelihood of wealth being successfully passed from one generation to the next.

The Risk Mapping Analysis

The proposed approach to family risk management brings to families a system of analysis and control similar to the risk management processes routinely used by businesses and other commercial organisations. In some respects the discipline of such a process is even more necessary in a family than in a business, precisely because emotional considerations can easily lead to important issues being avoided.

The family risk management strategy should be developed from a hierarchy that takes into account both financial and non-financial risks:

Develop an awareness and understanding of the potential risk areas

Understand the potential impact of each risk upon family wealth and on the family itself

Rank risks according to perceived levels of materiality, determinability and pervasiveness

Consider the potential for discrepancies between the actual and perceived risks

Develop and implement a mitigation plan for each major risk exposure

It can be useful to distinguish those risks which are quantifiable and can be isolated, from those which cannot be quantified and are more pervasive. Risks can thus be classified into one of the four quadrants depicted in the risk universe graphic below:

(Source: Stonehage Fleming, 2016)

Assessing the family’s risk universe in this way, may impact quite significantly on the approach to individual risks:

1.The discipline of such a process ensures all risks are considered and none avoided

2.Risks are prioritised, so that attention is focused on those with greatest potential impact

3.Defining risks more specifically, helps to suggest potential mitigation measures

4.It drives documentation of a risk mitigation plan

5.It helps identify groups of different risks which can be managed together, rather than individually

6.Perhaps most crucially of all, since interpretations of risks can differ considerably between family members, this exercise helps to bridge such differences and develop a unified and integrated approach

The result is an intelligent assessment of the family’s risk universe to develop a risk mitigation plan which records risks, probabilities, impacts and mitigating actions.

The risk mitigation plan is ideally developed through collaboration with family members to achieve buy-in. The plan should be considered dynamic and reviewed on a regular basis.

Such an approach should lead to refinements in the investment risk appetite, asset allocations and acceptable time horizons.

Conclusion

By focusing primarily on those tangible risks for which there are ready made solutions, we believe too many families, and their advisers, fail to address the more complex, less tangible and less measurable risks which are so often the cause of family wealth destruction.

We believe a process such as this will facilitate a more comprehensive and effective approach, which will help protect family wealth and family wellbeing across the generations. Perhaps above all it will help bridge differences of understanding between family members, thus helping to avoid the biggest risk of all.

本文转载自瑞士雷梭勒家族办公室,如有侵权,敬请告知删除。

Sooswiss为您提供

瑞士方向私人管家式的定制服务:

1)家族传承 2)财富管理 3)投资咨询

4)企业服务 5)居留计划 6)国际教育

更多资讯请登录网站 www.sooswiss.com